Fintech Is ‘Enormous Competitive’ Threat to Banks, Says JPMorgan Chase CEO Jamie Dimon

Dimon advocated for a regulatory field for all active participants in the financial system to compete in order to thrive.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Dimon advocated for a regulatory field for all active participants in the financial system to compete in order to thrive.

The completion of the Series D funding round comes a few months after the merger between Visa and Plaid was canceled.

A Twitter user, however, countered Allaire’s opinion on USDC and PayPal.

Signal said that its new payments feature would be accessible to UK residents only. The feature will be available on iOS and Android and not on desktops.

Celsius controls crypto worth over $10 billion and offers its services across over 100 countries globally.

The Central Bank of Japan has confirmed the phase 1 testing of its CBDC. This will see the Bank experiment with the environment and basic functions of the CBDC.

Rumors on PayPal’s Checkout with Crypto began on the 30th of March. Later in the day, PayPal CEO Dan Schulman confirmed this news.

DeFi total locked value has hit a record high, reaching nearly $80 billion. Though Ethereum-based protocols continue to lead the market, notable performance has been shown by their main rival – Binance Smart Chain.

Jacky Lee, the Chief Executive Officer of Tranglo, said that the partnership with Ripple Labs will go a long way to ensure that accessible and equitable financial services are delivered.

Nuvei has announced it will be supporting nearly 40 cryptocurrencies including DOGE and Reddcoin on its platform. The electronic payment processor said its partners can use these digital assets to settle payments across 200 countries.

Bitcoin price is highly correlated with the stablecoin market, thus making Visa Inc’s USDC incorporation key to the future of the crypto industry.

Cuy Sheffield, who is the head of the crypto at Visa, said that the increased demand from their customers to use and hold cryptocurrencies made them build the current features.

Skrill digital wallet users in the selected states can now purchase Bitcoin, Ethereum, Bitcoin Cash, and Litecoin through Coinbase.

To remain competitive in a fast-changing environment, Visa has put in place measures to bridge the gap between fiat and cryptocurrencies.

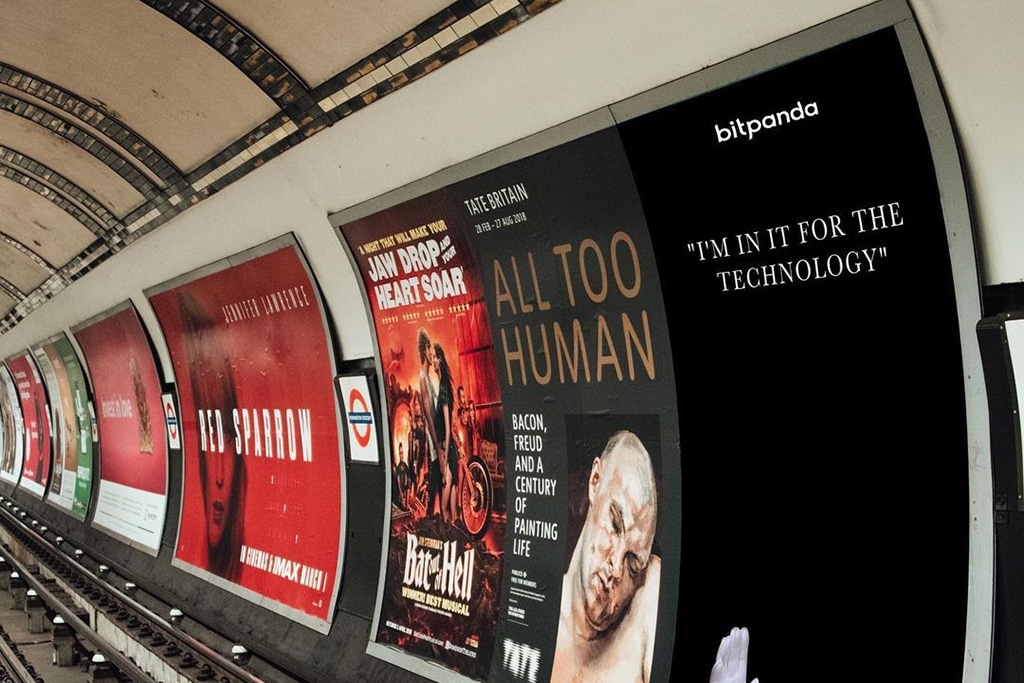

Now Bitpanda is going to expand its offerings beyond cryptocurrency trading, serving as a one-stop platform for anyone looking to trade digital securities.