Luge Capital FinTech-focused VC Fund Valued at $85 Million after Recent Funding

Luge Capital says that big organizations are pouring massive investments as Canada’s FinTech space is showing considerable growth.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

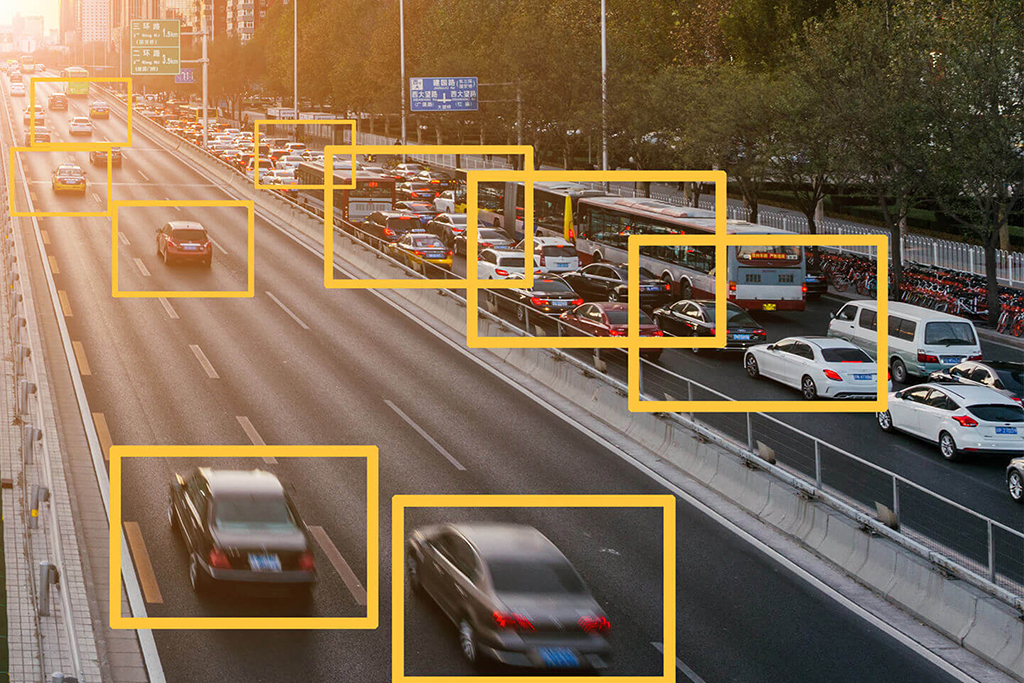

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Luge Capital says that big organizations are pouring massive investments as Canada’s FinTech space is showing considerable growth.

Mastercard and Revolut have formed a new agreement that will saddle Mastercard with the responsibility of operating all of Revolut’s U.S. debit cards as it prepares to launch in the US.

Money transfer fintech startup TransferWise has obtained an operating license in the United Arab Emirates and is set to begin operations next year.

SMBC is planning to use R3 and TradeIX’s Marco Polo platform to handle a trade transaction towards the end of the year.

G7 has just recently released a report addressing a long list of concerns it has with global stablecoins like Libra.

Many of the most discerning tech companies globally – including Chime, Robinhood, Monzo, Revolut, Transferwise, Varo and many others – trust Galileo’s APIs to open and verify new financial accounts, issue and process payment cards, and launch new products.

Without loud announcements, Bank of America has conducted testing of Ripple’s distributed ledger technology. And it may seem that it won’t stop at this stage.

According to Samsung SDS vice president Yoon Shim, the company started testing the system in August this year. The blockchain healthcare network is set to go live this month.

The fear for many authorities is that Facebook’s Libra could heavily disrupt the financial system and potentially enable illicit activities like money laundering or terrorist financing.

Libra’s interim managing director is quite sure the team will reach its goal of a hundred members by next year.

The South Korean government is going to put all relevant documents on the blockchain making them available for banking institutions, trading institutions, and others.

The fintech industry is booming as shown by investors in Singapore who poured a record $735 million into financial-technology deals representing a 69% surge from the prior-year period that had $435 million.

It has been revealed that Initially a vehicle identification network developed within the Mobility Open Blockchain Initiative will be tested in the US.

Mastercard, Visa, eBay, Stripe and Mercado Pago have all pulled out of the Facebook-led Libra Association following PayPal, which pulled its own support of the project earlier this week.

Samsung has officially announced that it will collaborate with the Finably fintech firm, a Ripple’s partner, to launch an international money transfer service on the Samsung Pay app targeting US users.