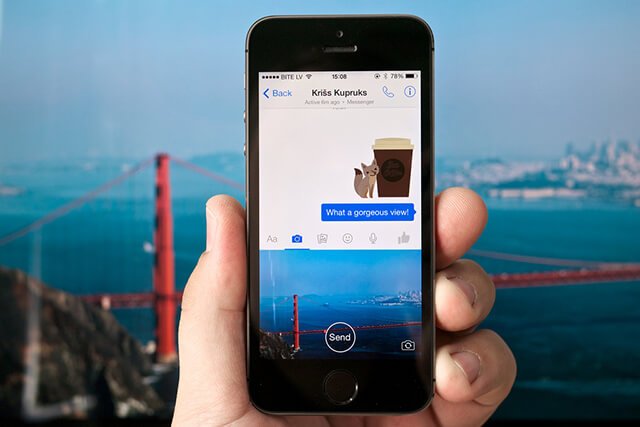

Square Helps Small Merchants by Offering Free Processing for Apple Pay Payments

Apple and Square join efforts to educate users across the nation about the value of mobile payments.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Apple and Square join efforts to educate users across the nation about the value of mobile payments.

Toronto can boast of multiple factors that altogether create a perfect environment for fintech development.

German automotive giant is launching its own ‘on-the-go’ payment solution to let drivers pay for the company’s mobility services using their mobile phones.

One of the leading private banks in India is accepting applications for its new fintech accelerator program aimed at facilitating innovation in the financial sector.

The whilepaper underlines the importance of further advancement and development of the fintech to serve multiple political and financial goals.

Former chief executive of Worldpay gets approval from UK regulators to launch a new bank that will provide financial services for fintech businesses worldwide.

The bank estimates the growing number of mobile payments and becomes one of the first ones to offer all five mobile payment options.

Electronics giant might soon launch a mini version of its mobile payment system and an upcoming artificial intelligence voice assistant Bixby.

With fintech quickly gaining traction around the world, the University of Strathclyde in Glasgow is planning to launch the first fintech degree in the UK.

South Korean electronics and information technology company is going to make its mobile payments service Samsung Pay available in India next year.

Online lender has completed its latest financing round to enlarge its team and expand its finance solutions, less than a year after raising $40 million in January.

Samsung Pay Mini won’t launch on the App Store in the near future, as Apple has rejected the company’s mobile payment application for unknown reasons.

The social network giant has got an e-money license from the Central Bank of Ireland, thus allowing its customers in Europe to pay via its Messenger app.

The company brings savings clubs into the digital world via blockchain-based mobile app.

Сhartering financial technology companies that offer bank products and services is connected with increased interest and inflow of investments in the sphere.