Doosan Robotics Shares More than Double in South Korea’s Thursday IPO

Doosan Robotics had an impressive IPO with shares jumping more than 100%, making it South Korea’s biggest trading debut so far this year.

This category covers crypto market news today, including crypto index trends, major exchange data, capital flows, sentiment shifts, regulation impact and crypto’s interaction with traditional finance. Designed to help you understand the forces driving valuation across tokens, sectors and regions.

Doosan Robotics had an impressive IPO with shares jumping more than 100%, making it South Korea’s biggest trading debut so far this year.

Astera Labs closed its series D funding round in November last year with $150 million at a valuation of about $3.15 billion.

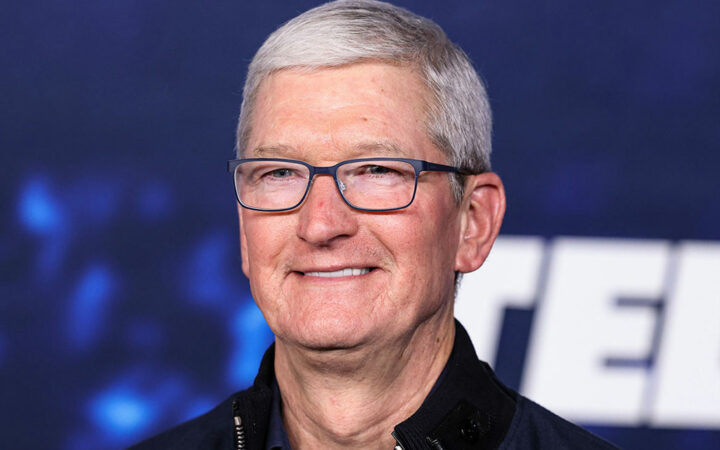

Analysts at KeyBanc downgraded Apple shares from ‘Overweight’ to ‘sector-weight’ citing a weaker sales growth outlook.

SAS will leave exchanges as part of its restructuring deal, in addition to splitting equity and debt among members of a takeover consortium.

The updated vaccine specifically addresses the XBB.1.5 subvariant of the Omicron variant, which has raised concerns due to its potential to evade immunity conferred by earlier versions of the vaccine.

Half of Sandoz’s revenue comes from Europe. Thus, it will be looking to leverage its brand presence in Europe for further growth.

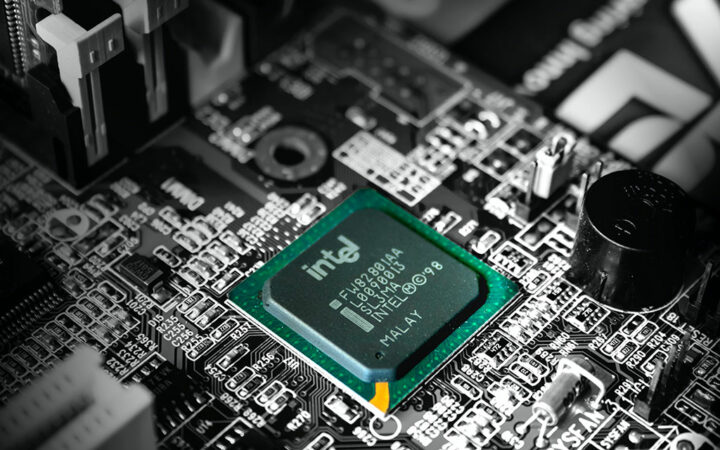

Intel is making a strong push in the semiconductor industry with FPGAs, which can be highly flexible, efficient, and used in various industries, are in high demand.

The affordability of funding new houses is expected to strain the already heavily taxed small businesses and individuals.

By mid-day, the ETFs had seen less than $2 million in trading volume. According to the analyst, this was “about normal” for a new ETF but low when compared to BITO, the first Bitcoin futures ETF, which did $200 million in the first 15 minutes of trading.

A substantial group of Evergrande’s offshore creditors is considering joining a liquidation court petition against the developer if it fails to submit a new debt restructuring plan by the end of October.

The downtime for the Tesla factory upgrades caused the decline in production and deliveries of electric vehicles in the third quarter compared to the second and first quarters.

JPMorgan Chase & Co. recently raised its Sphere Entertainment stock price target from $25 to $28 following the release of the entertainment company’s Q4 figures.

If approved, the move marks a significant step towards providing investors with transparent and regulated access to crypto within familiar product structures.

The launch of EFUT marks the company’s second foray into the futures ETF market.

Birkenstock confidently moves ahead with its IPO plans despite mixed performances of other listings in September. Goldman Sachs, JPMorgan, and Morgan Stanley shall be the underwriters for the IPO.