Meta Shares Soar to New Heights as They Hit 9th Month of Gains

Meta has encountered a slew of setbacks in the past year, casting doubt on its future prospects.

This category covers crypto market news today, including crypto index trends, major exchange data, capital flows, sentiment shifts, regulation impact and crypto’s interaction with traditional finance. Designed to help you understand the forces driving valuation across tokens, sectors and regions.

Meta has encountered a slew of setbacks in the past year, casting doubt on its future prospects.

The company reported record-breaking new member additions, surpassing the 584,000 mark.

Amid the euphoria of a robust first quarter, Panasonic has decided to maintain its full-year profit predictions.

While inflation in Eurozone shows signs of slowing down, it still remains much higher than the targeted 2%. Economists also pointed out other cracks in the Eurozone economy.

Ford lifted its guidance range for full-year 2023 consolidated adjusted EBIT to between $11 billion and $12 billion.

Roku reported a strong Q2 2023 beating analysts estimates on multiple fronts, also adding more active users and streaming hours.

Finance chief David Zinsner attributed the better-than-expected Q2 2023 earnings to some internal developments at Intel.

As the global economy continues to recover from the COVID-19 pandemic, the Eurozone is facing increasing chances of inflationary pressures.

To counter the margin pressure, Barclays announced plans for a share buyback of up to £750 million.

O’Leary says the Fed could still increase rates to 6.25% or 6.5%, resulting in bank failures in regional institutions.

Shell is struggling with a continuous fall in profits as Q2 2023 figures show significant reductions compared with last quarter and Q2 2022.

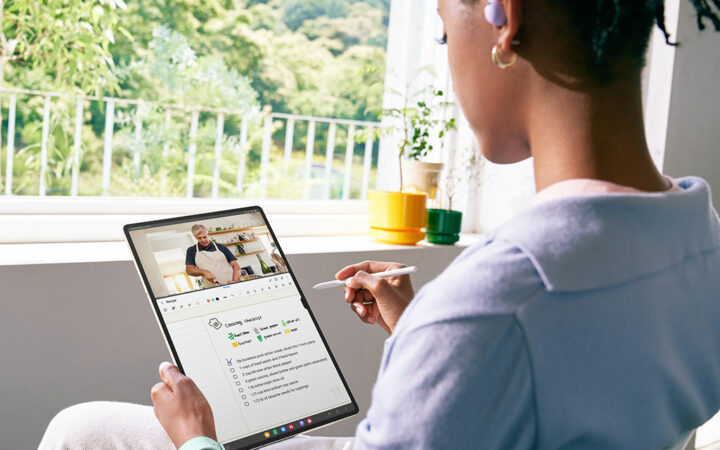

Looking ahead to the second half of 2023, Samsung expects the overall smartphone market to return to year-on-year growth, particularly in the premium segment.

According to Meta, operating losses from the Reality Labs unit will “increase meaningfully year-over-year due to ongoing product development efforts in augmented reality/virtual reality and investments to further scale the ecosystem.”

Meta CEO Mark Zuckerberg highlighted that the company’s app continued to record strong engagement and currently has an exciting product in the pipeline.

The recent Fed increase in interest rates has put the midpoint of the target range at the highest level in over two decades.