Top 10 Stocks Investors and Big Money Guys Opt For

While the entire investing terrain seems marred by the COVID-19 pandemic, there are some stocks that still attract investors.

While the entire investing terrain seems marred by the COVID-19 pandemic, there are some stocks that still attract investors.

Nike completely smashed Wall Street estimates by delivering much better than expected results. The company’s digital sales approach has helped it outsmart its competitors and manage to stay alive during these tough times.

The stock market remained upbeat on Tuesday as Fed Chairman Jerome Powell restored confidence among investors assuring the central bank’s support to the economy. Tech stocks continued to remain in charge of the market pullback.

Software development company Bentley Systems has revised its share price to between $19 and $21 per share as it is going to raise $225 million in IPO.

Airbus CEO Guillaume Faury has disclosed that the company may pursue job cuts. AIR stock is down today, trading at around 63 EUR.

Apple CEO Tim Cook said he is impressed with employees’ effective remote work. But he thinks that workers can return to the office by next year.

According to the series of tweets by Musk, Tesla is largely going to focus on battery cell production, which should take maximum speed in two years.

The unprecedented plunge of the shares of HSBC and Standard Chartered on the Hong Kong Stock Exchange has pushed the exchange to lead losses in the Asian region.

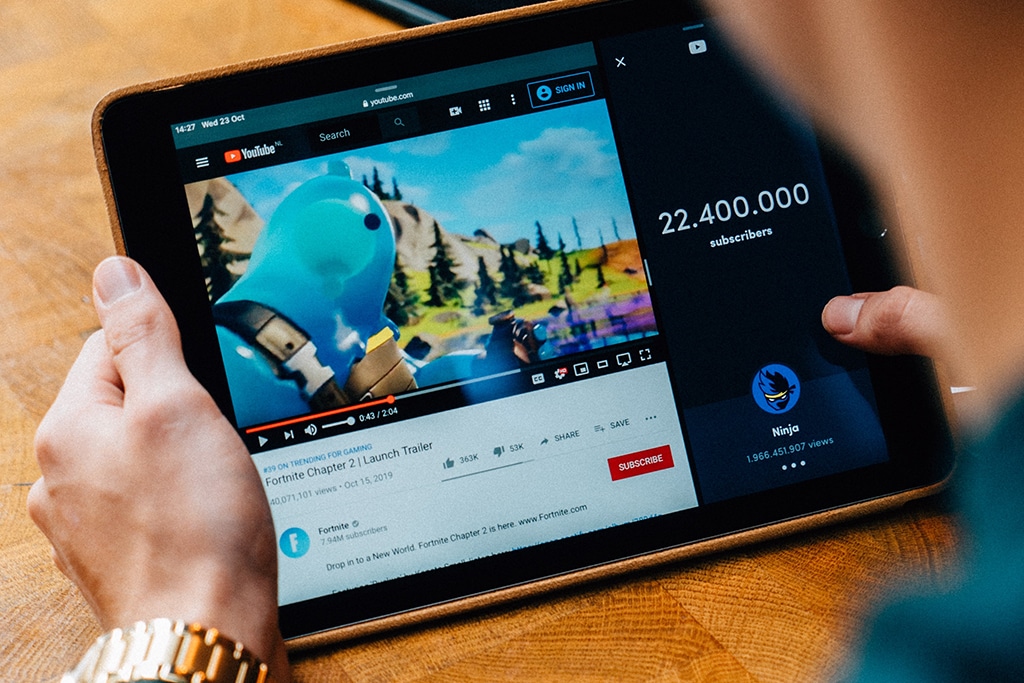

In its biggest gaming acquisition to date, Microsoft sealed a deal with taking over ZeniMax Media’s global operations while getting straight access to some of the popular gaming franchises. The acquisition will be closed by the second half of 2021.

The United Kingdom is mulling for another round of national lockdown as some medical scientists hinted at necessary measures to arrest the rise in COVID-19 cases. This has caused global investors to reconsider their positions as the road to economic recovery looks longer.

As Apple and Epic Games continue their lawsuits exchange, the game developer recently countered a “false” claim by Apple. AAPL stock is down.

General Electric (GE) shares have seen a massive rise and dump in the past days from the realities of two different events.

On Friday, the S&P 500 index closed 1.12% or 37.54 points down, at 3,319.47. The close was below S&P 500’s 50-day moving average for the first time since April. At the moment of writing, it is even lower, at 3264.41.

After Rolls-Royce confirmed plans to raise £2.25 billion ($3.23 billion) through an equity issue, shares fell over 7%. RR is currently down 14%.

In a leaked email from Tesla CEO Elon Musk to company employees, the billionaire CEO has asked to accelerate the deliveries to register another record deliveries in Q3 2020.