Unprecedented Sell-off Pulls Bitcoin Under $30,000, 40% of BTC Investors in Loss

If the sell-off in the US equity market doesn’t cool down anytime soon, we can expect further corrections in Bitcoin and the broader crypto market.

Your essential daily read: our featured Story of the Day highlights the most impactful development across crypto, blockchain, or regulation—curated for urgency, significance, and insight. Don’t miss what moves the market today.

If the sell-off in the US equity market doesn’t cool down anytime soon, we can expect further corrections in Bitcoin and the broader crypto market.

The price has fallen in four straight days with about a 3% decline in the last 24 hours trading at the current price of $33,697 as of press time.

Despite some positive development from China’s April trade data, global stocks still remain lower as investors remain tentative.

Stocks in the Asian market are largely seeing a bad day as the shares of tech giants buckled under the realities in the broader global market.

The Dow and Nasdaq recorded their worst day performances in almost two years on Thursday, as the S&P 500 also loses ground.

The digital currency ecosystem is also seeing a massive bullish correction with Bitcoin (BTC) trailing the broad market indices in the rally post interest rate hike.

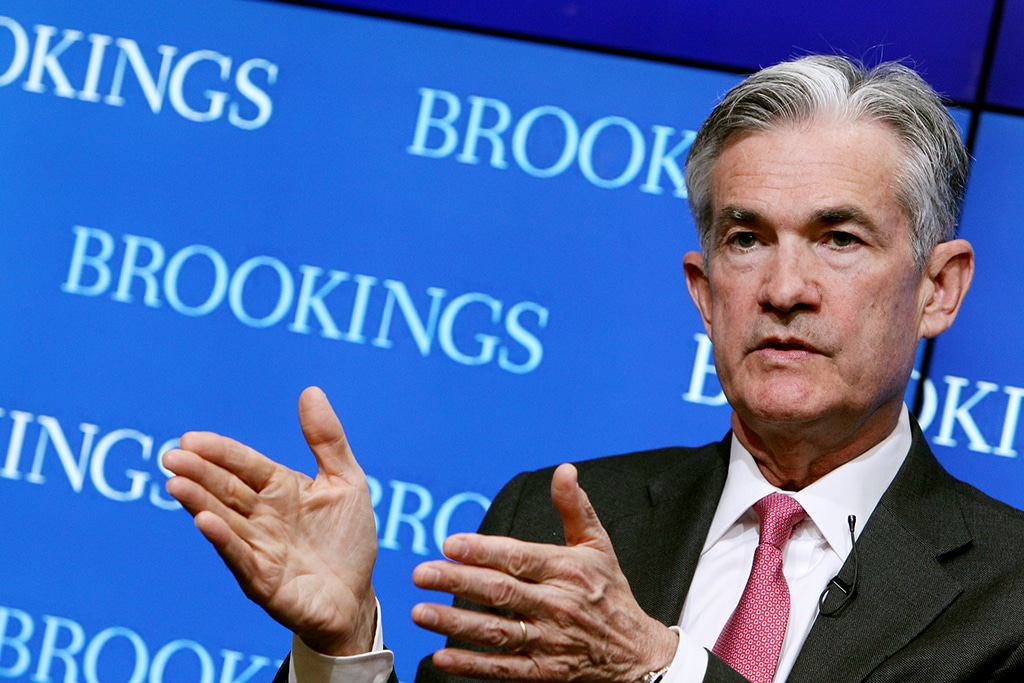

All three major US stock indices witnessed heavy selling in April 2022 amid concerns about the Fed’s hawkish move in monetary policy tightening.

NASDAQ futures, as well as futures of other US leading indexes fell after discouraging earnings reports from tech companies.

Meta explained that the Meta Store has an interactive Quest 2 display wall.

About a week ago, Musk submitted a filing with the SEC that shows that the Tesla CEO has secured $46.5 billion in debt and equity financing to support a potential Twitter takeover bid.

There are speculations that the price drop is traceable to further tension from Russia’s invasion of Ukraine and also the US Federal Reserve interest adjustment policy.

European markets opened 1.3% lower at the beginning of the week as investors continue to monitor developments around the war in Ukraine.

Tesla announced record Q1 numbers that surpassed analysts’ expectations in revenue and earnings per share despite supply chain issues.

The Ethereum network is known for its very high gas fees, however, Coinbase said it will not charge any fees for a limited amount of time.

European stocks turned positive after opening at the flatline as markets assess the Ukraine war and predictions from the World Bank and IMF.