Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.

Oasis.app has rolled out the G-Uni Multiply feature, allowing users to earn yields on their Dai deposits.

Edited by Julia Sakovich

Updated

6 mins read

Edited by Julia Sakovich

Updated

6 mins read

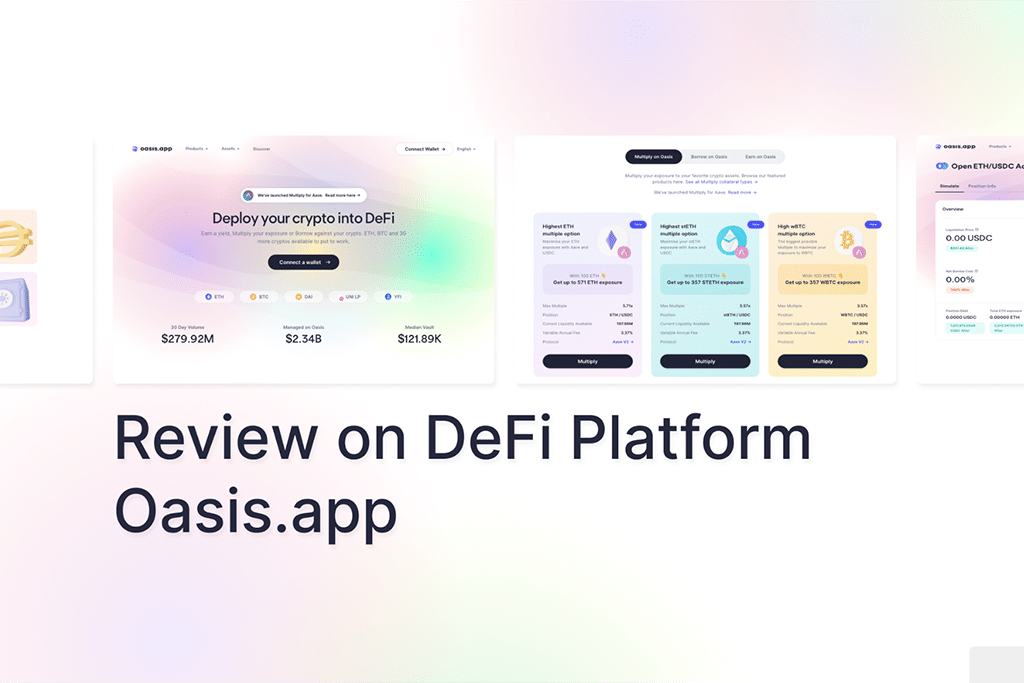

Cryptocurrency investors are exploring new avenues to generate higher capital returns, and decentralized yield opportunities have emerged as a popular choice. The allure of decentralized finance (DeFi) lies in the transparency and security it offers users, who can earn income while retaining control over their funds. This article delves into the yield earning and lending services provided by Oasis.app, a leading DeFi platform.

By utilizing Oasis.app, users can create Dai, a stablecoin pegged to the US dollar, by leveraging their digital assets through the Maker Protocol. The Oasis Borrow interface offers a hassle-free solution for users to engage with Maker Vaults, making it easy for them to access their desired amount of Dai without compromising the security of their assets.

With Oasis Borrow, users can lend Dai by utilizing a wide range of digital assets, including ETH and WBTC, which the Maker Protocol supports. The user-friendly and constantly evolving interface of Oasis Borrow streamlines the process of borrowing Dai, making it effortless for users. Additionally, the fact that Dai operates on Ethereum’s blockchain emphasizes the decentralized nature of the platform. One of the standout features of the Oasis.app is its credit-check-free lending system, providing users with an accessible way to obtain loans.

Oasis Borrow provides several benefits to its users. Firstly, it offers extra liquidity by providing the Dai stablecoin, which can be used for trading, spending, or saving, making it a versatile tool for managing digital assets. Moreover, Oasis supports various collateral types, rates, and ratios, providing flexibility for borrowers with different risk profiles. Oasis employs an Oracle security module to safeguard borrowers from flash crashes, which updates prices once per hour. Additionally, Oasis offers a flexible repayment system that does not mandate repayment schedules, minimum payments, or credit history checks. If their Vault remains properly collateralized, users can repay at their own pace, allowing them to manage their borrowing on their terms.

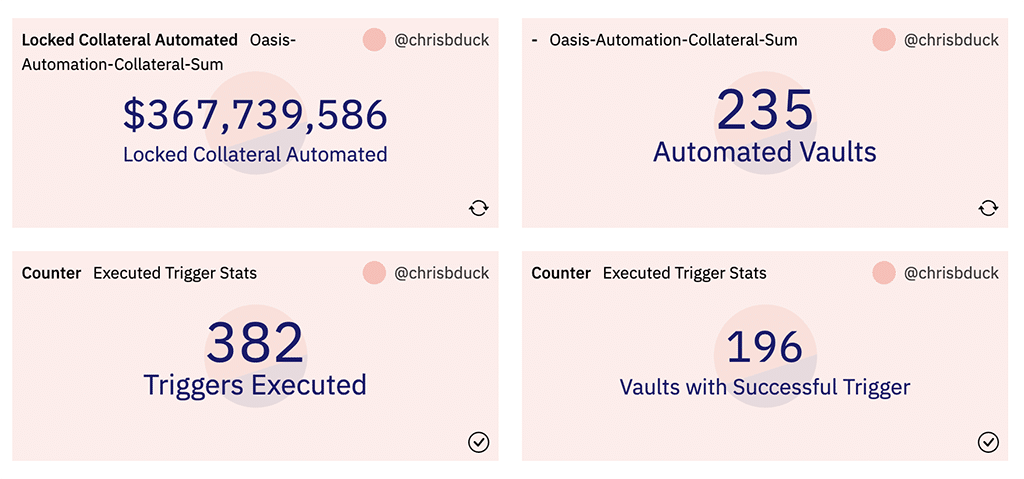

Oasis.app has recently unveiled a game-changing feature called “Multiply”, which enables users to borrow Dai directly within the platform. This groundbreaking feature allows users to adjust their cryptocurrency investments without the hassle of executing multiple transactions or switching between different apps. With the Multiply feature, users can effortlessly increase their holdings of the collateral crypto they use, enhancing their investment strategy. The Oasis.app empowers users to make more informed investment decisions by providing a streamlined approach to managing their digital assets.

Oasis.app’s Multiply feature offers investors an excellent opportunity to expand their exposure to digital assets. Via depositing ETH, WBTC, or any other approved collateral, into a Vault, a person has the possibility to generate Dai and further utilize it for getting additional collateral. Thanks to the ensured support for different types of crypto collaterals, the Maker Protocol-backed Multiply feature lets investors leverage the upward trends that can be observed in their preferred digital assets. With this feature, Oasis.app helps users to make the most of their crypto assets.

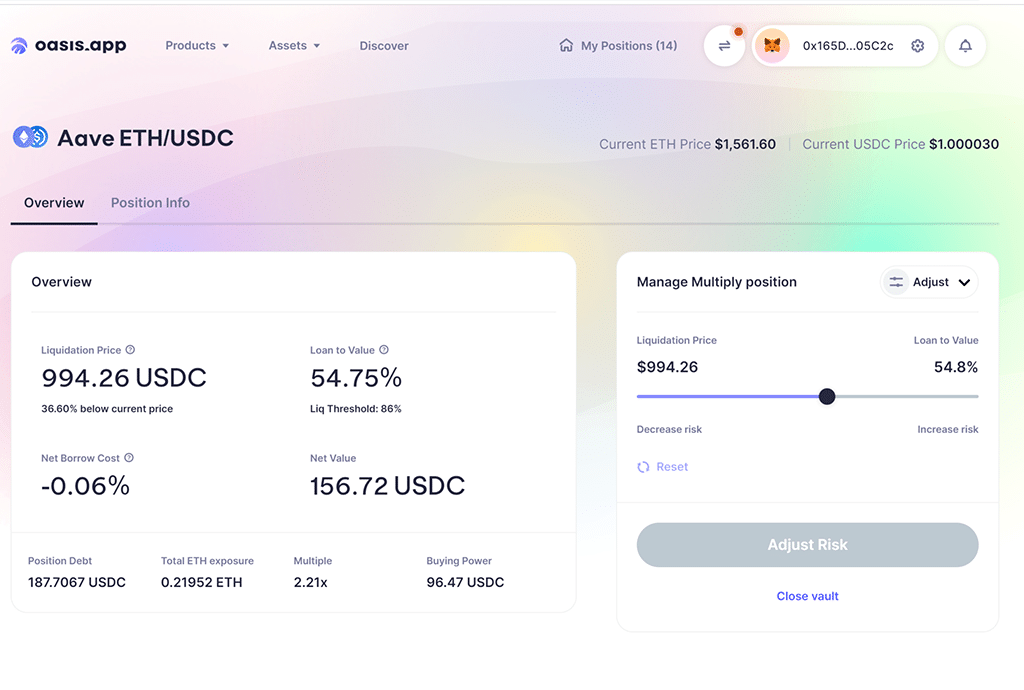

The platform has also integrated this feature with AAVE and created Oasis Multiply for AAVE. As a result, investors can use the borrowed USDC to buy more collateral within the Oasis.app platform. The platform is going to add more of the safest and most reliable AAVE-supported collaterals to this feature.

For getting the possibility to get access to the Multiply feature, users need to create a specialized Multiply Vault. This Vault includes both the Borrow features and the Multiply function. This process allows users to deposit and withdraw collateral or Dai to adjust their position. Users with an existing standard Vault can easily convert it into a Multiply Vault without additional deposits.

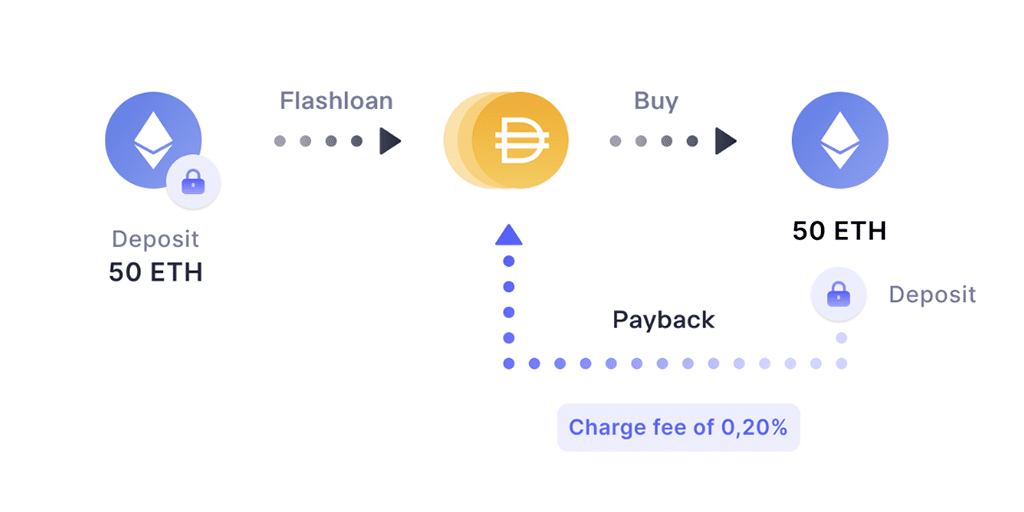

Using Oasis Multiply, investors can leverage flash loans to increase their exposure to cryptocurrency assets. This innovative feature enables users to deposit approved collateral, such as WBTC, into a Vault, which generates Dai that can be used to purchase additional collateral. For instance, users can multiply their WBTC exposure by up to 4.33 times, providing access to Bitcoin through an ERC-20 token, WBTC, to participate in DeFi applications. However, flash loans come with inherent risks that users must consider before using them. It is crucial to maintain an appropriate collateralization ratio to avoid liquidation. Oasis.app offers a secure platform that allows users to explore these new opportunities while mitigating potential risks.

Alternatively, AAVE offers even higher multiples and the added benefit of earning yield on users’ collateral, which can be utilized to offset borrowing costs, potentially leading to a lower net borrowing cost than Maker. However, it’s essential to evaluate the benefits and drawbacks of each protocol carefully before making a decision. Comprehensive reviews of Maker and AAVE can help users determine which platform best aligns with their investment goals and risk appetite.

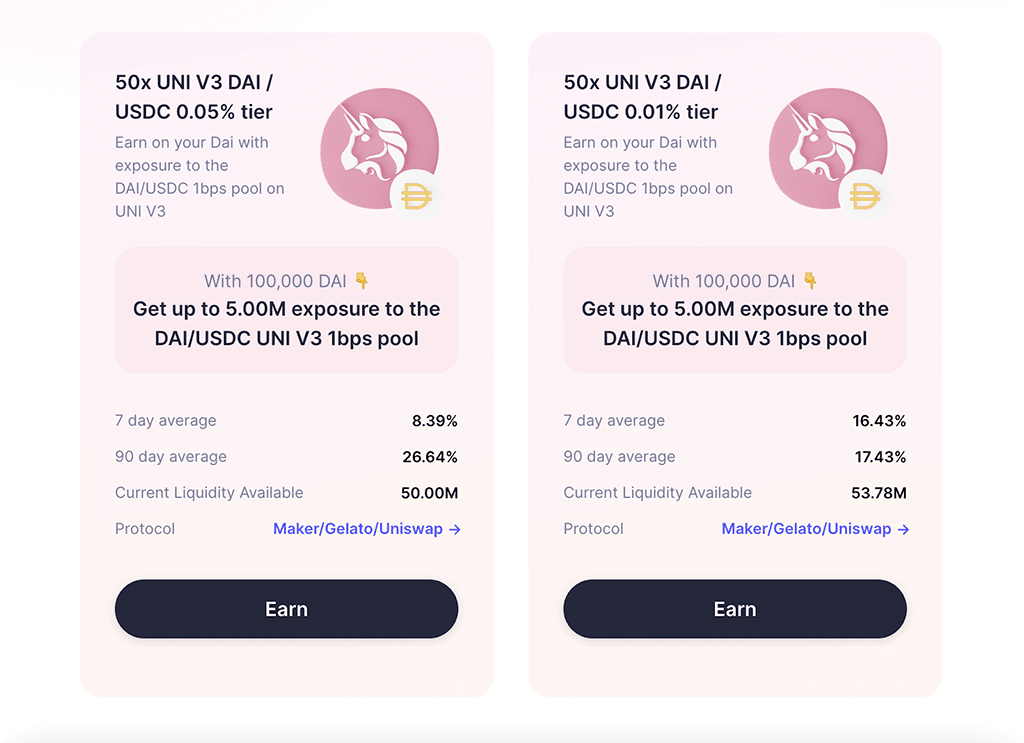

Oasis.app has rolled out the G-Uni Multiply feature, allowing users to earn yields on their Dai deposits. This innovative feature utilizes G-Uni Vaults, designed to optimize Uniswap V3 fees, enabling users to deposit Dai into the Vault and multiply it to the maximum possible amount before converting it back to Dai. Instead of generating Dai or withdrawing collateral, the yield is generated from the fees earned by the G-Uni Vaults. This feature offers users an alternative way to maximize their returns and highlights Oasis.app’s commitment to providing diverse and innovative yield-earning opportunities.

The Oasis.app platform charges a variable fee, the stability fee, and an interest rate for all its services. The amount of the stability fee is determined by MKR token holders who oversee the protocol and can vary for each type of Vault. The fees range from 0% to 4.5%, depending on the type of token used as collateral.

The Oasis.app provides various financial services with fees and costs. Oasis Borrow is free, but users are responsible for transaction gas costs in ETH. Oasis Multiply incurs a 0.2% fee in Dai and transaction gas costs in ETH. The Oasis Earn Vault involves a 0.04% fee in Dai and transaction gas costs in ETH to set up. However, closing a Vault with Oasis Stop-Loss requires a 0.2% fee in Dai and transaction gas costs in ETH. If protection is triggered, users incur a transaction gas cost in Dai.

The only withdrawal fees are transaction gas fees, which include a network fee and a flat fee to the platform.

The cryptocurrencies supported by Oasis.app include the following:

Oasis.app has a robust support system to ensure its users can access help when needed. The platform provides a detailed knowledge base covering all aspects of its services and various channels through which users can seek assistance, including email and social media. Additionally, the platform keeps its users informed about the latest news, features, and other important information, ensuring that users can access the most up-to-date information about the platform.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.