With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Tokenized Treasuries have experienced rapid growth, increasing from $769 million in January to more than $2.2 billion by September, driven by rising US interest rates, making government-backed investments highly appealing.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

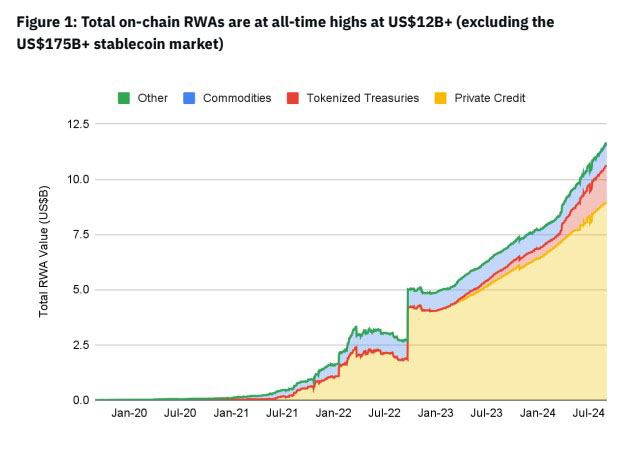

The value of tokenized real-world assets (RWAs) surged past $12 billion, reaching a historic high, as highlighted in Binance’s September 2024 report, “RWAs: A Safe Haven for On-Chain Yields”. This growth, excluding the stablecoin market valued at over $175 billion, reflects growing interest from institutional investors and decentralized finance (DeFi) supporters.

Source: Binance Research

RWAs represent digital versions of physical or intangible assets like currencies, real estate, and government bonds. By using blockchain technology, these tokenized assets increase efficiency, transparency, and accessibility, linking traditional finance (TradFi) with decentralized systems.

Institutional participation, led by major players such as BlackRock, Franklin Templeton, and WisdomTree, has significantly fueled this expansion. The trend towards tokenization not only opens new avenues for investors but also drives innovation in supporting infrastructure like smart contracts, oracles, and asset custody systems.

Since the beginning of 2024, tokenized Treasuries have experienced rapid growth, increasing from $769 million in January to more than $2.2 billion by September. This sharp rise in market value stems from rising US interest rates, which have made government-backed investments highly appealing.

With the Federal Reserve maintaining a target rate of 5.25% to 5.5%, the highest in over two decades, these yields remain competitive, drawing interest from both institutional and individual investors.

Among the leaders in this space is BlackRock, whose BUIDL product commands a market cap of over $500 million. Franklin Templeton’s FBOXX follows closely with $440 million, while WisdomTree Investments has expanded further into tokenized equity products and other digital funds.

The tokenized Treasuries yield between 4.5% and 5.5%, and it will take multiple rate cuts before these returns become less attractive to investors. This window provides a critical moment for DeFi platforms like Ondo, Open Eden, and Centrifuge to cement their positions in the market by offering these risk-free, yield-bearing assets on-chain.

Beyond government bonds, real-world assets cover various financial categories. Private credit has gained significant importance, with blockchain-based loans expanding by 56% over the last year. Despite this rapid growth, the sector remains relatively small, representing only $9 billion within the broader $2.1 trillion private credit market.

Figure, a leading fintech firm, has driven much of this development by using a permissioned blockchain to offer credit lines backed by home equity.

Similarly, tokenized commodities, particularly gold, have emerged as a growing area. Paxos Gold and Tether Gold currently lead this market. These digital assets have streamlined the process of managing physical commodities, but they still lag behind traditional gold exchange-traded funds (ETFs), which command over $110 billion in market capitalization.

With the US rate-cutting cycle likely to begin on September 18, 2024, tokenized Treasury yields are expected to decline. However, RWAs offer more than just yield. They provide investors with diversified, transparent, and accessible investment opportunities.

Source: Binance Research

Moreover, advances in technologies like zero-knowledge proofs and decentralized oracles will continue to strengthen the RWA ecosystem by improving regulatory compliance while maintaining user privacy.

However, legal and regulatory challenges persist for RWAs. Most products still require strict KYC checks and are limited to accredited investors, which restricts access. On the other hand, innovations in decentralized identity solutions, such as soulbound tokens (SBTs), could transform this space by enabling anonymous yet compliant transactions on public blockchains.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.