With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Despite recent outflows from Bitcoin ETFs, analyst Eric Balchunas says it’s only 1% of total inflows and calls it “minuscule” in the bigger picture.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

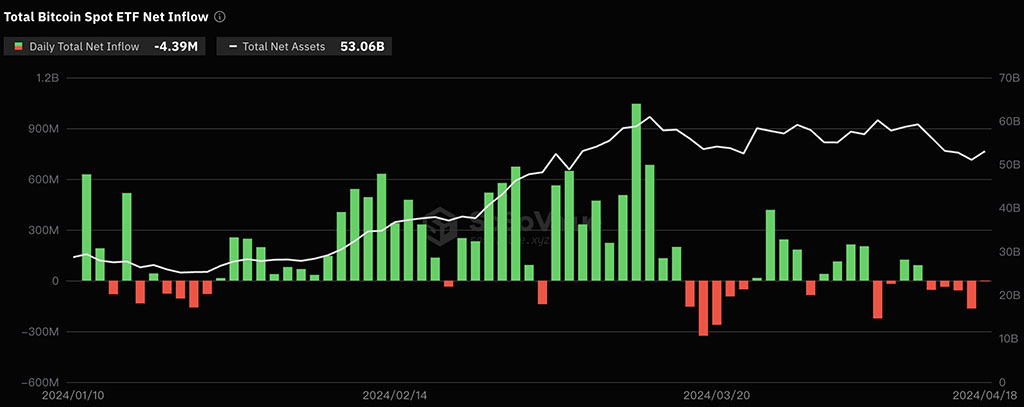

The cryptocurrency landscape shifts, with spot Bitcoin Exchange-Traded Funds (ETFs) riding the wave. Despite Bitcoin’s recent price dip of 8% in the last week, five days of consecutive outflow from spot Bitcoin ETFs got little relief, reaching 4.3 million from a substantial outflow of $165 million the previous day.

On April 18th, 2024. SoSoValue reported a net outflow of $4.3876 million from spot Bitcoin Exchange-Traded Funds (ETFs). Notably, Grayscale’s prominent Bitcoin Trust (GBTC) experienced a substantial net outflow of $89.9918 million. This adds to the fund’s historical net outflow, which now stands at a remarkable $16.685 billion.

Photo: SoSoValue

While Grayscale faces challenges, newer entrants are finding their footing. Fidelity’s FBTC emerged as a frontrunner, recording a substantial net inflow of $37.3959 million on the same day. Remarkably, FBTC’s cumulative net inflow has soared to an impressive $8.087 billion since its inception.

Moreover, BlackRock’s IBIT constantly demonstrated positive inflows, with a net inflow of $18.7627 million, bringing its historical net inflow to a commendable $15.392 billion, showing its growing prominence among investors seeking new avenues for investment in the ever-evolving crypto landscape.

The Grayscale Bitcoin Trust ETF experienced a substantial outflow, with investors withdrawing $89.99 million on April 18, contributing to an overall net outflow of $1.66 billion historically. Additionally, BlackRock’s Bitcoin ETF inflow drops to $18.76 million from its sufficient inflow of $308 million on April 5.

Despite the recent outflow trend, Bloomberg expert Eric Balchunas offers a balanced perspective. He highlights that these outflows are just 1% of total inflows to Bitcoin spot ETFs since their inception. Balchunas downplays the current trend’s significance, calling it “minuscule” in the bigger picture.

“Totally normal for ETF category to cool off after a breathtaking pace like this, esp w/ price down 12% in past 5 days. Over past five days the ten’s net flows are -$223m, that is 1% of the ten’s net inflows since launch and 0.4% of their assets,” said Balchunas.

The United States is not the only participant in the ETF race. Europe faces its distinct set of hurdles. Two months prior, the UK revealed intentions to foster a conducive climate for pioneering Bitcoin ETFs headquartered within Europe. However, the finalized regulations remain pending implementation.

The recent decline in spot Bitcoin ETF activity coincides with two key events: the ongoing tax filing season in the United States and heightened geopolitical tensions in the Middle East. These factors, coupled with the inherent volatility of the cryptocurrency market, have likely contributed to the recent dip in Bitcoin’s price, which in turn, is reflected in the ETF outflows.

While recent outflows and price fluctuations grab headlines, it’s important to remember the long-term growth trajectory. The emergence of strong contenders alongside established players indicates a maturing market. As regulatory frameworks around the world evolve, the future of spot Bitcoin ETFs appears bright, but not without its bumps along the road.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.