Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!

Invoices Plus will offer Square customers advanced features that include those previously available on the free version.

Square Inc (NYSE: SQ) stock closed yesterday trading at $271.92, 1.46% higher than the day’s opening price. Meanwhile, SQ stock traded around $272.20, up approximately 0.10% as of Aug 31, 2021, 6:56 a.m. EDT. News outlet TechCrunch reported that Square is set to introduce a subscription service from its free invoicing software dubbed Invoices Plus.

Reportedly, Invoices Plus will offer Square customers advanced features that include those previously available on the free version.

Some of the notable features of Invoices Plus include multi-package estimates, custom invoice templates, and custom invoice fields. These and many more will be available for a set monthly fee that has not yet been confirmed by the company.

Worth noting, the company’s free invoice software version will still be available for the customers to enjoy. As a result, free users can expect to enjoy invoice tracking, reminders, and reporting tools.

Square will as a result continue to generate revenue from its free invoice software plan. Currently, the company is estimated to generate approximately 2.9% ($0.30) per invoice paid online via check or debit card plus a 1% fee per ACH transaction.

As a technology-oriented company, Square has significantly benefited from the coronavirus market distribution. Furthermore, more global businesses continue to shift towards adopting different technologies in their line of business.

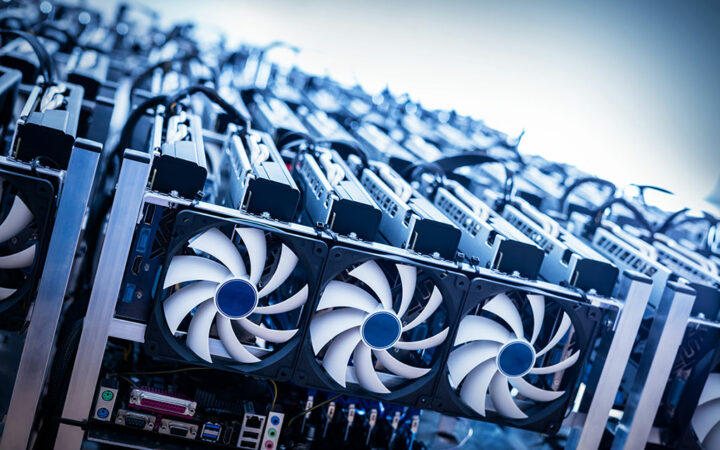

From a different perspective, the company has also significantly benefited from holding Bitcoin on its balance sheet. Consequently, its stock market has almost directly correlated with Bitcoin price. Moreover, the company has embarked on developing Bitcoin products including a hardware wallet.

According to market analytics provided by MarketWatch, SQ stock has added approximately 63.16%, 24.9%, and 22.51% in the past year, eight months, and three months respectively through Monday. The company has a reported market valuation of approximately $123.2 billion and 397.4 million outstanding shares. According to a survey conducted by the same media outlet, SQ stock received an average rating of Over from 39 ratings.

One notable rating is by JPMorgan that raised its price target from $300 to $320. The company continued to see a rise in its revenue growth, partially fueled by its Bitcoin holding. Notably, during the second quarter, Square reported revenue of $4.68 billion.

In a bid to reach the global market and diversify on its source of revenue, the company acquired Australian buy now pay later Afterpay for a whopping $29 billion. “Square and Afterpay have a shared purpose. We built our business to make the financial system more fair, accessible, and inclusive, and Afterpay has built a trusted brand aligned with those principles,” said Jack Dorsey, Co-Founder, and CEO of Square.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!