Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

Key Notes

- Stablecoin minting patterns historically precede major Bitcoin price rallies within 10-30 days of issuance.

- Combined Tether and Circle activity indicates liquidity retention and new capital entering crypto despite recent volatility.

- Market indicators suggest whales are positioning for upward movement with Bitcoin potentially bottoming around current levels.

Tether just minted $1 billion more of the leading stablecoin, USDT, totaling—together with Circle, the USDC issuer—over $20 billion in stablecoins minted since the October 10-11 crash. This movement provides valuable insights into what is next for the crypto market, liquidity-wise.

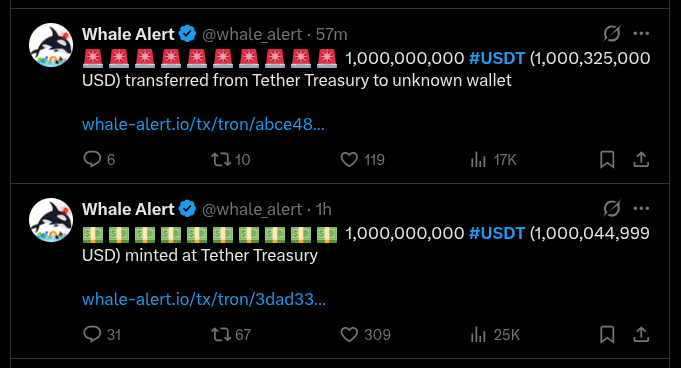

On December 2, one hour ago from this writing, Tether minted another 1 billion USDT and moved it to an unknown wallet on the Tron Network, according to data Coinspeaker gathered from Whale Alert.

Tether’s 1 billion USDT mint and transfer, onchain activity as of December 2, 2025 | Source: Whale Alert

The mint was also reported by Lookonchain, which highlighted the $20 billion in accumulated mints from Tether and Circle since the unprecedented $19 billion liquidation event on October 10 and 11 that crashed the market in what BitMine’s chairman described as a quantitative tightening effect for crypto—driving liquidity away.

Tether(@Tether_to) just minted 1B $USDT!#Tether and #Circle have minted $20B in stablecoins after the 1011 market crash.https://t.co/Ptsy2BsPoEhttps://t.co/bJ4jMdPZxo pic.twitter.com/IxbczCtNa8

— Lookonchain (@lookonchain) December 2, 2025

What Does $20 Billion in Stablecoin Mint Mean for Crypto?

Nevertheless, the so far minted $20 billion worth of USDT and USDC shows a different perspective on the crypto market, liquidity-wise. This is because stablecoins, especially the dollar-pegged ones issued by Tether and Circle, are the most used on- and off-ramps—being important liquidity and capital flow indicators.

As a rule of thumb, a diminishing market cap for stablecoins indicates capital is leaving crypto, with investors cashing out in traditional USD for non-crypto applications. On the other hand, an increasing market cap for this asset class indicates investors are depositing USD to get USDT and USDC so they can allocate capital in cryptocurrencies.

In theory, Tether and Circle can only mint USDT and USDC backed by real, deposited dollars. Therefore, these companies minting $20 billion post the $19 billion liquidations from October 10-11 suggests the liquidity not only remained in the crypto ecosystem, but additional liquidity has been entering the crypto rails at these prices.

A similar dynamic was observed on September 4, with Tether minting 2 billion USDT during a market retracement. This was the largest mint in nine months, only preceded by a $2 billion-worth mint in December 2024. All these mentioned mints have also preceded a price rally.

For example, Tether’s mint on December 6, 2024, preceded a 10-day, 8% rally on Bitcoin BTC $69 043 24h volatility: 4.1% Market cap: $1.38 T Vol. 24h: $60.88 B , achieved on December 16, 2024—from $99,000 to $107,000, approximately. Then, on September 4, 2025, the reported 2 billion USDT mint preceded a 30-day, 12% rally to BTC’s current all-time high—from $110,500 to $124,500

Bitcoin (BTC) one-year price chart, with Tether mints and rallies, as of December 2, 2025 | Source: TradingView

If history repeats, Bitcoin could see a similar rally from its current levels, between $85,000 and $90,000, potentially marking a local bottom. Other market movements Coinspeaker covered also suggest crypto whales are favoring longs rather than shorts, accumulating for what could be the next rally.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.