March 5th, 2026

The Valkyrie CIO says that the SEC will ask for comments and possibly approve an ETF proposal this month after all issues are addressed.

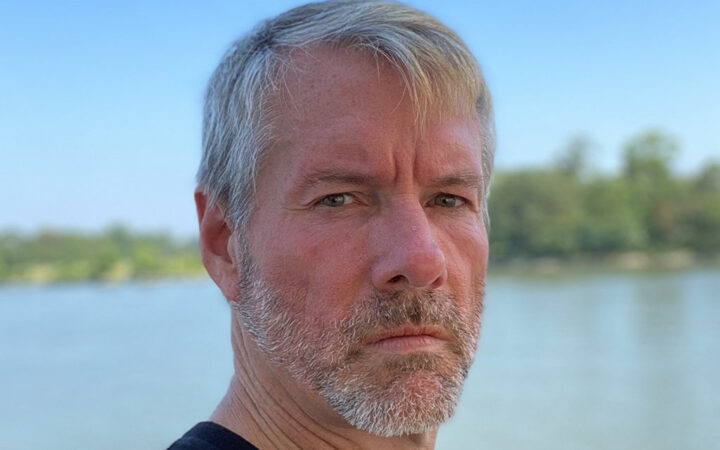

According to Michael Saylor, Bitcoin will pump significantly after the SEC approves a spot ETF and demand for the king coin spikes.

Most predictions are optimistic about a Bitcoin bull run considering the expected spot ETF approval and the upcoming halving.

Market makers, crucial components of ETF ecosystems, are responsible for the creation and redemption of new ETF shares, ensuring that the ETF’s market price remains in line with the underlying assets it represents.

Experts continue to speculate on what the SEC’s next course of action regarding crypto-based ETF applications could be.

As of late October, the SEC is reportedly reviewing eight to ten potential spot Bitcoin spot ETF filings.

Analysts expect 10-20% of the Gold ETF money moving into Bitcoin post the BlackRock ETF approval i.e. $12 billion to $14 billion worth of inflows in BTC.

Meanwhile, Galaxy Digital estimates that a spot Bitcoin ETF could attract enough capital to drive the price of Bitcoin up by 74%.

With the US SEC opting not to appeal the Grayscale Investments case, amid ongoing application amendments, experts believe the approval of spot Bitcoin ETF is a matter of when and not if.

In anticipation of this pivotal event, there has been a substantial uptick in trading volume for products launched by ProShares and Grayscale.

The Bitcoin network has set a new historic mining hashrate record as the market prepares for next year’s halving.

The recent uptick in amendments to filings awaiting SEC approval could be a sign of progress in negotiations between asset managers and regulators.

With how LINK is moving in recent times and its historical precedent, there are indications that it may serve as a market leader once again, potentially triggering another bullish trend.

While the prospect of a Bitcoin ETF is undoubtedly exciting, it is essential to acknowledge the potential challenges and roadblocks that may surface.

The Bitcoin halving, an event that takes place once every four years and cuts the reward for mining Bitcoin transactions in half, could also pave the path for a new bull run.