December 17th, 2025

Dive into the latest DeFi news and uncover important details about the evolving world of decentralized finance as the sector changes public interaction with financial services by ensuring direct access instead of using middlemen. DeFi offers users heightened control of their assets, as well as more financial services that are usually not obtainable when dealing with traditional platforms.

The protocol uses TODA auction mechanism to match heterogeneous proof workloads with specialized provers and introduces BREV token for payments and staking.

Despite a $400 billion crypto market cap loss in the past 30 days, analysts argue that the market is witnessing a reset for the next DeFi cycle.

Ethereum-based DEX Balancer has seen massive withdrawals from its platform, running to the tune of tens of millions.

Investment firm 1kx analyzed over 1,200 protocols, projecting that total 2025 fees will reach $19.8B as blockchain infrastructure costs decline.

21Shares has filed an S-1 with the SEC for the 21Shares Hyperliquid ETF, a fund that will track HYPE’s price and staking rewards.

The partnership will leverage Alpen Labs’ “Glock” cryptographic verifier to establish Starknet as a secure execution layer for BTC holders.

Societe Generale-FORGE and Bitpanda are extending their agreement to deploy regulated stablecoins into DeFi protocols for European retail users.

Polychain Capital-backed Enso Network has gone live on Ethereum and BNB Chain, offering a unified access layer that connects over 1,000 blockchain frameworks.

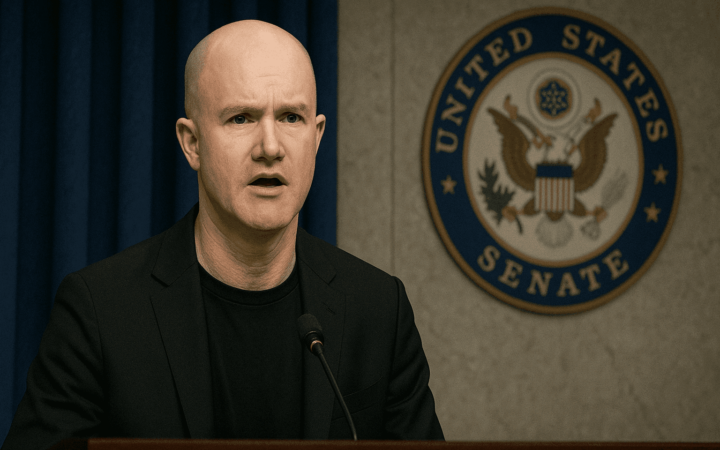

Coinbase CEO has publicly condemned a new DeFi market structure proposal from Senate Democrats, calling it a threat to innovation and the US crypto industry.

The YZi Labs-backed decentralized exchange, Aster, has garnered significant attention from both large and small investors and is now experiencing strong momentum.

DeFi lender Aave’s TVL has recently achieved a new peak, surpassing Lido to become the leading DeFi platform.

World Liberty Financial, a DeFi project publicly backed by the Trump family, is voting on a plan to use protocol fees to buy back and burn its WLFI token.

Mantle has surpassed $4 billion in treasury assets, making it the largest DeFi treasury in the market.

Speaking at the BNB Day event in Tokyo, Binance founder Changpeng Zhao predicted that DEXs will one day surpass CEXs in trading volume.

A new wave of interest has emerged in the decentralized finance sector, quite similar to the altcoin and meme coin frenzy of 2021.

DeFi is a short way of writing decentralized finance. Generally, DeFi encompasses cryptocurrencies and financial smart contracts, protocols, and decentralized applications (dApps) that are built on the Ethereum ETH $2 817 24h volatility: 4.5% Market cap: $340.27 B Vol. 24h: $26.57 B blockchain. To break it down further, DeFi is simply a blockchain-based financial software that can be joined together piece by piece like Legos.

DeFi represents a shift from traditional financial systems, as it gives people more direct control over their financial transactions. Using blockchain technology, DeFi platforms remove the need for financial intermediaries like banks, by automating most financial functions through smart contracts. These smart contracts control borrowing, lending, and trading, executing specific functions depending on the rules of the contract’s code.

The decentralized nature of DeFi ensures that users fully control their assets, unlike the traditional financial system, which has centralized institutions in control. This feature is executed smoothly because the blockchain is transparent, with transactions easily verifiable by anyone. Transparency is another advantage of decentralized finance, as no transactions or network decisions are shrouded in secrecy. As a result, DeFi has been effective in attracting users who want alternatives to traditional finance.

Another prominent feature of the decentralized finance sector is accessibility. While conventional options have high entry barriers, including high fees, strict identification requirements, and geographical restrictions, DeFi is available to anyone with an internet connection. The technology has been useful in satisfying areas where access to banking infrastructure is limited.

However, despite its exciting perks, DeFi comes with a few risks and challenges. These include smart contract vulnerabilities and unsupportive or unclear regulations. Nevertheless, the future of DeFi is promising as projects continue to innovate and create cohesion between the traditional and crypto sectors.

Explore the DeFi guide for more details about innovations and new features transforming the global financial sector.

Decentralized finance (DeFi) refers to a financial system that eliminates intermediaries using blockchain technology. DeFi platforms let users engage in financial activities directly, using smart contracts to automate the processes and ensure transparency.

There are several ways to earn money with DeFi. Users can consider providing liquidity to decentralized exchanges (DEXs) for trading fees or staking tokens in Defi protocols for rewards. Nonetheless, all users should thoroughly understand potential risks before starting.

The best DeFi wallet depends on individual needs. For instance, people who prioritize convenience may prefer a hot wallet like MetaMask or Trust Wallet. On the other hand, people who are more worried about security breaches may use a cold wallet like Trezor or Ledger.

DeFi offers several advantages over banks, including lower fees and faster transactions. In addition, users enjoy global accessibility and much more transparency than conventional systems.