December 29th, 2025

Brad Garlinghouse said that many other jurisdictions have done a better job than the US in providing clarity to crypto players.

The Uniswap ecosystem is expected to significantly benefit from Polkadot’s vast multi-chain capabilities and vice versa.

The company noted that its customers will have the possibility to use the Voyager app to begin requesting paybacks, which will take place in 30 days.

Telegram has implemented various security features to enhance user privacy and data protection.

CoinShares maintains a cautious optimism going ahead amid a strong surge in the regulatory activity taking place in the crypto market.

With crypto giant Coinbase seeking a license to operate in Bermuda, the country’s crypto market is buzzing with activity of more US firms showing interest.

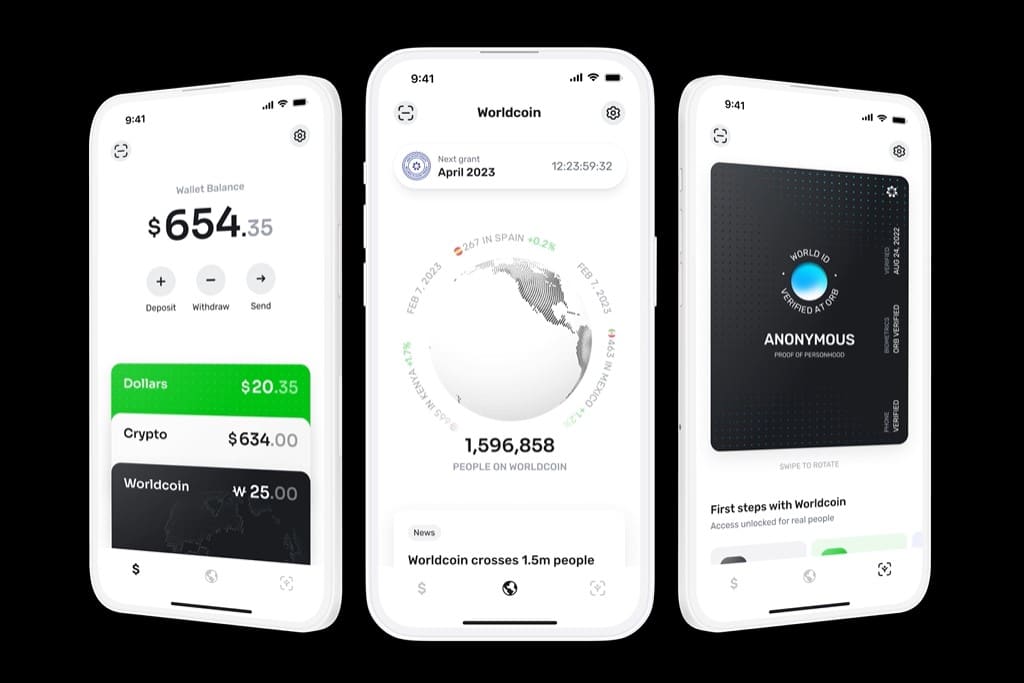

The scanning of people’s eyes gives guaranteed access to use the Worldcoin digital currency.

The ultimatum highlights the growing pressure on the SEC to take a more transparent approach to its regulatory activities.

A judge has approved repayment for BlockFi custodial wallet holders but said interest-bearing funds still belong to the bankrupt company.

Amid the US regulatory crackdown and the fall of the crypto-friendly banks recently, the lack of liquidity has become a major issue currently in the market.

In its claim, the IRS alleged that FTX, Alameda, and co failed to report transactions and activities for a sustained period.

The exit of Jane Street and Jump Crypto will contribute to the liquidity crunch in the market segment and this outlook is unhealthy for the industry.

Miller Thomson, the law firm representing QuadrigaCX stated that a small number of affected users are likely to receive notice of Disallowance of Claim.

Meanwhile, the defunct FTX continues to pursue various options to recover customer funds.

The officials claim FTX-affiliated Alameda Research had largely repaid the $8 billion borrowed from Genesis Trading, a few weeks before the former filed for Chapter 11 bankruptcy protection.