December 29th, 2025

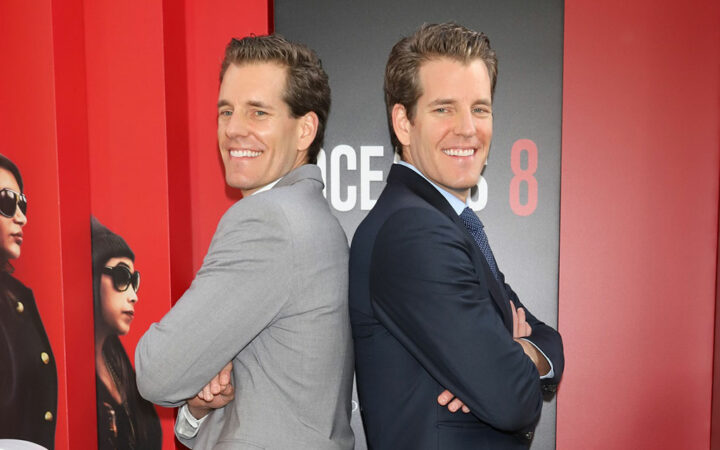

The Gemini founders filed for the first Bitcoin ETF with the US SEC ten years ago, which was rejected for almost the same reason the recent BlackRock and Fidelity products were dismissed.

When categorizing the funding by sector, the infrastructure category emerged as the frontrunner, with $213 million recorded in June.

When providing his opinion on the regulatory environment for cryptocurrencies in Canada compared to the United States, Anthony Scaramucci stated that Canada had learned from the US.

FTX is also seeking to reclaim the funds Friedberg received while working for FTX.

The possibility of FTX reopening its crypto exchange services under the new management has been tagged feasible by some industry observers.

Kirkland & Ellis is currently the legal representative of many crypto exchanges that are faced with bankruptcy.

The people familiar with the matter noted that interested buyers in the Anthropic stake signed non-disclosure agreements before the announcement that FTX was pausing the sale.

SBF will have to issue arguments beyond doubt to the judge and jury why he is not guilty of the charges levied against him.

Fireblocks’ cloud support comes at a time when more and more institutional investors and corporations are joining the crypto space.

The report noted that former FTX Group officials including SBF commingled customer deposits and corporate funds, and misused them with unnecessary spending.

The 30-day window of opportunity opened on Sunday, June 25th, and would run till July 23rd.

The suit was filed at the United States Bankruptcy Court for the District of Delaware.

Michigan Rep. Bill Huizenga pointed out that the documents shared by the SEC contained minimal information, mainly consisting of public briefings on the collaborative efforts between the SEC and the Justice Department in the case of SBF.

SBF is expected to return for a court hearing later this year, when all the investigations will be tabled for the judge to rule on the matter.

Instead of accepting or acknowledging the license return, the commission insists that BlockFi undergo administrative proceedings. The bankrupt crypto exchange was left with no option but to sue Jorge Perez, the Connecticut banking commissioner.