March 5th, 2026

The SEC has until October 7, 2024 to put forward an appeal.

Legal experts, including former SEC attorneys, believe an appeal is likely, citing concerns about inconsistencies in rulings related to programmatic XRP trading.

Top lawyer says the SEC’s potential appeal is a complete waste of taxpayer money.

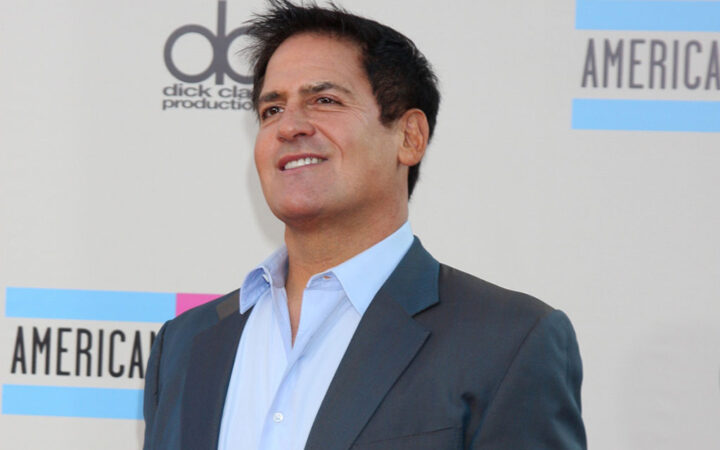

Mark Cuban has voiced his interest in leading the US SEC under Kamala Harris’ administration.

The shutdown of Terraform Labs sets an important standard for how bankruptcies are handled in the crypto industry, and will likely influence future bankruptcy cases.

Infinex’s “Patron” non-fungible tokens (NFTs) available to both – retail investors and venture capitalists providing a level playing field to investors of all sizes.

SEC Chair Gary Gensler said that the SEC is forced to hold the SAB 121 accounting rules in place citing multiple bankruptcies like FTX, Terraform, Celsius, etc.

Ripple’s legal victory over the SEC in 2024 boosted market confidence. XRP was declared a non-security in secondary market trades, giving the crypto industry much-needed regulatory clarity.

Both current and future products from Securitize will benefit from the Wormhole partnership, enabling them to function across various protocols, including both private and public blockchains.

The closure of the Ripple vs SEC lawsuit that saw the firm ordered to pay $125 million in civil penalty has significantly freed XRP from bearish sentiments.

The recent breach of the Supreme Court’s YouTube Channel highlights a growing trend where cybercriminals are taking advantage of social media accounts belonging to individuals, businesses, and organizations to promote fraudulent cryptocurrencies.

Consensys said that the Texas court today dismissed our lawsuit on procedural grounds without looking at the merits.

The Terraform Labs startup is on track to wind down its operations after receiving the approval from Judge Brendan Shannon.

Coinbase has reportedly agreed to a demand for a discovery deadline extension requested by the US SEC.

In August, the SEC issued a Wells notice to OpenSea, the largest Ethereum-based NFT marketplace, signaling the regulator’s intention to take enforcement action.