October 31st, 2025

It is becoming a trend that the SEC is choosing enforcement actions over dialogue.

The United States Congress is set to discuss a new bill geared towards providing requirements for payment stablecoin issuers, and research on a digital dollar.

While the reasons for Sun’s recent financial transactions remain unknown, he has responded to the claims with just a comment “4” a number that signifies False News and Fear, Uncertainty and Doubts (FUD) amongst others.

The SEC says the TRON founder and the other two accused have 21 days to answer its summons or incur further punitive action.

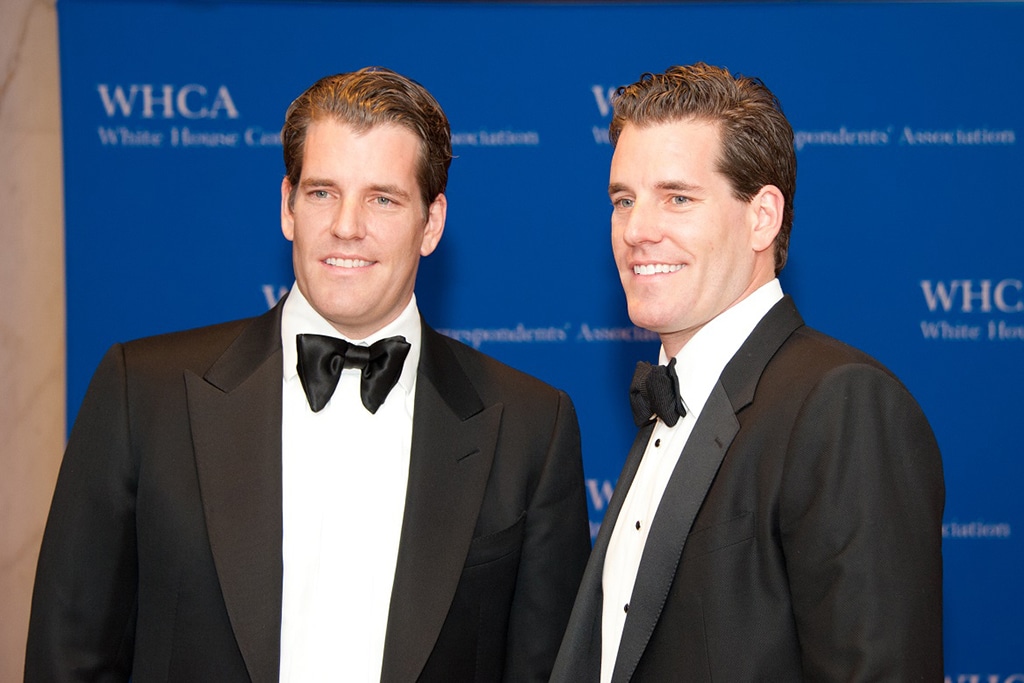

Gemini Exchange has previously been providing crypto custody services to Canadian ETFs.

In its delisting announcement, Binance.US said it would remove TRON’s TRX from its trading platform on April 18th.

The percentage of crypto developers in the United States has dropped by approximately 10 percent since 2018 according to the a16z State of the crypto report.

Following the guilty plea and while he is serving 10 months in prison, a New York District Court has released an order of restitution for the ex-Coinbase employee’s brother.

Bitkraft is focused on taking up equity positions in the startups it is backing while also not discounting the likely benefits of holding the beneficiary outfit’s token.

US government agencies have been actively encouraging similar ideas associated with financial literacy since 2003 when April was formally appointed the National Financial Capability Month.

Ranking as the sixth largest stock exchange in the European Union and second in Germany, Boerse Stuttgart is committed to doubling down on its track record concerning its new crypto service offerings.

It is said that the exchange exposed its users to a very significant risk by combining several aspects of its operations that should have been registered and operated separately.

The collapse of FTX in November might have played a major role in the decision of Gemini to foray into derivatives trading.

Amid the tightening of regulatory rules in Canada, crypto exchanges are contemplating whether to continue their operations or exit from the country.

Despite the lack of clarity in the rules, the SEC chairman has reiterated that any attempt to create new laws will unsettle the status quo.