Will ETH Hit $10,000 by May 2025 Amid Rising Adoption and Pectra Network Upgrades? – Brand New Ethereum Price Prediction and Ethereum News Today

/PlutoChain/ – The second-largest cryptocurrency builds on its successful Dencun upgrade from last year while attracting major institutional players like Deutsche Bank and Franklin Templeton.

But is it possible for Ethereum to reach $10,000 by May? We’ll check out what the technical charts and price movements show.

As traditional finance embraces Ethereum’s Layer 2 solutions, a new project called PlutoChain ($PLUTO) is coming up with plans to potentially bring similar scalability benefits to Bitcoin’s ecosystem.

Here’s all you need to know about these developments.

Can Ethereum Break Through $10,000 by May 2025?

As of January 5, 2025, Ethereum (ETH) is trading at approximately $3,624.76, with a 24-hour trading volume of around $13.16 billion.

In terms of support levels, Ethereum has solid support at $3,250, with milder support at around $3,200.

On the upside, resistance is noticeable at $3,898 and becomes stronger at $4,137.

Right now, ETH’s RSI is at 64, which means it’s nearing the overbought zone but hasn’t quite hit it yet.

In March 2024, Ethereum introduced the “Dencun” upgrade, which brought lower transaction fees on Layer 2 networks.

Adoption has been climbing too. Big names like Deutsche Bank have started using Ethereum’s Layer 2 solutions, Hong Kong’s ZA Bank is offering Ethereum trading, and Franklin Templeton is tokenizing funds on the network.

Looking ahead, Ethereum’s roadmap includes upgrades like “The Surge,” aimed at improving scalability with sharding, and “The Verge,” which will simplify storage and reduce node sizes.

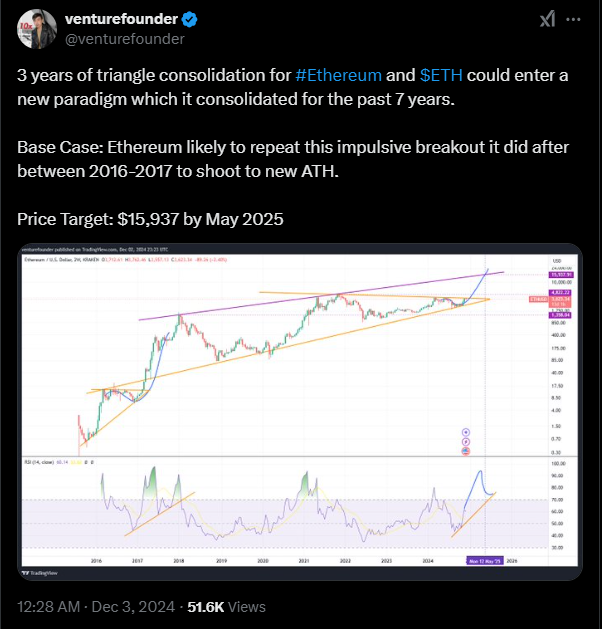

Moving on to the predictions, a crypto analyst venturefounder is saying that Ethereum, after three years of triangle consolidation, could enter a new phase similar to its breakout in 2016-2017.

He anticipates Ethereum will surge to a new all-time high and targets a price of $15,937 by May 2025.

Anonymous predicts Ethereum’s next price target to be $5,000 and expects it to outperform Bitcoin over the next six months. He also believes the start of “Altseason” will happen in Q2 2025.

Philakone predicts that Ethereum will experience a strong bullish trend and that once it surpasses the $4,100 level, it will break its all-time high and exceed $10,000 in 2025.

PlutoChain ($PLUTO) Might be the Long-Anticipated Solution to Solving BTC’s Scalability Issues and Bringing New Upgrades

Bitcoin is the original cryptocurrency, but it’s far from perfect. Slow transactions, network congestion, and hefty fees often frustrate its users.

PlutoChain ($PLUTO) may step in with a solution that could fix these issues through its hybrid Layer-2 network built to work alongside Bitcoin’s blockchain.

PlutoChain could lighten the load on Bitcoin’s network, reduce fees, and speed things up.

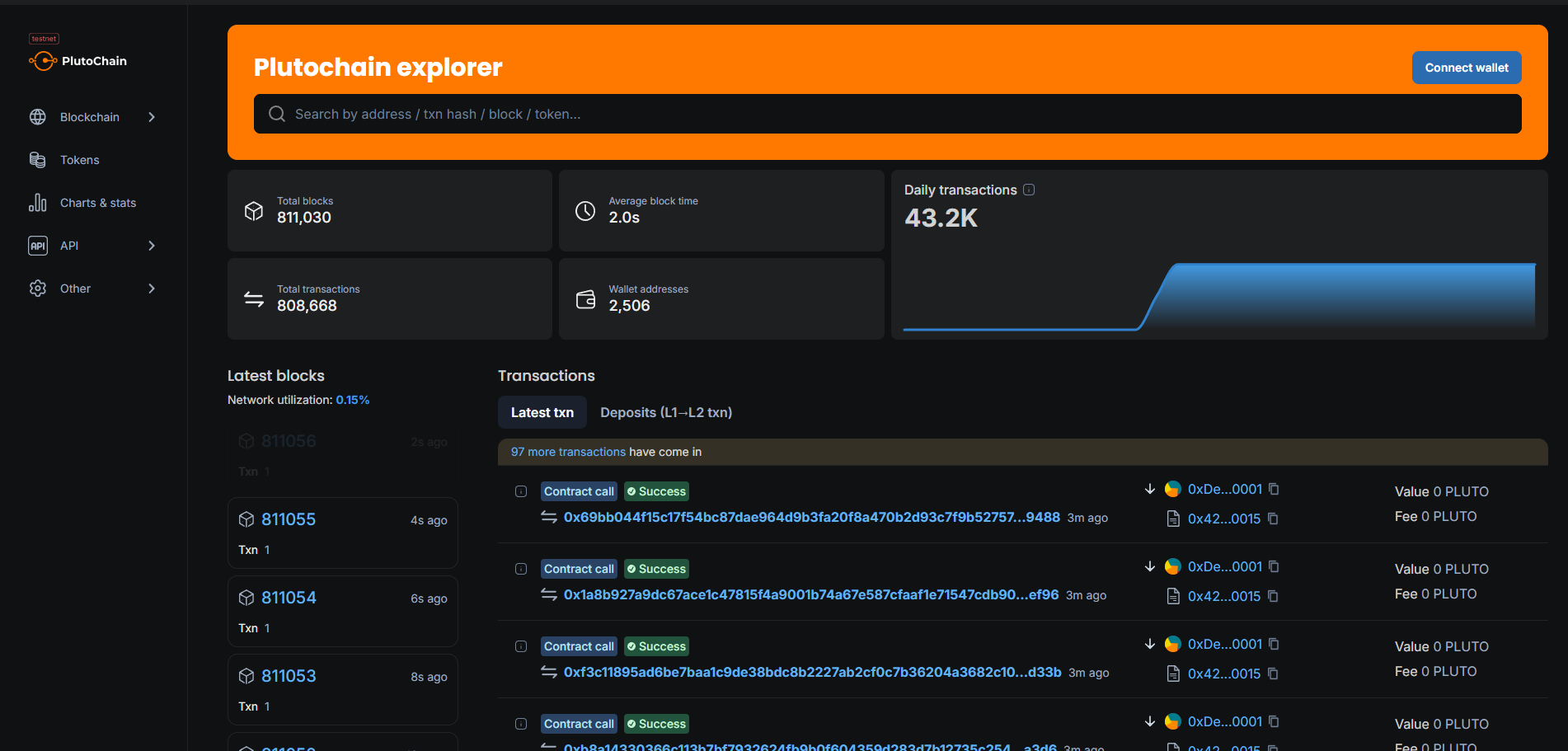

Instead of Bitcoin’s 10-minute block time, PlutoChain’s Layer-2 technology could help handle transactions in just 2 seconds on its own L2 chain.

This massive improvement could push Bitcoin beyond its role as digital gold and introduce smart contracts to it without sacrificing its security.

One of PlutoChain’s standout features is its Ethereum Virtual Machine (EVM) compatibility.

Developers could plug Ethereum projects directly into Bitcoin’s ecosystem, which would make space for innovations like DeFi platforms, NFTs, and AI-powered apps.

In testing, PlutoChain handled 43,200 daily transactions with ease, which shows it’s ready for real-world use.

Its security measures include audits by SolidProof, QuillAudits, and Assure DeFi along with regular stress tests to keep the network stable and compliant.

PlutoChain’s community-driven approach is another thing that sets it apart. Through its Discord channel, users suggest upgrades, partnerships, and new features.

The Bottom Line

The path to $10,000 for Ethereum appears more grounded in fundamentals than mere speculation.

With institutional adoption accelerating and crucial technical upgrades on the horizon, Ethereum continues to lead the market as the most powerful smart contract platform.

At the same time, PlutoChain ($PLUTO) could replicate this success in the Bitcoin ecosystem. Its Layer-2 solution could address Bitcoin’s limitations and merge its security with Ethereum’s flexibility.

With PlutoChain, Bitcoin’s ecosystem might finally catch up to the demands of today’s blockchain ecosystems. .

Please keep in mind that this article is not financial advice. All crypto tokens are volatile, and trading involves risk. Always do your own research and consult a qualified expert before joining any crypto venture. Mention of any tokens in this article does not guarantee future performance. Statements regarding the future carry risks and are not assured to be updated.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.