Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

Key Notes

- GENIUS Act provides regulatory framework allowing banks and fintechs to issue stablecoins in the US market.

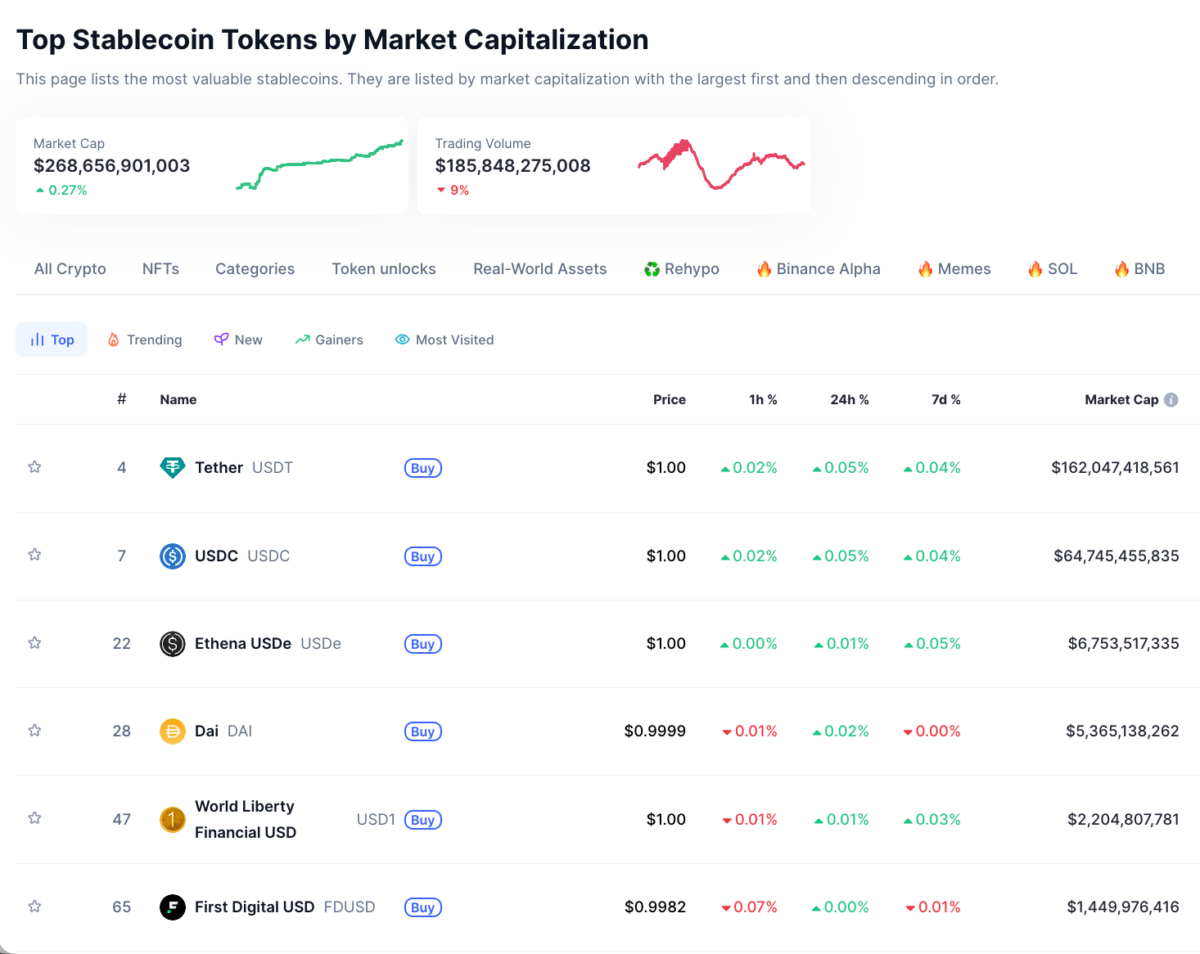

- Circle's USDC dominates US with $65B circulation while Tether's USDT leads globally with $162B market cap.

- Tether leverages strong international presence in Latin America, Africa, and Asia for competitive advantage.

Tether, issuer of the world’s largest stablecoin, is finalizing its return to the US following the passage of the GENIUS Act. CEO Paolo Ardoino confirmed the company’s reentry strategy during a Bloomberg interview on Wednesday, outlining plans to focus on institutional payments and settlements.

The GENIUS Act, now law, allows banks and fintechs to issue or use stablecoins while providing clear regulatory guidelines for such activity in the US. This development opens the door for USDT to compete directly in the regulated American market, where Circle’s USDC has dominated in recent years.

Ardoino attended the GENIUS Act signing ceremony alongside executives from major crypto firms including Coinbase and Gemini, signaling industry-wide support for the new regulatory framework. Tether had previously withdrawn from the US market due to ongoing regulatory uncertainties and compliance challenges, but the company now indicates it has resumed discussions with auditors as part of its reentry preparations.

“We are ready to engage directly with US regulators,” Ardoino stated in the Bloomberg interview.

Circle Faces Stiff Competition as Tether Plan US Re-entry

Circle has dominated the US stablecoin market by operating under clearer regulatory compliance, growing its USDC token to $65 billion in circulation. Meanwhile, Tether’s USDT—despite holding a commanding $162 billion in global circulation—has been largely excluded from the regulated US market due to past legal challenges and regulatory scrutiny.

Top Stablecoins by Market Capitalization | Source: CoinMarketCap, July 23, 2025

Tether says its global reach gives it an edge. Ardoino pointed to strong adoption in Latin America, Africa, and Asia, hinting that the company understands local markets better than US-based stablecoin issuers.

Tether now plans to expand USDT’s role beyond trading into interbank settlement and cross-border payments, with the GENIUS Act providing legal ground to compete directly with Circle in these sectors.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.