The crypto debit card provider, Wirex, will soon add an Ethereum wallet to their service, meaning that people can use Ether on their cards. This considerable feature will make Wirex more accessible to other crypto users who choose to use Ethereum exclusively.

The addition of Ethereum means that Wirex will now support three separate wallets, also including Bitcoin and Litecoin. Users will be able to add funds via Ether, as well as exchange Ether for Litecoin, Bitcoin, and fiat currency. Also people will be able to purchase Ether with fiat right from the website or mobile app, similar to how they can do with Bitcoin and Litecoin, no longer needing to buy or sell Ether, which currently makes $499,57 according to the CoinMarketCap, on a secondary exchange.

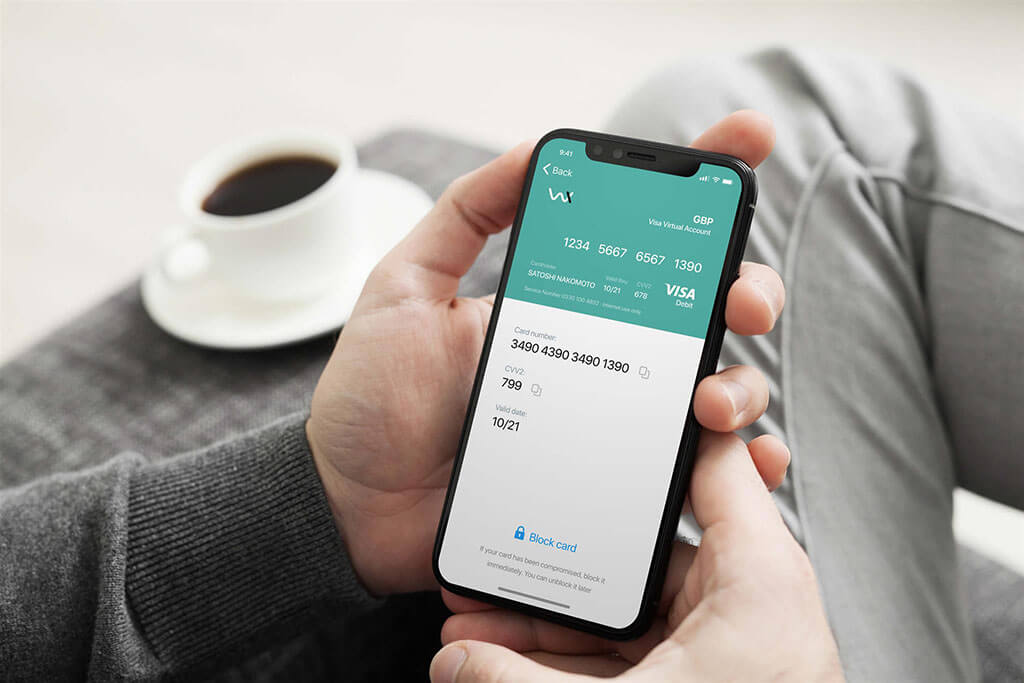

As with the other supported coins, Wirex will let people use their Ether to fund cards, and buy goods in brick and mortar stores, online, or even withdraw cash from an ATM. The Wirex card comes with all the functions of a standard fiat bank-issued card, meaning users can also take advantage of contactless payments as well. The main difference is that Wirex contains more capabilities than a standard card as, apart from other, it facilitates crypto.

Addition of Ethereum makes Wirex the most versatile and capable crypto card on the market with its competitors being much further behind regarding both: their technology and their development. While some companies claim to offer support for several other coins, many of them, TenX and Monaco are among these, have yet to release physical cards to the public. This said, it could be rightfully argued that such companies over-promised and, unfortunately, under-delivered.

That fact that Wirex can now handle Ethereum also makes its competitors somewhat redundant, as Wirex has created a more robust product without the need to invest in a particular coin or token. This is especially important as quite a lot of companies encourage this behavior, which, in fact, is counterproductive to the entire ecosystem– they force users to jump through hoops so that they can access the technology. Wirex, in its turn, is accessible to all users and does not encourage these actions – this fact makes it significantly more functional and robust.

Meanwhile, as part of its development strategy implementation, Wirex recently launched its CryptoBack rewards programme for payment card customers. In essence, those using Wirex’s Visa debit card now earn 0.5% back in Bitcoin from all in-store retail purchases. While customers, who wish to spend their CryptoBack rewards, can choose the redeem option in the app, which credits their rewards to their Wirex Bitcoin wallet. From there, customers can convert their crypto to fiat and spend it just as they choose.

On top of that, Wirex also makes it possible for customers to earn additional CryptoBack rewards, with the only thing they have to do is to refer people to the platform – while there is a nominal monthly fee for the payment card, there is no fee to join the rewards programme.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.