Crypto lit up like a Christmas tree a year ago in Dec 2017, everybody got their gifts and more, and joy was in the air. Now the lights are out, snow is thick, and all the wonderful gifts have been returned, except nobody got their money back.

Bitcoin has been cited as the worst investment instrument in 2018, having lost more than 72% of its value in the year. And many tokens that were hot items a year ago, simply ceased to exist. Santa Claus definitely did not come to town, and from the looks of it, won’t be for a while. So we find ourselves asking, “what happened?”

Pundits, analysts, and experts have written many words trying to answer this question, citing lack of adoption, an inevitable bubble, regulations, etc., yet there is a much simpler answer composed of two items: greed and listing.

First, greed of crypto funds, exchanges, projects, and token buyers themselves have hurled the industry headlong into a chasm. The irony is that greed is a good thing, as Mr. Gecko famously pointed out in the movie Wall Street. Greed is the foundation of competition, and is what drives corporations to compete not just for a slice of market share, but for the entire pie.

However greed without regulations always lead to bad things happening, as history shows over and over again. This is why there are rules and regulations, to protect the public and reduce foul play. Yet the crypto industry lies within a vacuum, and that space has been filled with parties all eager to take profit with whatever means necessary.

But crypto has been outside regulatory oversight for many years, why have we seen 2017 and 2018 explode and implode? The second part of the answer lies in unchecked token listing on exchanges. Crypto projects are unique in that their tokens can list on exchanges and trade immediately as liquid assets, without having gone through any review or check.

With no users, revenue statements, product, or even real team members, projects and token buyers are able to induce massive transfers of wealth through conducting ICO’s and then list immediately. It would be unprecedented in any other industry for a company to be traded solely off the strength of its marketing and white paper, yet it has been the norm of the crypto industry.

The lack of accountability or even legality in this process created a fundamentally misaligned incentive structure for all parties involved, funds, projects, exchanges, and retail token buyers. Most crypto funds do not care about a project beyond its speculative value and projects are ill-incentivized to actually develop when they’ve already been paid millions for writing a wishlist.

Exacerbating the issue is that exchanges generate revenue from listing and trading of tokens, meaning they are inherently incentivized to look the other way if a project seems fraudulent. Finally, retail token buyers who do not have any technical background, product building, and business experiences are directly exposed to projects without any guidance of measurement or review.

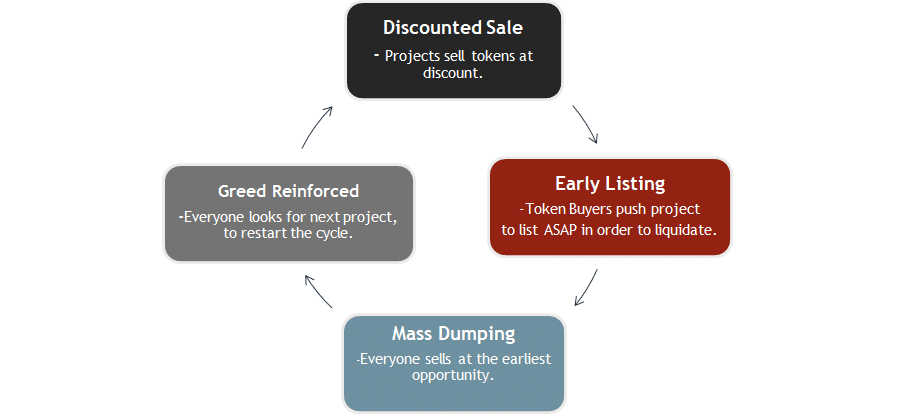

This has created a dysfunctional cycle that has decimated the industry:

- Projects put most of the time and resources into developing and marketing a whitepaper, not an actual product. Marketing team does a good job, and ICO is expected to smoothly. Tokens are sold privately with a heavy discount for “crypto funds.”

- ICO is conducted and retail buyers rush in due to the project’s backing by “well-known” crypto funds.

- Due to pressure from crypto funds to liquidate, projects rush to list on exchanges.

- Project pays exorbitant listing fees, as exchanges are the sole gateway to liquidity

- Once listed, everyone dumps to realize gains. Price tanks, whoever is unlucky enough to buy last, is now left holding the bag.

- New projects start and the cycle begins again.

Dysfunctional Cycle of Crypto (DCC)

So now that there are no one left to fleece, how do we break the cycle? There are 3 major changes that must happen in order to right the damage done to the industry, and they are not easy:

So now that there are no one left to fleece, how do we break the cycle? There are 3 major changes that must happen in order to right the damage done to the industry, and they are not easy:

- Stop funding ideas and focus on execution;

- Regulate exchanges;

- Dis-intermediate, not de-centralize.

First, we as an industry, need to stop funding ideas and instead fund execution. It has been reported that over half of ICO’s that started in 2017 failed within the first four months. By now the failure should be well over 90%. And that is normal, as failure is the norm for any new company, blockchain or not. It is easy to write words, but much harder to make anything work.

There is a saying that “an idea is worth 1%, execution is the other 99%.” ICO’s are essentially being funded with millions, and sometimes tens, hundreds of millions based just on their ideas. As a serial entrepreneur, I am now on my fourth startup with Asia Innovations. My first startup struggled and was sold. My second one failed. My third one was sold to Zynga, and my fourth and current one has grown from 0 to close to $200mln in fiat revenue in 5 years.

GIFTO, my token project, was incubated together with Binance in 2017, based on the strength and insights of the existing business. Even after all this, most of the new ideas that came up in my company never go anywhere. There is also a very good reason why traditional venture funding is in stages, and amount of funding is small at the beginning.

Why does a new team of 10 needs $10mln? One time, big ICO’s should go away and instead become a series of smaller fundings, to better accommodate the natural failure rate of doing anything real.

Second, exchanges must be regulated, especially in listing and trading of tokens. Exchanges are not incentivized to be discerning when listing projects since it is profitable to list and money is made simply on trading, whether it is sell or buy. There needs to be regulations that hold them accountable for the projects listed on their platform.

The simple fact is that retail investors need to be protected, and trading needs to regulated. Liquidity availability must be based on actual economic value generated, not speculative. GIFTO has been traded on 16 exchanges. We have seen first hand a wide range of listing and trading management capabilities on exchanges.

Unfortunately, it is natural for human beings to not want rules, until they consistent suffer negative consequences, like those of us who don’t wash hands before you eat and end up with a tummy ache (yes, I’m looking at you). Specifically, two areas must have clear consistent rules:

- Listing: Projects must be listed not just based on “quality of proposal”, but based on “quality of delivery”. Remember, most projects will fail naturally, and listing of a project does not increase its chance of success. In fact, listing has only negative distractions and incentives for the project. Ultimately, only those projects that have had traction and success, in terms of users and economic value generated, should list.

- Trading: non-regulated trading puts all the power in hands of sophisticated traders and firms with large amount of money. Simply put, this is the same as in equity markets, where if unchecked, traders have huge incentives and capability to fleece the retail. This is exactly what happened, and is still happening

Finally, we must accept that “de-centralization” is still a myth and act accordingly. Despite the popular narrative that everything will benefit from “de-centralization”, crypto is the most “centralized” industry I have ever seen. Everyday conversations revolve around twitter comments and actions of a few “crypto influencers”, and a recent fight between two prominent individuals dragged down the whole market.

The most lucrative businesses are centralized exchanges and powerful crypto funds, and we forever are searching for “crypto gods” who can deliver us a new world. Let’s face it, de-centralization is a myth. Dis-intermediation, or reduction of middlemen is the key. It was how Internet and mobile technologies created huge value and entire new industries, and it is what blockchain will do too.

Thus, existing companies and who have an established business, brand and savvy enough to figure out how to use blockchain will herald the next wave of blockchain value creation.

The true pioneers of this concept are likely to come from Asia, where regulations are much friendlier than in the United States. The recent announcement of the Asia Blockchain Accelerator in Taiwan are hints at the direction the industry needs to move in.

The accelerator is officially sanctioned and supported by the Taiwanese government, and accelerates projects that are already delivering real economic value and seeking to enhance their services through blockchain technology. The ABA represents a test case for the future this piece advocates for, one where credible companies tokenize successfully with the right government oversight.

The 3 steps outlined above are not easy. Rebounding from the painful lows of the past year requires focus and willpower that may simply be lacking at this juncture. No good things are ever easy. Only by slowing down the rapid liquidity cycle, can projects, token buyers, and the whole industry refocus on building, not speculating. With the number of smart and resourceful folks still remaining in crypto, it is possible that we will once again hear sleigh bells in the next few years.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Andy Tian is CEO at Asia Innovations Group (AIG). He also founded XPD Media, a social games company which was acquired by Zynga. As GM of Zynga China, Andy operated a portfolio of top-ten mobile games accessible in 15 languages globally. Previously, Andy led Google’s mobile business in China where he introduced Android to the Chinese market. At AIG, Andy has integrated the Gifto token into their flagship livestreaming app Uplive to revolutionize the economics of social media for content creators.