Jeff Fawkes is a seasoned investment professional and a crypto analyst. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.

The FED interest rate will receive a cut-off despite the fact that Jerome H. Powell was previously against that. Donald Trump and Steven Mnuchin send the words of support. The U.S. is full of coronavirus fears.

Due to the coronavirus attack, the U.S. Federal Reserve (FED) decides to take 50 basis points off the interest rate. After the news, Bitcoin price went up, later showing again that the trend is not moving in a positive direction. No matter what, Bitcoin is in the relax zone below $9000. The stocks have experienced similar bump, and then the bullish trend has drowned in volatility game.

The experts have started claiming that rate cuts will bump up the crypto market. However, it appears that the data from the past suggests the opposite.

Previously, honorable Jerome H. Powell has said that he will oppose the idea of White House to cut the FED rate in 2020. But now, when the U.S. dive in coronavirus preparations, it is necessary to urgently stimulate the economy. Per Jerome:

“The magnitude and persistence of the overall effect on the U.S. economy remain highly uncertain and the situation remains a fluid one. Against this background, the committee judged that the risks to the U.S. outlook have changed materially. In response, we have eased the stance of monetary policy to provide some more support to the economy.

The coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate.”

The current target range is 1-1,25%, while the FED claims that the risks from the virus are increasing. Right after the news, Bitcoin’s price went up to $8,880 and then went back to $8,700 level. Charles McGarraugh who works at Blockchain.com as Head of Markets, claims that the moment should be bullish because the dollar will lose strength.

Indeed, a hefty of weak fiat currencies worldwide already received a boost after the FED’s revelations. However, when we look at the crypto market, it seems pretty quiet. The grand rally is not happening, and the Bitcoin halving seems like the only big volatility chance so far.

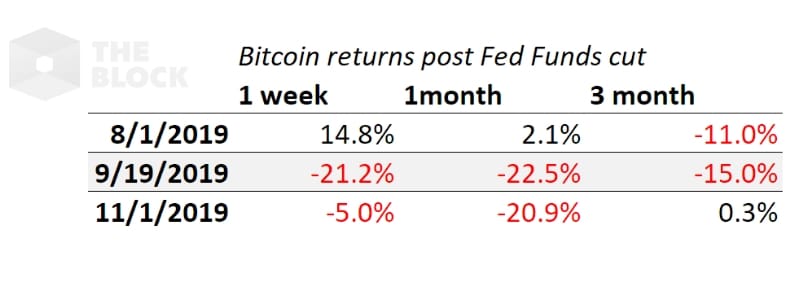

The rate cuts in the past have decreased the value of Bitcoin. Let’s look at the previous three rate cuts, occurred in August, September, November 2019.

Photo: The Block

Bitcoin price went down from -5% to -20% in one to three months, as we see. So, what’s in it for Bitcoin? Nothing good, because the coronavirus will rush to destroy any economy it likes. It won’t pick the sides like here’s the good libertarians and here’s the bad government. No, it will make the country a worse place, if we look at Italy or China. People across the planet start the panic, stocks rise and fall, and uncertainty makes investors sell stocks.

The decrease becomes the first one since the infamous base rate cut back in 2008.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Jeff Fawkes is a seasoned investment professional and a crypto analyst. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.