Bitcoin Hyper leads our best crypto ICO calendar in February 2026, based on our research. It remains speculative, but over 1.3B tokens staked point to strong early interest in Bitcoin L2 experiments.Also worth watching are Maxi Doge, a leverage meme built around trader culture, and BMIC, a project focused on building a quantum-secure wallet.

We track and update these picks using our methodology, which scores projects using key factors such as fundamentals, the whitepaper, vesting schedules, community growth, market fit, the team, and audits. This calendar is better suited to high-risk traders looking for early-stage projects to invest in.

Why Trust Coinspeaker

At Coinspeaker, we take trust seriously and follow the highest editorial standards to ensure accuracy, transparency, and reliability in every article.

- Proven Expertise – Our editorial team brings over 10 years of experience in presales and ICOs, Bitcoin, Ethereum, and altcoins.

- Recognized Authority – Our articles have been referenced by major crypto and finance outlets, including CoinGecko, Cointelegraph, CoinCodex, Forbes, and Yahoo Finance.

- Editorial Rigor – In the past 12 months, our editors have researched and reviewed more than 50 presales using Coinspeaker’s own methodology.

- Transparency & Accuracy – Every article is fact-checked, regularly updated, and reviewed against our strict Editorial Policy.

What Is An ICO?

An ICO, or initial coin offering, is a token sale in which a crypto project offers its new coin directly to investors before listing on CEXs or DEXs. It is also known as a crypto presale.

ICOs serve as a method for new projects to raise funds. The project uses these funds for development and startup costs. In 2025, the average amount raised per ICO was $5.4 million.

Anyone with a crypto wallet in a legal jurisdiction can participate. They connect to the ICO page or launchpad and swap an established coin like ETH, BNB, USDT, or SOL for the project token. This reserves the token until it is ready to launch. Investors receive their coins after the Token Generation Event (TGE) when the coin is created on the blockchain.

How Are ICOs Ranked on This Calendar?

We selected projects with a memorable branding or concept, a community-first approach, clear and fair tokenomics, and narrative alignment. We chose trend-based ICOs due to past performance, such as SUI in 2023, which aligned with the call for fast L1 alternatives to Ethereum. SUI’s presale achieved an all-time high ROI of 54x.

We avoid projects with low allocations for the public sale, such as $TRUMP, which allocated just 10%, as they often spike initially but fall quickly and continuously.

How Can I Tell if an ICO Is Legit or a Scam?

While there is no way to be certain if a presale is legitimate or not, do research and focus on these five green flags:

- A good but not overly ambitious idea (unless the project has large-scale funding from VCs).

- Smart contract audits.

- Reasonable tokenomics.

- A detailed whitepaper or documentation.

- The team members are public or have a good track record.

Scam projects often have unrealistic promises or mismatched project details across different resources. Other red flags include undisclosed tokenomics, unclear vesting schedules, high allocations to private investors, and a lack of audits.

How Do I Find ICOs Early?

Keep track of websites like this one, follow important Web3 social media accounts, especially on X, Discord, and YouTube (but make sure to verify the project is real), and read crypto news. Potential ICOs are often announced first on socials. The Best Wallet crypto app also features upcoming presales.

How to Invest in ICOs

Do your research, then invest using the steps below:

- Research the team, project, and whitepaper, and check for working MVPs.

- Create a compatible wallet, for example, Best Wallet or another from our list of best decentralized wallets.

- Fund your wallet with an accepted currency like ETH or USDT, using a CEX like Binance or Coinbase, or via a Web3 wallet.

- Connect your wallet to the ICO platform, making sure you have the real website, and complete KYC if required.

- Purchase your tokens, then return to the presale at TGE to claim them for sale or storage.

The Bitcoin Hyper presale supports Best Wallet, WalletConnect, MetaMask, and Base Wallet. Source: Bitcoin Hyper

Are ICOs Safe to Invest In?

ICOs come with a high level of risk. Some are scams, while others may have genuine intentions but still may fail. Only a small percentage of ICOs generate an ROI, but when they do, returns can be as high as 14,000x, as with Ethereum. Just remember that returns like this are the rare exception, not the rule. To avoid other potential risks, see our risk checklist above.

What’s the Difference Between ICOs, IDOs, and Presales?

While the terms are often used interchangeably, a presale is when private and other investors can invest in an upcoming, unreleased coin.

A presale becomes an ICO (Initial Coin Offering) when the public is offered the opportunity to invest, again, before the project is live.

An ICO becomes an IDO (Initial Dex Offering) when it gets listed on a DEX. Many tokens go straight to an IDO without a presale or any initial funding rounds.

What Are the Biggest Risks When Investing in ICOs?

The biggest risks when investing in ICOs are scams, total capital loss, and phishing concerns. Here’s more about them and what you can do to avoid them.

- Impersonators in Telegram, X, and Discord. Support will never DM you first. Never share your wallet keys or passphrase with anyone.

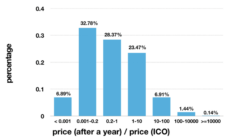

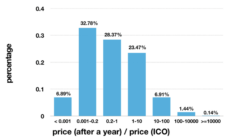

- Capital loss. In 2025, 32% of ICOs achieved a 0.001-0.2x return after one year. Only 1.44% achieved 100–10,000x, showing how rare these kinds of gains are.

- Wallet hacks or draining by connecting to copycat phishing websites and fake socials. Always ensure you have the correct details and use Revoke.cash to disconnect from suspect websites.

Average percentage change in ICO token prices after 1 year from launch in 2025. Source: CoinLaw

Are ICO Investments Taxable?

Yes, ICO profits are taxable in most countries, including the US and most EU member states, as well as many other countries worldwide. As with regular crypto, disposing of an asset is a taxable event. For the most part, ICO gains are subject to Capital Gains Tax, though holding periods can affect the tax rate.

In the US, EU, and UK, all crypto profits must be reported, and in 2026, the EU and UK are moving towards stricter monitoring and taxation laws.

How We Evaluate the Best Crypto ICOs in Our Calendar (Methodology)

We rank ICOs based on our research methodology using statistics and metrics, our evaluations, and personal experiences with the ICOs, when possible. Below is the methodology we have used specifically for ICOs, based on the underlying principles of our Coinspeaker methodology.

Metrics, Whales, and Vesting Schedules (30%)

To see how popular a presale is, we monitor its raise progression, consider whether prior investors bought in at lower seed phases, and look for any whales holding a disproportionately large share of the supply, which could be bad for decentralization and price action.

We also consider vesting schedules for the team and advisors, as well as for the public sale.

Fundamentals and Whitepaper Analysis (25%)

We start by reviewing the project’s documentation, including whitepapers and litepapers, roadmaps, and vision statements. We look for projects that add value to the world or to Web3, have token utility, prioritize sustainability, set realistic milestones, and have a clear project scope. We avoid projects with vague promises or ones that overpromise.

Community Growth & Sentiment (20%)

Projects receive varying levels of social media attention. While some (such as B2C or memes) lend themselves well to social media, B2B platforms may not do as well. Projects with complex tech developments are more likely to have an active Discord, while a meme community might be more active on Telegram. We keep all of this in mind and measure Telegram followers and chats, X posts and engagement levels, and Discord activity.

Market Fit and Timing (15%)

Much of shorter-term crypto trading is about narrative fit. When the market is bullish about a topic such as AI or real-world assets (RWA), projects associated with them can do well, as people follow the patterns of big VCs and other large investors. We consider the longer and shorter-term trends in order to assess ICO for inclusion in our list.

Team, Security, and Audits 10%

While the vast majority of ICOs have anonymous teams, where available, we look for teams with good backgrounds and past achievements who have completed KYC. We look for security audits and clickable links to the results. This doesn’t guarantee safety, but it’s a good place to start.

FAQ

What Is the Best Crypto ICO?

The best crypto ICOs tend to be ones that solve real problems, have good social hype, and a trending narrative.

Can You Make Money Investing in ICOs?

Yes, in certain cases, you can make returns as high as 100x+. Though in others, you can also lose all your money.

Are ICOs Legal?

ICOs are legal in the US and most of the EU. They are not currently legal in the UK or China. Check with a local professional if in doubt.

What Returns Can I Make Investing in ICOs?

According to data from Coinlaw, in 2025, within one year, 6% of projects saw returns as high as 100x, while 6% resulted in almost total capital loss. Meanwhile, 23% of ICOs achieved an ROI of 1–10x.

How to Identify Legit ICOs

Look for solid projects, KYCd teams, smart contract audits, an engaged community, and ideally an MVP.

References

- Trump’s SEC Is Ending Crypto Lawsuits and Investigations – These Are the Biggest (Decrypt)

- Digital Asset Market Clarity Act of 2025 (Rules Committee Print 119-6)

- What Is a Smart Contract Audit? (CertiK)

- Crypto regulations in APAC (Trulioo)

- Markets in Crypto-Assets Regulation (EU) 2023/1114 (EUR-Lex)

- ICO Market Statistics 2026: The Truth Behind the Boom (SQ Magazine)

- Factors leading to the adoption of blockchain technology in financial reporting (Frontiers in Blockchain)

- 2026 Digital Asset Outlook: Dawn of the Institutional Era (Grayscale Research)

- Blockchain Assurance Services & Solutions (PwC Switzerland)

- Crypto Trends To Watch in 2026 (Coin Metrics)