Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

Key Notes

- Validators directly vote against their financial interests as halving inflation reduces their yearly rewards by 50%.

- The controversial governance mechanism has been NEAR's standard process since mainnet launch five years ago.

- DWF Labs pledged to buy 10 million NEAR tokens if the 2.5% inflation reduction passes the community vote.

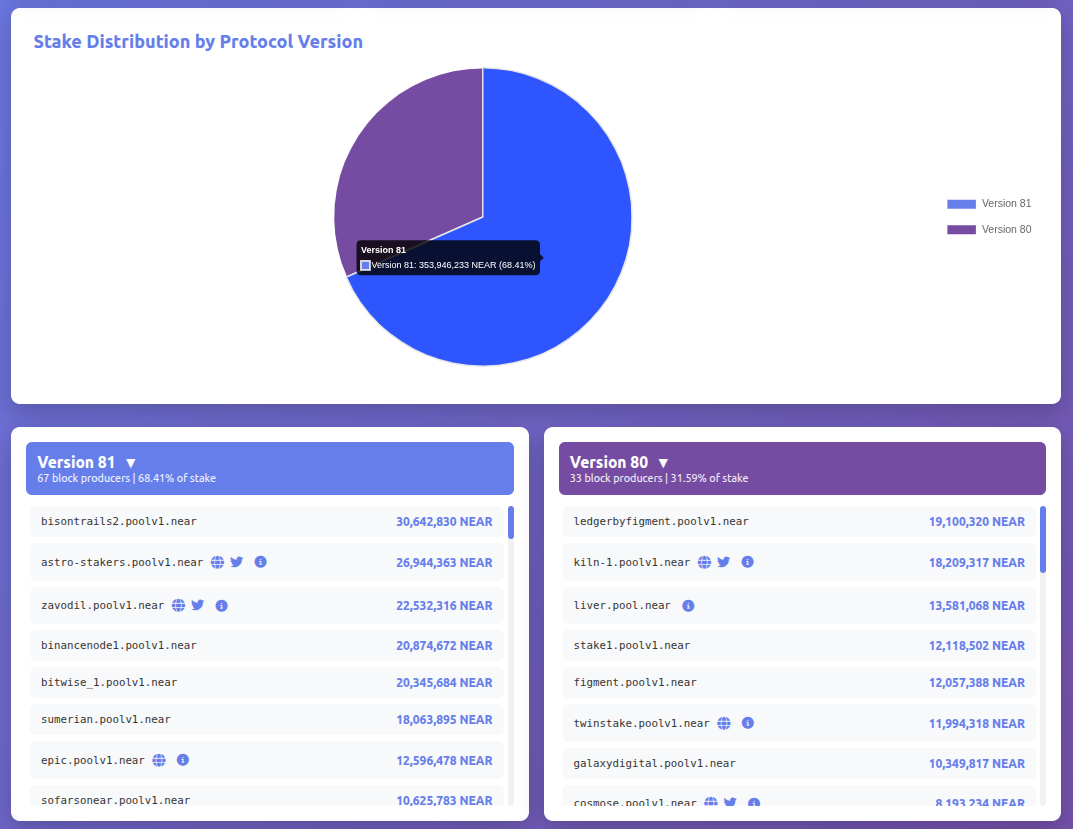

The Near Foundation is proposing an inflation halving for NEAR NEAR $1.48 24h volatility: 0.4% Market cap: $1.90 B Vol. 24h: $110.89 M , effectively reducing the token’s yearly tail emission from 5% to 2.5%. Voting started on October 28, with node-level governance, and 68.41% of all block-producing validators already signaled to favor the reduction—missing less than 12% staking weight for approval.

As reported by Coinspeaker last week, on October 21, the nearcore v2.9.0 release proposed one key change to the Near Protocol: cut emissions from 5% to 2.5%. Validators who favor this change can upgrade to the backwards-compatible Protocol Version 81, while those who oppose it need to remain in Protocol Version 80, not upgrading. Stake delegators can redelegate to new validators accordingly, directly influencing the vote outcome.

The voting ends in 23 days from October 23, with a “NO” outcome, keeping NEAR’s inflation as is, or when the 80% staking threshold is met, activating in the following epoch. An epoch is a unit of time that equals 43,200 blocks, lasting between seven and eight hours at a 600-millisecond block time.

Data Coinspeaker gathered from NearSpace at the time of this writing shows 67 block producers already upgraded to Protocol Version 81, temporarily signaling a “YES” to NEAR’s inflation halving. Together, they sum up to 68.41% of the needed 80% staking to approve the proposal.

Meanwhile, 33 validators still did not upgrade, remaining in Protocol Version 80, temporarily signaling a “NO.” This scenario could change in the following 23 days as validators can upgrade or downgrade their nodes and NEAR investors can redelegate to new validators according to their choices.

NEAR: Stake distribution by protocol version, as of October 28 | Source: NearSpace.info

Controversy Around NEAR Inflation Halving Governance Mechanism

Interestingly, validators are voting directly against their own short-term benefit, bringing controversy to the process. If the network approves this proposal, validators should expect to receive half of the yearly rewards they now receive at the same percentage of the total staked tokens.

This has sparked some public discussions from industry-level staking providers like ChorusOne, who manifested against the reduction and, especially, against the governance mechanism being used for this proposal. Yet, Illia Polosukhin, NEAR co-founder, explained this same mechanism has been used for Near Protocol governance since its mainnet launch five years ago, being a normal procedure.

Rules for upgrading NEAR Protocol have been the same since MainNet 5 years ago: 80% of block producing stake must adopt new version for protocol to upgrade.

See Protocol Specification: https://t.co/ZazMZniJkO

As a validator you expect to evaluate the changes to protocol and…

— Illia (root.near) (🇺🇦, ⋈) (@ilblackdragon) October 24, 2025

On the other hand, institutional crypto investors like Andrei Gachev from DWF Labs promised on June 11 that he would “buy another 10 [million] NEAR on [the] secondary market” if NEAR reduced the inflation to 2.5%, as is being voted right now. This would add to DWF Labs’ disclosed position of 5 million NEAR held liquid and 6 million NEAR staked with validators.

Hey @BowenWang18 @ilblackdragon @NEARProtocol , we already hold 5M NEAR and have 6M NEAR staked, but we want you to reduce inflation to 2.5% to boost long term token value and ecosystem growth.

If you manage it, we will buy another 10M NEAR on secondary market

Let us know!— Andrei Grachev 🦅🟠 $FF (@ag_dwf) June 11, 2025

With NEAR currently trading at $2.30 per token, the next few days will play a significant role in defining the future of the project from an economic perspective, initiating discussions around potential improvements in its tokenomics, which should be discussed, proposed, and voted on independently, per official communication on this ongoing proposal.

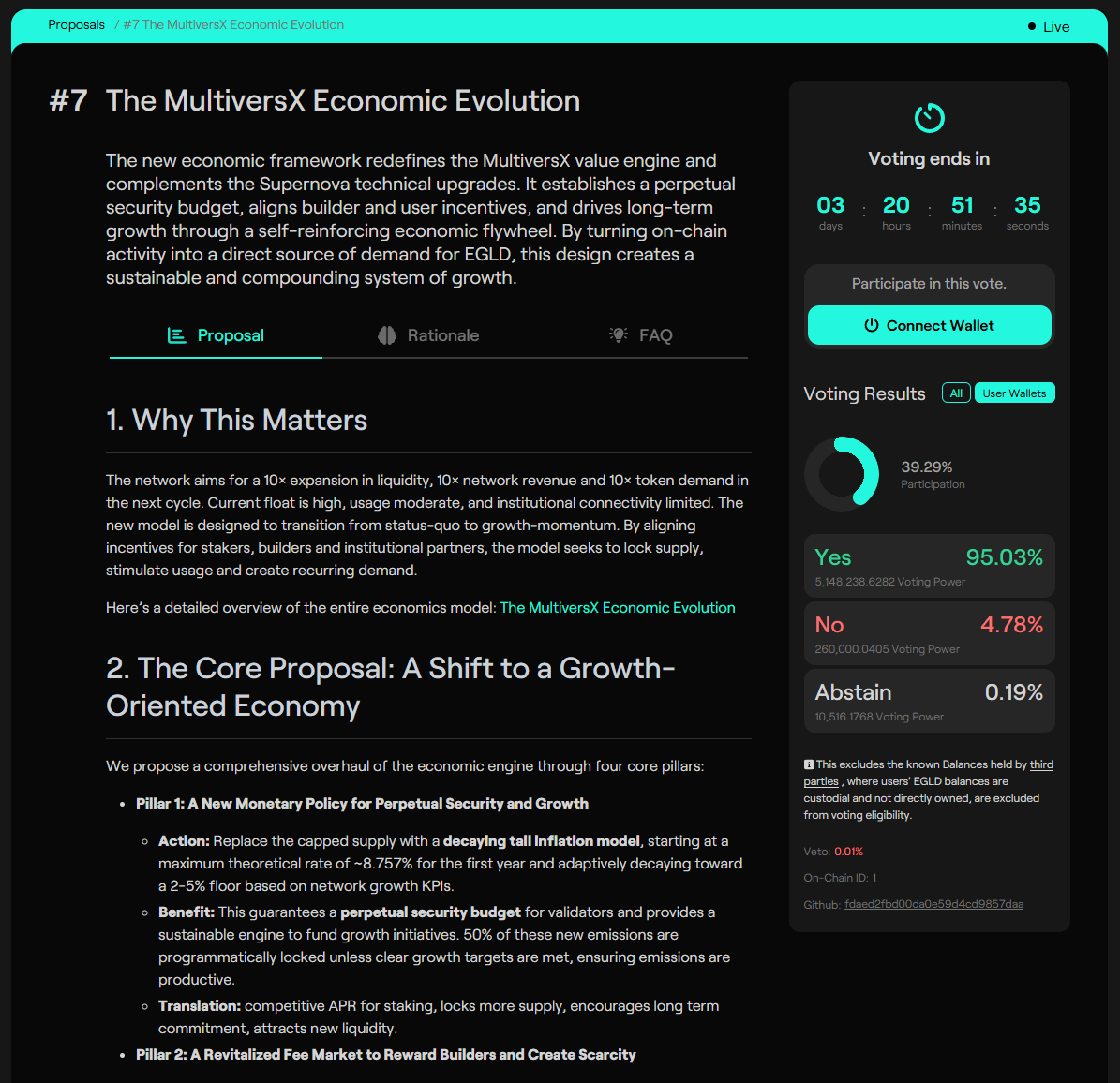

This all happens as MultiversX—another sharded blockchain similar to NEAR—has just voted favorably to remove the previously promised hard cap and add a theoretical maximum tail emission of 8.75% to EGLD EGLD $5.75 24h volatility: 1.6% Market cap: $168.01 M Vol. 24h: $5.77 M .

The MultiversX Economic Evolution | Source: Governance.multiversx.co

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.