Japan Introduces Regulation Proposals for ICO Market Legalization

With a view to legalize its ICO market, a Japanese research group proposed guidelines for regulating this form of venture-capital fundraising.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

With a view to legalize its ICO market, a Japanese research group proposed guidelines for regulating this form of venture-capital fundraising.

The blockchain smartphone will host tons of feature with crypto-related activities. The first batch will be shipped in October 2018 at a price of $1000.

Ripple is making a big step forward as its XRP ledger’s underlying technology has been for the first time used to create the digital currency for e-commerce.

Blockchain is constantly showing its potential in new ways, and the world of content sharing is one area that could especially benefit from more decentralization.

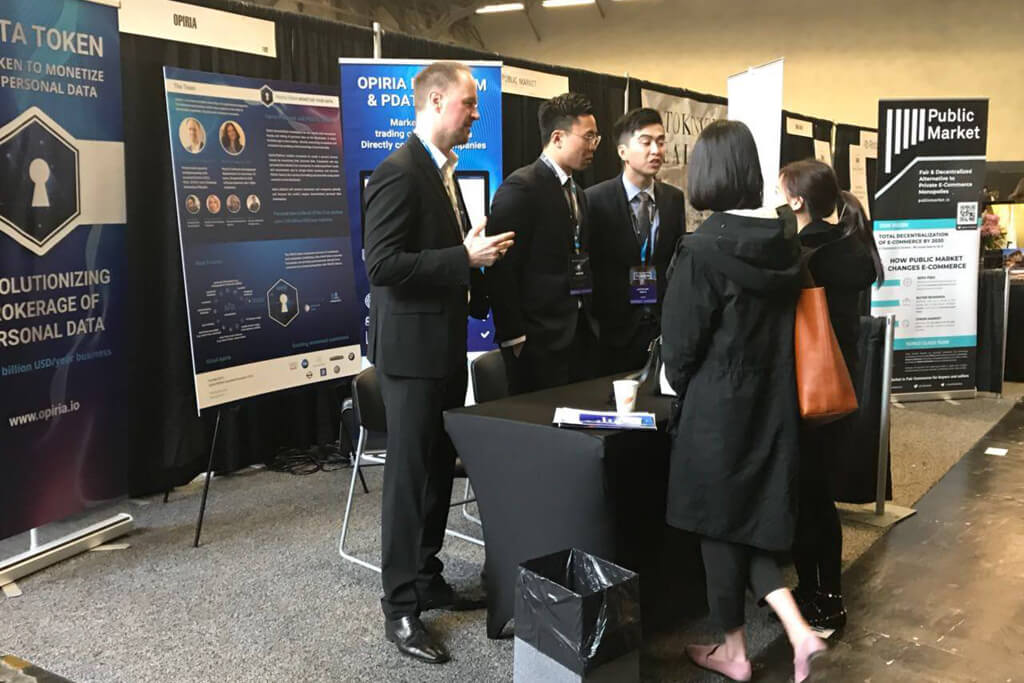

While data brokers invade the privacy of consumers to get their data, Opiria is creating a decentralized marketplace that offers companies the opportunity to buy personal data directly from consumers, without middlemen and with consumers’ full consent.

CoinList, a platform that is connecting investors with blockchain projects, has raised $9.2 million which will be allocated for business development.

Ripple is said to have made lucrative offers to the crypto exchanges which could have possibly ensured huge liquidity for the XRP tokens.

Coincheck, the cryptocurrency exchange that suffered the largest theft earlier this year, has accepted a takeover bid by Japanese online brokerage Monex Group Inc.

FTC asked to revise the adhesion contracts as they were causing problems for the user in withdrawals thereby largely compromising the consumer’s interests.

The ability to afford one of the world’s most expensive vehicles doesn’t only indicate high status of bitcoin holders, but shows the cryptocurrency has real-world value.

While high volatility and never-closing markets may make Bitcoin trading tough, Automated Bitcoin Trading is providing a working solution for maximizing the returns in such circumstances – presumes our guest author, Susan Tindol.

The feud between Buterin and Wright took out in the open during a Q&A session at Deconomy where both criticized each other with some hard-hitting comments.

Amber Baldet, a JPMorgan Chase executive who leads the bank’s blockchain team, is leaving the company to start a business of her own.

Despite some negative trends noticed by experts, Bitcoin continues to gain a momentum. Over $6 trillion has been transferred already across its network.

Beijing-based Bitcoin mining company has recently confirmed the launch of new ASIC chips Antminer E3. The chips are set to ship in July this year.