Tron (TRX) Price Hits ATH of Over $0.44 amid South Korean Unrest

Tron has reclaimed a new ATH, serving as a yardstick for other altcoins to chart related growth course.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

Tron has reclaimed a new ATH, serving as a yardstick for other altcoins to chart related growth course.

A detailed analysis revealed that the compromised library versions contained hidden code designed to steal private keys and send them to a specific wallet address.

Bitcoin price is once again on an upward trajectory after consolidating around $95,000 last week amid reduced profit-booking activity as well as selling pressure from long-term holders.

Roger Ver is challenging tax evasion charges linked to $240 million in crypto sales, arguing the IRS exit tax is unconstitutional.

The rise of BNB price is heavily bolstered by the robust fundamentals of the Binance ecosystem including vibrant DeFi protocols and rising stablecoins inflows.

As market demand grows, AAVE is on a path to becoming a DeFi superstar. The lending and borrowing protocol crosses historic TVL borders, but whales remain the puppet masters.

With the entry of Grayscale in the Solana ETF race, the news has sparked a 3.62% price surge in Solana. This adds to the growing optimism around its future potential in Solana, as it surpasses Ethereum in various DeFi metrics.

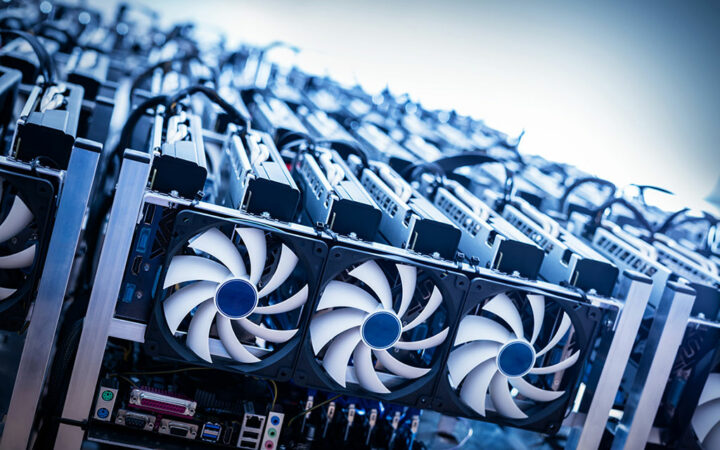

The wind farm will mine Bitcoin only when wind energy is available, reducing dependence on traditional grids and leveraging sustainable power sources.

For the next chapter of Web3, the team behind the BNB Chain has curated a three-phased strategy for development.

Binance Exchange ranks above its core rivals like Coinbase and Kraken as the right channel for corporate investors to enter the market

Bored Ape Yacht Club creator Yuga Labs strengthens its Web3 presence by acquiring Tokenproof’s technology team, integrating their expertise in NFT verification systems into their research and development division, The Workshop.

Brazilian banking giant Itaú Unibanco enhances its digital asset offerings by launching cryptocurrency trading services on its Ion investment platform, allowing customers to trade Bitcoin and Ethereum with a minimal entry threshold.

Vitalik Buterin humorously critiques crypto custody models, warning against the risks of centralized exchanges, highlighting failures like Sam Bankman-Fried (SBF).

The strategic partnership between CreatorBid and io.net will enable the former to access scalable and flexible GPU resources to enhance performance and reliability.

The newly instituted martial Law in South Korea has forced selloffs in the broader crypto market