SUI Price Spikes Over 16% Today after Grayscale Announced Sui Trust to Eligible Investors

The Sui blockchain has grown to a vibrant Web3 ecosystem with over $712 million in TVL and nearly $400 Million in stablecoins market cap.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

The Sui blockchain has grown to a vibrant Web3 ecosystem with over $712 million in TVL and nearly $400 Million in stablecoins market cap.

Buterin’s “training wheels” concept for Ethereum scaling has shifted over time. First introduced in 2022, it lays out a plan for layer-2 solutions to move toward full decentralization.

The deployment of GHO has been limited to Ethereum and Arbitrum networks, at least for now.

Charles Hoskinson took to X to flag the increasing misinformation, stating that the Cardano stake offering is not locked, negating the rumor claims.

Scaramucci has been outspoken about his bullish stance on Bitcoin.

Institutional staking firm Attestant said that Ethereum could grab some of this mindshare through a mix of better value proposition and refined marketing.

By listing the token on these platforms, HMSTR will benefit from their various trading volumes and liquidity, which will help bolster the token’s visibility and trading activity right from day one.

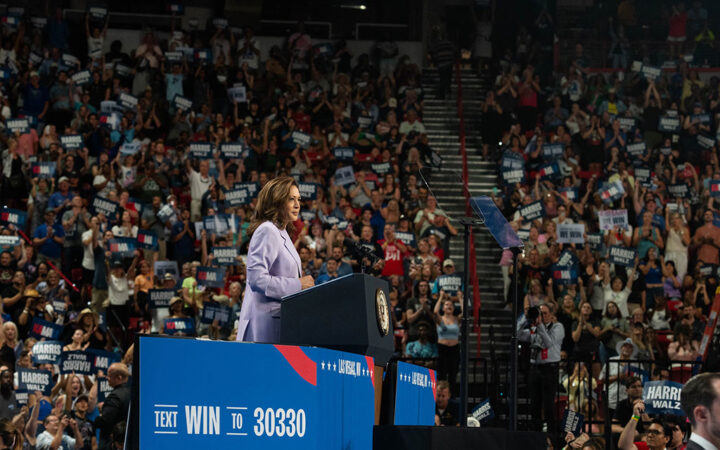

Earlier on September 11, publicly traded crypto and Bitcoin mining firms saw their share price drop in reaction to the first Presidential debate between Kamala Harris and Donald Trump.

With strong technical indicators and ongoing support from the Cardano community, ADA appears well-positioned for potential further gains.

As a key player in the RWA sector, Chainlink prides itself on the capacity of its Cross-chain Interoperability Protocol (CCIP) to connect various on-chain environments.

The possibility of the US Fed cutting its benchmark interest rate next week has increased, thus rejuvenating bullish sentiments for Bitcoin and the entire altcoin industry.

FTX was closely tied to Solana before its collapse in November 2022. The exchange’s demise sent shockwaves through the blockchain ecosystem, with SOL plunging as low as $8.

The Stacks Asia Foundation will play a crucial role in advancing Bitcoin’s decentralized finance (DeFi) capabilities through Stacks’ Layer-2 solutions.

Ark Invest and 21Shares’ ARKB led the outflows after $54.03 million left the product yesterday.

The community eagerly awaits the Catizen listing price, with predictions suggesting a potential surge in value ahead.