Crypto.com Partner Cronos Launches Layer 2 zkEVM Testnet Chain with Matter Labs

Cronos has announced a layer 2 network for the Ethereum blockchain in collaboration with Matter Labs, Crypto.com, Fulcrom, VVS, and Veno.

For the average millennial or at least anyone that pays attention to the business world, the term “cryptocurrency” would not seem like such a strange word. If that is, then the terms Bitcoin, Ethereum or at least Blockchain should ring a bell. One might wonder, why are these terms suddenly so prevalent, especially cryptocurrency news? Computing is getting rather pervasive and the society is leaning towards digital services. The finance world too isn’t spared as the disruption of technology into this sector has fostered the birth and development of Fintech organizations.

These Fintech organizations look to digitize payments and transactions, offering the same services that are currently in existence but in a better, efficient and more effective way.

Blockchain is the network upon which most of these cryptocurrencies operate on. The history of blockchain and bitcoin, in particular, does not have a definite story. In 2009, an individual or group of individuals known to be “Satoshi Nakomoto” developed and published the technology to allow people make digital payments between themselves anonymously without having an external party to verify or authorize the transfer of the currency being exchanged.

Although technologies like this might seem rather complex, understanding how Blockchain works is quite easy, given that one has a basic idea of how networks work. Blockchain is simply a database shared between several users, containing confirmed and secured entries. It is a network, where each entry has a connection to its previous entry.

This technology affords a very secure model whereby every record in the database cannot be tampered with. Apart from the stellar security that this network offers, the transparency and speed at which the network operates give it an edge over the conventional way of conducting transactions.

In simple terms, cryptocurrencies are just monies in digital form, transacted via digital means and over a digital network. The transfer of these currencies is utilized with cryptography and the aforementioned blockchain network. Up until the 2010s, cryptocurrencies were not really known until Bitcoin made its breakout and this gave rise to the birth of new cryptocurrencies.

Cryptocurrencies have had their fair share of bullish and bearish trends, going to show how unstable they can be. The latest cryptocurrency news reports lots of people predicting prices for various cryptocurrencies in the years to come but no-one can say for sure.

Blockchain, on the other hand, is making its way into pervasive computing, especially IoT, giving way for the development of new solutions that embrace data security and transparency.

Cronos has announced a layer 2 network for the Ethereum blockchain in collaboration with Matter Labs, Crypto.com, Fulcrom, VVS, and Veno.

Solana, the blockchain network hosting Bonk, has experienced an impressive run in 2023. Earlier this month, SOL saw a remarkable 50% jump in just a few days, indicating a strong bullish trend.

The crypto market responded positively to the FASB announcement, with Bitcoin’s price rising over 4.12% to $42,979 following the guidance release.

Bitwise has published 10 predictions for the crypto industry in 2024, including a fall in Ethereum transaction cost and the approval of Bitcoin ETFs.

Cardano’s DeFi total-value-locked crosses a significant $450 million with its native stablecoin Djed contributing a significant portion. Smaller protocols like LendFi and Spectrum Finance recorded an impressive 90% surge in TVL.

DTCC data shows that the Wise Origin Bitcoin FD SHS is listed under the ticker BITB. Bitwise joins BlackRock, Invesco Galaxy, and Fidelity on the DTCC’s list.

The Santa Claus rally in the crypto market is likely to continue with analysts expecting the Bitcoin price to touch $48,000 during pre-spot ETF approval.

The Champions Tactics game itself will launch on Oasys, a separate chain from that of the Warlords NFTs – Ethereum.

Goldman believes that the Fed could begin rate cuts from the first quarter of next year as inflation hopefully falls.

The first reports said the SEC gave the green light but did not say “ETF”. This made people wonder if it was really an approval for a Bitcoin exchange-traded fund.

Coinbase said the launch of the international digital asset trading platform is part of its move for global expansion driven by regulatory uncertainties in the United States.

With the US inflation having eased without significant unemployment, the Fed unanimously agreed to hold the borrowing rate between 5.25 and 5.5 percent for the third consecutive time.

Buterin believes the enshrined zkEVM method, which returnes functions to L1, is the next course of action as “light clients” get stronger.

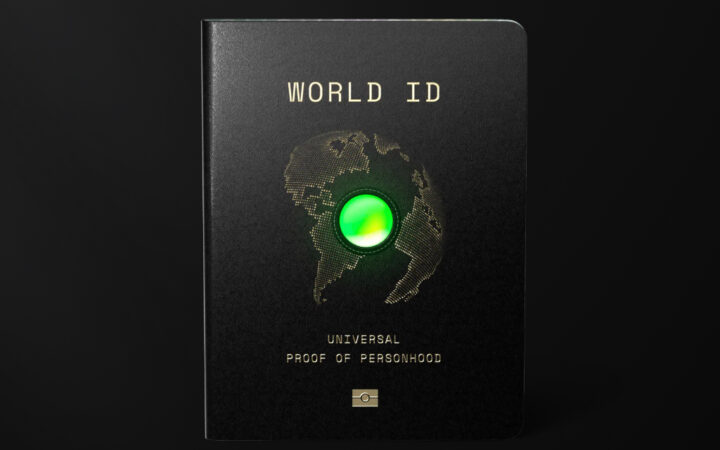

Riding in its current wave of success, Worldcoin has decided to spread its tentacles. Presently, the company is looking at expanding to Mexico and Singapore.

JPMorgan analysts predict that Ethereum will see massive growth in 2024, mostly thanks to its upcoming EIP-4844 upgrade. This upgrade will introduce improved sharding methods.