German Asset Manager DWS to Issue Euro Stablecoin Along with Galaxy

To uphold the token’s value, stablecoin issuers often reserve cash or liquid assets. Amid rising interest rates, DWS is poised to manage the reserves for the new stablecoin.

For the average millennial or at least anyone that pays attention to the business world, the term “cryptocurrency” would not seem like such a strange word. If that is, then the terms Bitcoin, Ethereum or at least Blockchain should ring a bell. One might wonder, why are these terms suddenly so prevalent, especially cryptocurrency news? Computing is getting rather pervasive and the society is leaning towards digital services. The finance world too isn’t spared as the disruption of technology into this sector has fostered the birth and development of Fintech organizations.

These Fintech organizations look to digitize payments and transactions, offering the same services that are currently in existence but in a better, efficient and more effective way.

Blockchain is the network upon which most of these cryptocurrencies operate on. The history of blockchain and bitcoin, in particular, does not have a definite story. In 2009, an individual or group of individuals known to be “Satoshi Nakomoto” developed and published the technology to allow people make digital payments between themselves anonymously without having an external party to verify or authorize the transfer of the currency being exchanged.

Although technologies like this might seem rather complex, understanding how Blockchain works is quite easy, given that one has a basic idea of how networks work. Blockchain is simply a database shared between several users, containing confirmed and secured entries. It is a network, where each entry has a connection to its previous entry.

This technology affords a very secure model whereby every record in the database cannot be tampered with. Apart from the stellar security that this network offers, the transparency and speed at which the network operates give it an edge over the conventional way of conducting transactions.

In simple terms, cryptocurrencies are just monies in digital form, transacted via digital means and over a digital network. The transfer of these currencies is utilized with cryptography and the aforementioned blockchain network. Up until the 2010s, cryptocurrencies were not really known until Bitcoin made its breakout and this gave rise to the birth of new cryptocurrencies.

Cryptocurrencies have had their fair share of bullish and bearish trends, going to show how unstable they can be. The latest cryptocurrency news reports lots of people predicting prices for various cryptocurrencies in the years to come but no-one can say for sure.

Blockchain, on the other hand, is making its way into pervasive computing, especially IoT, giving way for the development of new solutions that embrace data security and transparency.

To uphold the token’s value, stablecoin issuers often reserve cash or liquid assets. Amid rising interest rates, DWS is poised to manage the reserves for the new stablecoin.

The revised spot Bitcoin ETF proposal from BlackRock provides access to banks, allowing them participate via broker-dealers.

S&P Global Ratings senior analyst Lapo Guadagnuolo believes that the growth of stablecoins does not mean that they are immune to risk factors.

Reacting to Coinbase’s announcement, BONK quickly took to its heels, gaining nearly 8% in value to reach $0.00001132.

VanEck analysts correlate Trump’s predicted victory with a global backlash against what they term an “anti-growth agenda”.

BlackRock’s recent app update indicates their engagement with the SEC led by Gary Gensler on Dec. 11, marking the third meeting in a series held over the past few weeks.

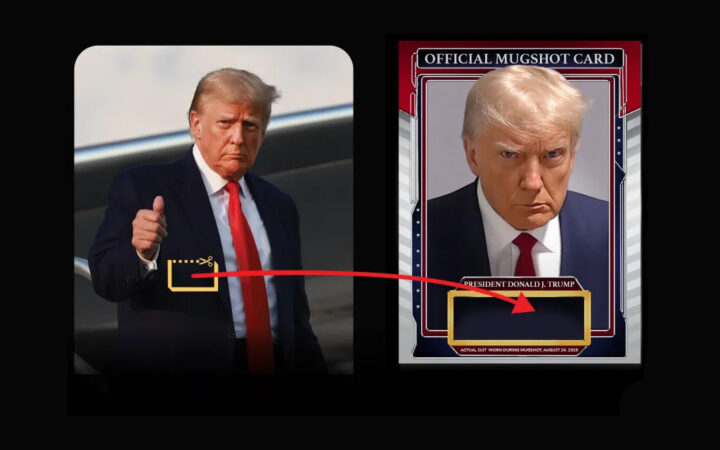

The new NFT collection will give users a chance to own an actual piece of the Trump mugshot suit and tie, and access to dinner at his resort.

Coinbase-backed Project Diamond will leverage the Base L2 network and the Coinbase technology stack to enable institutional investors to tokenize and trade real-world assets.

Analysts at Fortune found that the flourishing landscape of blockchain gaming is not without its hurdles. As such, they have pinpointed several important factors hindering the sector’s growth.

The recent updates for BNB Greenfield contains extensive details on its roadmap, basic principles, and features that support AI adoption.

As part of the settlement, KuCoin will refund $16.77 million to New York customers and pay an additional $5.3 million to the Attorney General of the State of New York.

TIA’s price skyrocketed to a record high of $13.1, followed by a subsequent correction. Presently, the price has found support around $10.8 and has the potential to continue its upward trajectory, which has been evident since its launch.

The newly launched ORBS guide on StakingRewards provides token holders access to robust analytics for optimizing staking strategies. The customizable dashboards offer at-a-glance visibility into key metrics.

Binance says it has agreed to a robust monitorship for its compliance and sanctions control programs.

Several companies are anticipating the changes expected from the Bitcoin halving next year and have pumped in more mining investments.