Bitcoin (BTC) Tanks 7% Under $30,000, Risks of Further Correction Still Alive

Bitcoin loses steam once again following a poor show on Wall Street on Monday. Selling pressure comes just ahead of the US releasing its inflation numbers this week ahead.

Everything you need for the flagship crypto: from price movements and halving cycles to institutional adoption, on‑chain metrics and market strategy around Bitcoin. Follow how Bitcoin’s narrative evolves, why it matters to global finance, and what shifts could impact its future role as digital gold.

Bitcoin loses steam once again following a poor show on Wall Street on Monday. Selling pressure comes just ahead of the US releasing its inflation numbers this week ahead.

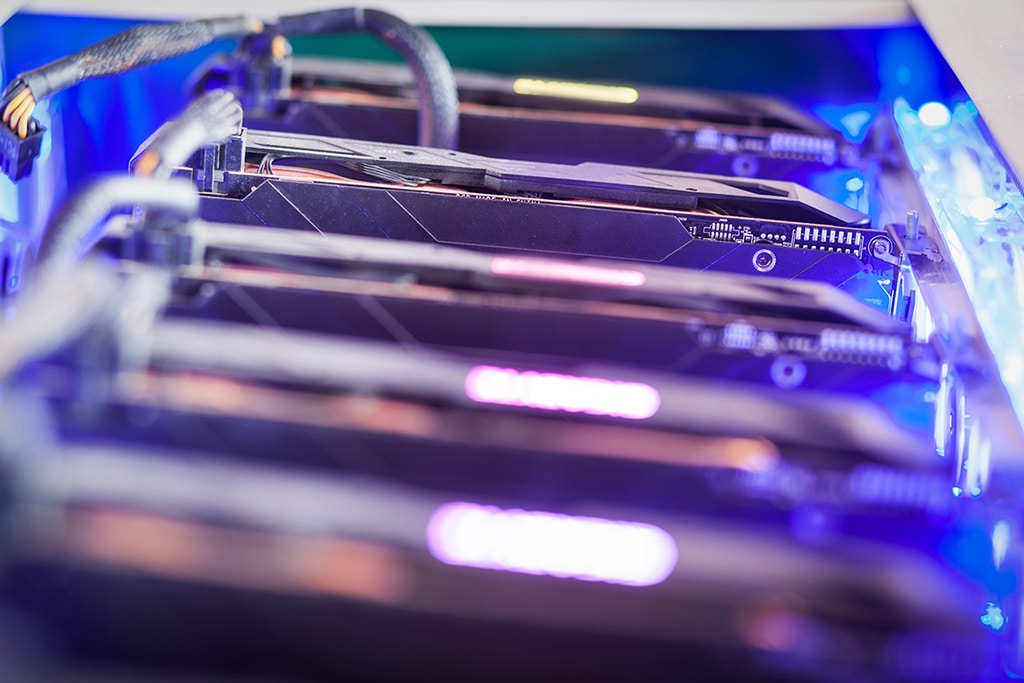

Bitcoin miner Hive said that it has grown its hashrate by 8% during the month of May and mined 273.4 Bitcoins last month.

Owing to a February 2022 hack of $36 million, the IRA accused Gemini for lack of transparency with its cybersecurity protocols and failing to provide sufficient security for the funds.

Investors in Australia have already lost $81.5 million in crypto scams and $148 million overall, including several other investment scams.

Bitcoin last traded at these levels on June 1, when it began a downward correction that saw BTC fall from around $32,000 to below $30,000 for the majority of the weekend.

Michael Saylor said he is not interested to make any short-term predictions and that his company won’t take any call of selling unless BTC price corrects 95%.

New York lawmakers have passed a moratorium that seeks to bar Bitcoin mining operations for two years in order to ease environmental concerns.

With several tech experts joining hands against crypto, Vitalik Buterin said that it pains to see that the crypto industry has turned so adversarial in the last decade.

The ongoing macroeconomic events have a massive toll on the price of cryptocurrencies, and according to Arthur Hayes, there may still be more downsides to watch out for.

Chipotle is the latest addition to a growing list of restaurants that accept cryptocurrencies.

Bitcoin has lost steam once again slipping under $30,000. If bears continue to dominate, the BTC price can see further downside to $22,000.

Experts’ prediction on BTC price suggests that the leading crypto may wallow below $32K for a while unless strong bullish action rescues it.

Bitcoin has given a strong bounceback on Sunday preventing a negative closing for the ninth-consecutive week in a row. Bitcoin decoupling from US equities still remains a concern.

The two leading cryptos, Bitcoin and Ethereum suffered the most with $122.6 million and $234.2 million in liquidation respectively.

21Shares CEO Hany Rashwan earlier disclosed that the approval of the ARK 21Shares Bitcoin ETF would be a big win for the crypto industry.