Bitcoin Price Shoots Past $65,000 amid Boost in BTC Futures Open Interest

The massive Bitcoin price rally in 2024 is majorly due to the continuous inflows into the Bitcoin ETFs launched in January.

Everything you need for the flagship crypto: from price movements and halving cycles to institutional adoption, on‑chain metrics and market strategy around Bitcoin. Follow how Bitcoin’s narrative evolves, why it matters to global finance, and what shifts could impact its future role as digital gold.

The massive Bitcoin price rally in 2024 is majorly due to the continuous inflows into the Bitcoin ETFs launched in January.

A report by JPMorgan forecasts a potential correction in BTC price to as low as $42,000 following the April halving when miner rewards will be halved for the fourth time in Bitcoin’s history.

The billionaire CEO described the current market level as “frothy”, noting that BTC is experiencing a price discovery phase with the arrival of the ETFs, bringing in “a new army” to test the market.

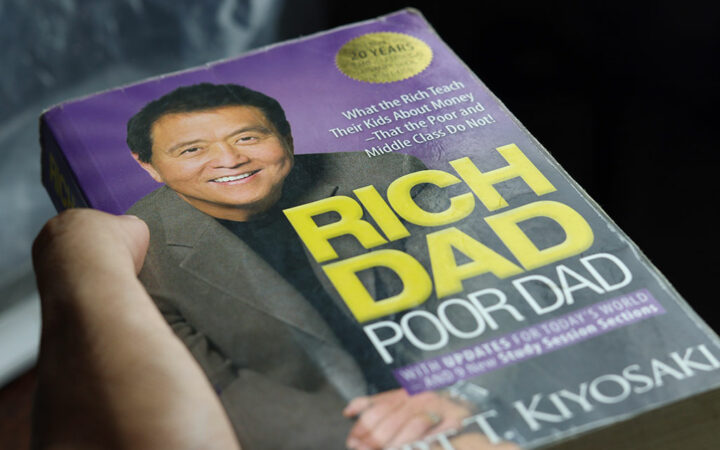

In a recent tweet, Kiyosaki praised Bitcoin for its strong performance and expressed concerns about the US dollar, which he believes to be unreliable, slamming it as fake.

The company disclosed that the chains are designed with distinct features, such as a merge-mining system that allows miners to potentially earn Bitcoin-denominated revenue from transactions on sidechains while continuing to mine Bitcoin on the base layer.

The Bitcoin restaking platform BounceBit is now in early access mode. Since its launch on January 23, it has accrued over $545 million in total value locked (TVL).

Commenting on Bitcoin’s recent movements, Mike Novogratz, CEO of Galaxy Digital, noted that BTC is in a price discovery phase, fueled by increased accessibility to US investors.

Morgan Stanley is well known for its leadership in alternative investments and the private market sector, with assets under management exceeding $150 billion.

As the bitcoin price teases a move above $60,000, investors epculate new all-time highs before halving. Ethereum joins the party ahead of the Dencun upgrade in March.

Many analysts have been bullish about Bitcoin over the next few months and Peter Brandt is one of them.

The upsurge in trading activity is ascribed to several factors, including FOMO, which was driven by Michael Saylor’s disclosure that MicroStrategy had expanded its BTC holdings

BTC whales have been on a buying spree with MicroStrategy adding 3,000 Bitcoins to its kitty on Monday. Bitcoin ETF trading volumes hit all-time high.

The change in market sentiment towards Ether is in stark contrast to previous months when institutions were more bullish on Bitcoin.

Saylor and MicroStrategy appear to have concluded that the benefits inherent in the BTC acquisitions far outweigh any potential risks.

While Bitcoin remains the focal point for many investors, other cryptocurrencies have also experienced notable inflows.