Ethereum Price Analysis: ETH/USD Targets $154 Price Level

The Bulls are fully in control of the ETH market and a further increase in Ethereum price above $154 price level is expected except the Bulls lose their momentum.

The Bulls are fully in control of the ETH market and a further increase in Ethereum price above $154 price level is expected except the Bulls lose their momentum.

On Tuesday, Bitcoin price jumped nearly 20% in just under an hour registering massive recovery after heavy consolidation. Along with Bitcoin, altcoins too have joined the bull show.

The increase in Bullish momentum will increase Ethereum price to reach $143 – $146 price level. In case the Bears defend supply level of $140, the ETH price will decline towards $136 – $134 price level.

Ethereum is struggling hard, says Dmitriy Gurkovskiy, chief analyst at RoboForex.

Increase in the bearish momentum will drop Ethereum price at the demand level of $131 in case $134 price level does not hold. Should the Bulls defend the demand level of $134; the ETH price may roll up towards the supply zone of $140.

A sneak peek into Buterin’s account highlights the ETH holdings of the Ethereum founder and his cashing-out into fiat currencies in the last four years.

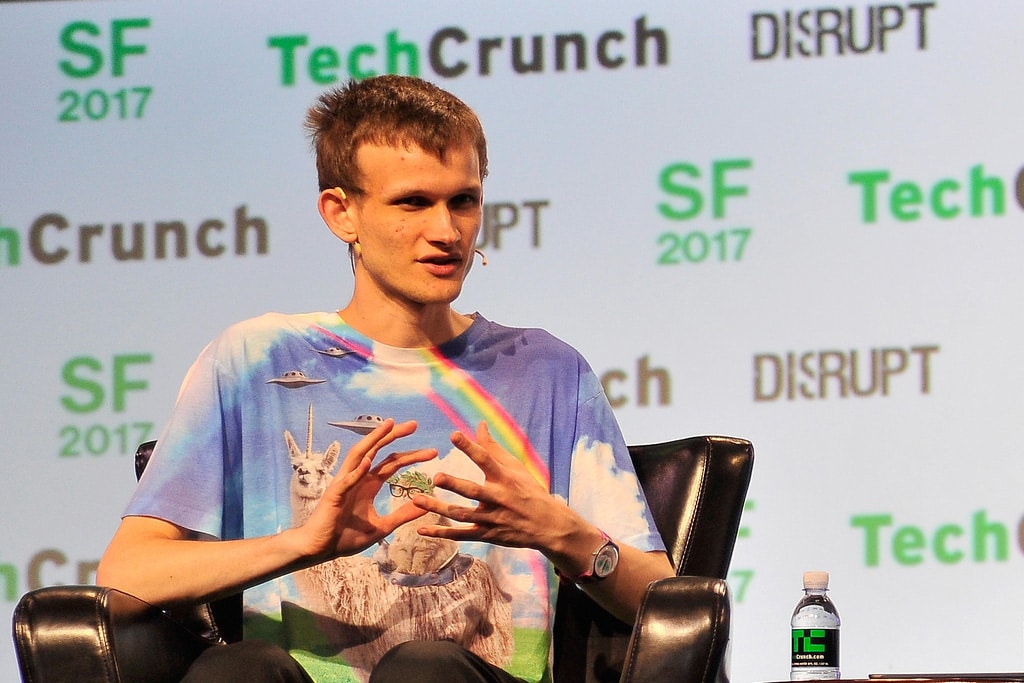

In his recent interview, Vitalik Buterin explained why Ethereum price is important for the crypto industry and answered to many other questions.

In case the Bulls gain enough momentum to push up Ethereum price and break the upper trend line of the triangle and sustain the momentum, the ETH price may reach $149 – $161; otherwise, the bearish breakout will target $134.

Further increase in the Bullish pressure will penetrate the supply zone of $149 and may target $161 price level. On the other hand, in case the Bulls lose their pressure Ethereum price may continue ranging towards $134 demand zone.

Ethereum needs support, reports Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

Radical pressure is required from the bears to break down the $134 demand level; this will enable Ethereum price to find support at $125. If the $134 demand level holds and the bulls gain momentum, ETH may have the supply zone of $149 as its target.

In his answer letter, Jay Clayton opens up on defining ICO tokens as securities saying that there cannot be a static approach to deal with different crypto assets. Meanwhile, according to the agency’s laws, Ethereum is not the case.

In case Ethereum price goes down below $134 with the bearish candle close below the level right down there, then the bears will drive ETH price towards $125 price level. If there is a rejection at $134, then the ranging movement may continue.

Samsung may have offered the entire crypto market a lifeline through the introduction of new devices with built-in crypto support features enabling users to transact using digital tokens.

In case the Bulls maintain or increase their momentum, Ethereum price will reach its target of $149 supply zone. The loss of bullish momentum will make the coin range towards the previous low of $125 price level.