Fidelity Investments Acquires Fintech Firm Shoobx for Undisclosed Sum

The financial details of the deal remain undisclosed but come off as the first acquisition Fidelity Investments has made in about 7 years.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

The financial details of the deal remain undisclosed but come off as the first acquisition Fidelity Investments has made in about 7 years.

Huobi and Visa share similar goals in wanting to bridge the gap that exists between the crypto ecosystem and traditional finance.

With the conclusion of its latest funding, Toss plans to grow further its suite of services, including Toss Bank and Toss Securities.

Payment facilitator Visa has posted a technical paper delineating plans to channel Ethereum functionality for customer auto payments.

The partnership is the latest strategic move by Polygon, which is trying to become the face of gasless fees for NFTs.

VISA said that this new investment will help towards greater financial inclusion in the underbanked African continent.

The service has officially been rolled out to select PayPal users within the United States, with more expected in the coming weeks.

MoonPay has secured FCA UK registration and will now comply with all financial regulations laid down by the regulator.

Most people have privacy and security concerns when it comes to making payments online. With the ZELF card, this becomes a no-issue.

Paypal noted that its crypto product offering in Luxembourg is designed to provide all prospective users with easy accessibility.

The partnership will see several Web 3.0 companies gain more uses and increase the usability of their products and services.

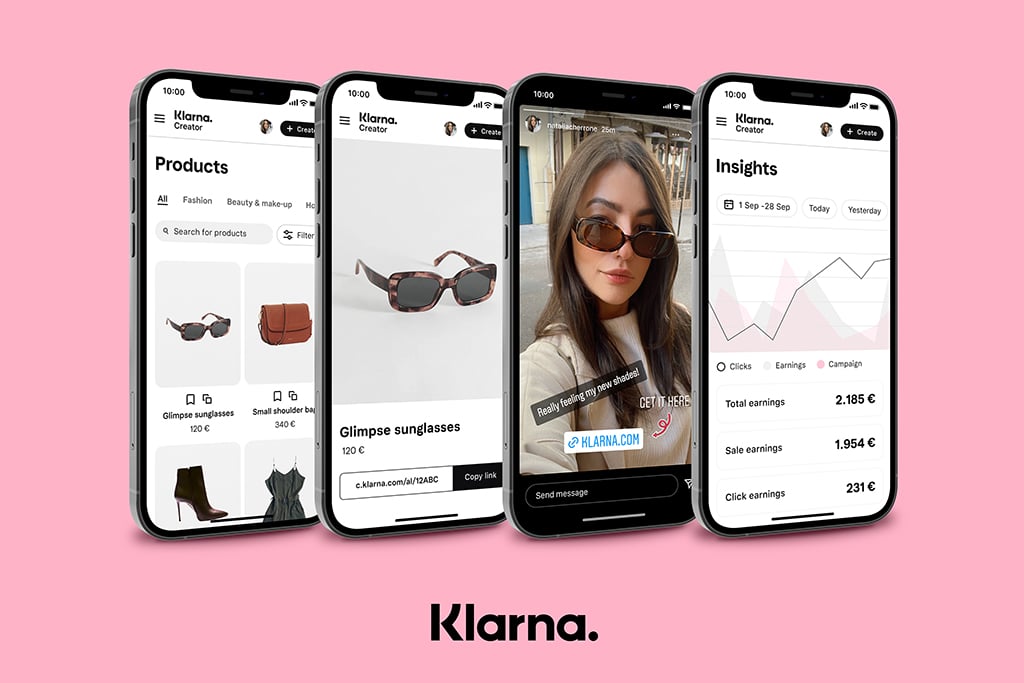

The Creator Platform from Klarna takes a somewhat different model from its BNPL primary offering.

According to the announcement, the Lite service will be kickstarted in Latin America, Southeast Asia, and the Middle East.

The ongoing trials of the FTX platform have confirmed the saying that no one wants to tag along with a failure.

The average monthly transacting users on Paytm jumped by 39% from a year ago.