PayPal Launches MasterCard-branded Debit Card for Its Mobile App Venmo

Now Venmo users will have more opportunities to use their Venmo balances, as PayPal will offer them debit cards for payments in the real world.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Now Venmo users will have more opportunities to use their Venmo balances, as PayPal will offer them debit cards for payments in the real world.

Stock trading app Robinhood is constantly working on offering new services for its clients. Now it is going to get a license to perform banking services.

Owing to the blockchain technology, two companies have renewed a credit line worth €325 million, the first initiative of this collaboration.

Amid Bitcoin growth after quite a long-term downward trending, fintech startups livened up offering their solutions to the crypto industry. Here are the top 3 definitely worth monitoring in 2018.

Ant Financial will use this funding to expand its operations globally as well as towards developing emerging new technologies like blockchain.

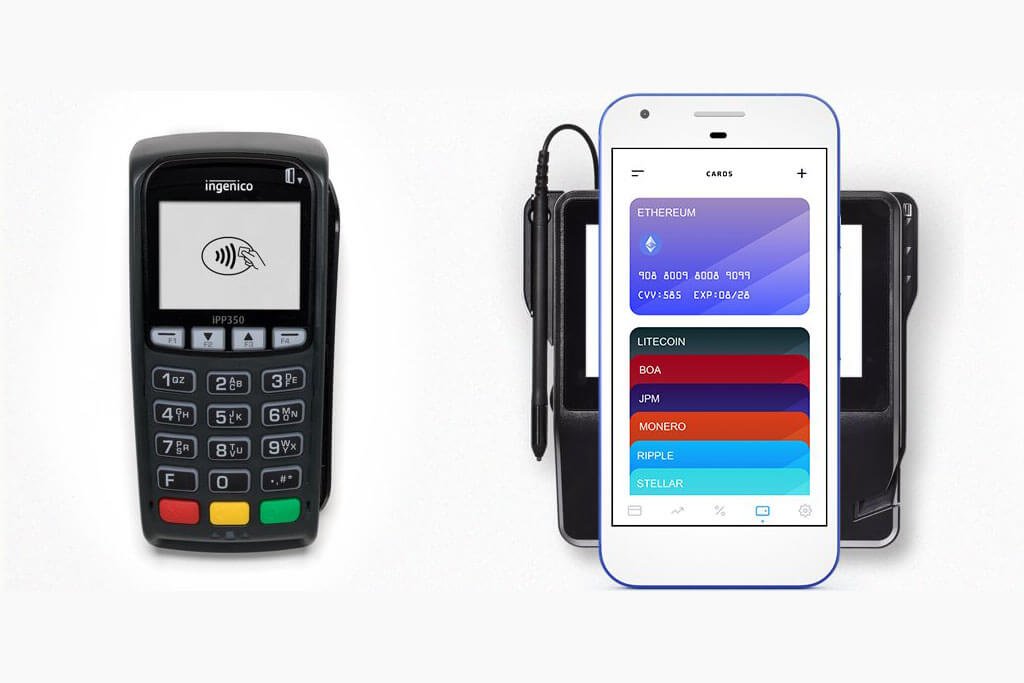

Thanks to Basepay ambitious plans, cryptocurrency payments will soon become available to a great number of people all over the world.

Revolut allows its users to spend, store, send, and receive payments from both – cryptocurrency accounts and bank accounts.

Cryptocurrencies are no longer a passing fad – blockchain is changing the standards of the financial systems. Bitcoin, Ether and Ripple have initially stimulated the development of numerous start-ups, but today they experience the increasing interest on the part of traditional financial institutions.

The Payment Request API introduced in Apple is interconnected with Ripple’s Interledger Protocol that allows easy payments across multiple ledgers.

The PBoC also said that it will allow for a level playing field for the foreign players to compete with the local players in the highly saturated payments market of China.

CoinMetro, a decentralized financial service provider designed to facilitate compliance of Blockchain-based setups with country-specific regulatory requirements, raises over 11.5 Million EUR from its TGE.

Thanks to the obtained U.K. e-money license San Francisco-based cryptocurrency exchange Coinbase now can operate in the EU countries.

Square, digital payments company, continues buying and selling Bitcoin. Experts believe that one day the firm could launch a cryptocurrency exchange.

The fund will also make indirect investments through Venture Capital funds whose priorities in technologies like the Blockchain.

Cryptocurrency trading platforms now have a serious competitor: Robinhood Crypto offers services to its users absolutely free of charge.