French Startup Lydia Raises $16M to Become the PayPal of Mobile Payments

Having ambitious plans to replace PayPal, Lydia has already become a mobile payment leader in France and is not going to stop.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Having ambitious plans to replace PayPal, Lydia has already become a mobile payment leader in France and is not going to stop.

Singapore proves to be one of the most important Asia-based fintech hubs – and the role of the government in this success can hardly be overestimated.

Square’s Cash App will incorporate Bitcoin trading facility at zero commission charges.

An international digital asset exchange council has been formed as a step towards the adoption of global standards for tokenization of assets and to improve regulatory measures for asset exchanging and digitization.

Following outstanding ICO performance where London-based fintech company has managed to reach the $24M threshold, world first-class financial and innovative experts now include BlockEx in the TOP100 most influential companies of blockchain industry.

The Gibraltar-based fintech startup PayPro will offer their clients a decentralized portfolio of financial services to guarantee the protection of their interests. ICO is on the way.

Robinhood’s zero commission approach for its clients will surely give other crypto exchange a run-for-its-money.

Stripe stops handling bitcoin on April 23 due to transaction-connected prolems. However, the company stays optimistic about other cryptocurrencies, planning to add support for other coins in the future.

The consumer launch of UK-based startup Curve was described as a major milestone for the whole fintech industry on its way to disrupt conventional banking system. Up until now, the service was running in beta version exclusively available to business users.

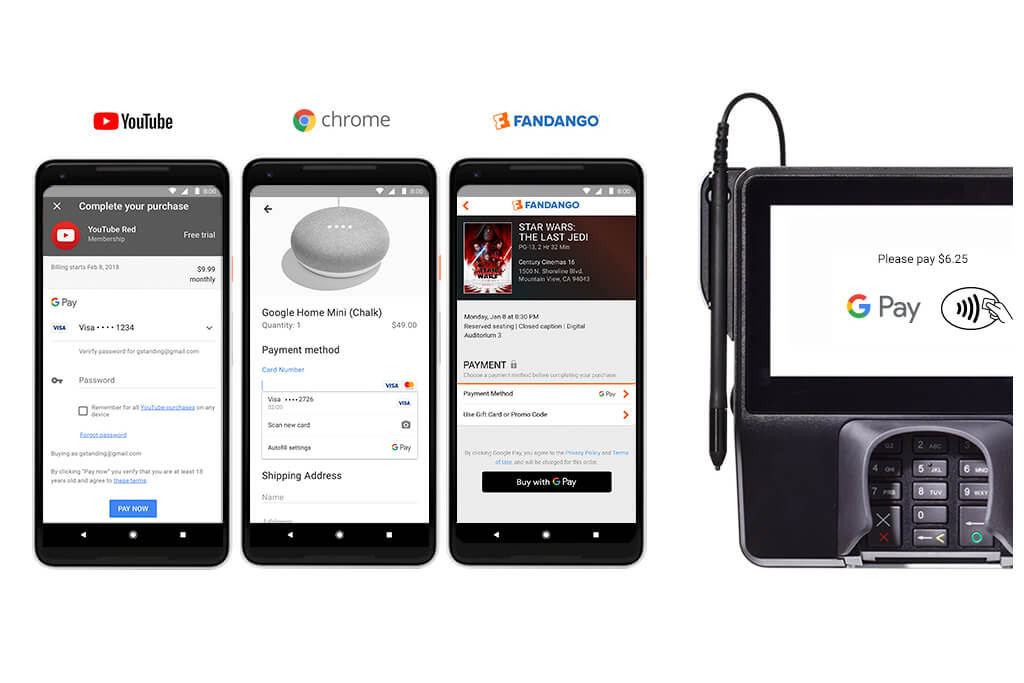

Google is bringing together some of its payment services under a new brand called Google Pay. The service will simplify online payments and accelerate access to users’ payment information.

Chain is now developing Ivy, Bitcoin-based programming language, used to facilitate coding of smart contracts and compete with Ethereum platform.

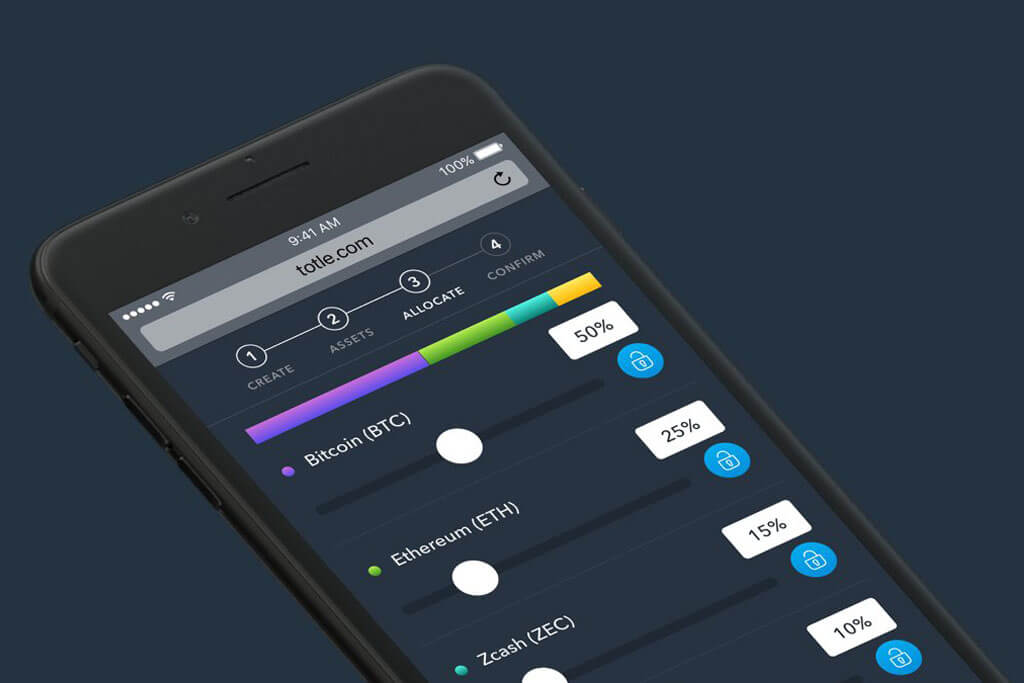

Totle, a platform for managing crypto portfolios, bridges the gap between conventional and crypto fund management enabling investors construct a diversified crypto portfolio through a user-friendly interface.

Finance platform MarketInvoice will provide business loans for customers of Investec Asset Finance. To fund these loans, the banking group will render £50 million to the platform.

German FinTech company NAGA Group AG is working on a sophisticated robo-advisor called ‘CYBO’ that provides traders with crowd data indexing and market stats.

Apple enters a market with the peer-to-peer payment system Apple Pay Cash that can become a killer of similar services due to its’ simplicity.