Samsung Pay Has Finally Launched in the UK, Takes on Apple and Google

Samsung Pay becomes available for customers in the UK starting May 16, two years after the service was first introduced in 2015.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Samsung Pay becomes available for customers in the UK starting May 16, two years after the service was first introduced in 2015.

The new payment platform, which is set to be launched across France later this week, will allow users to make purchases using their mobile phones.

The new fintech body is aimed at improving financial research, coordination and planning, China’s central bank announced on its website on Monday.

The regulatory bodies aim to foster financial innovation through a partnership that will support fintech startups seeking to grow their businesses.

Ant Financial, the operator of Alipay, is expanding its mobile payments platform into the United States market, following limited trials in California and New York.

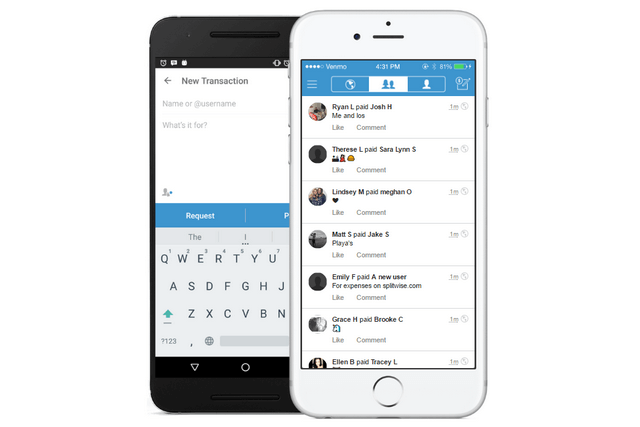

Online payments giant is adding Venmo as a new payment option and is planning for more partnerships with companies across multiple sectors.

The UK’s leading bank has announced the opening of the new innovation site in London, which is set to be the largest financial technology centre in Europe.

Apple users will soon be able to transfer money to other people, as the company is reportedly going to launch a new peer-to-peer payment feature later this year.

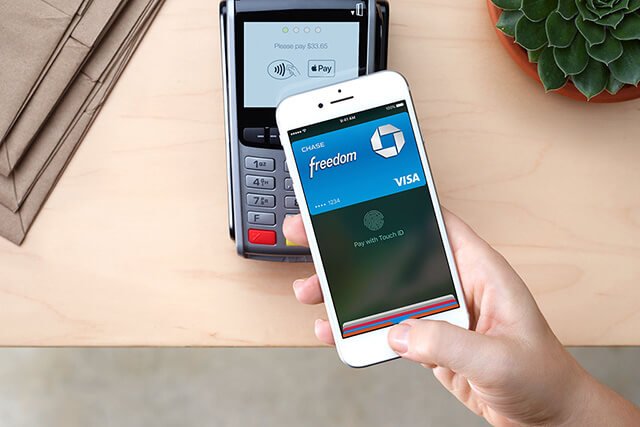

Android Pay users in the US will soon be able to make payments with their PayPal balances at thousands of new retailers, including Walgreens, Dunkin’ Donuts and Subway.

Ant Financial is set to bring mobile payments technology to customers in Indonesia via a new partnership with major local media company Emtek.

The UK’s central bank has developed its own Proof of Concept ledger and will make the next version of its interbank payments system compatible with settlement in a distributed ledger.

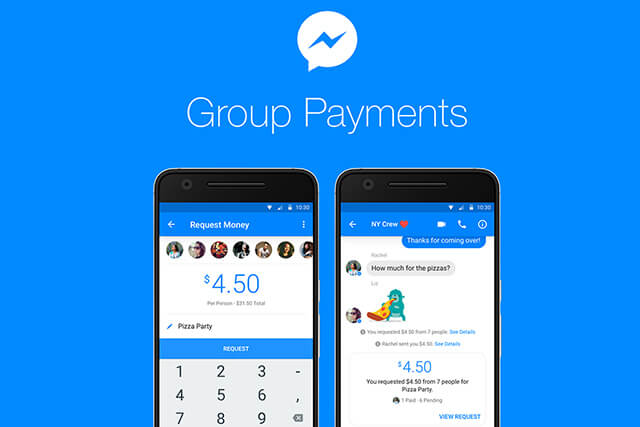

With the new payments functionality, the social media networking giant will enable Messenger users to send funds to several members of the group chat.

Offering Apple Pay as a payment method in the US and later to the UK, Western Union allows customers to conveniently and reliably transfer money whenever they want.

The cooperation will allow the increasing number of Chinese travelers in the UK to purchase goods and services via the WeChat Pay application on their mobile phones.

The company not only described the potential use cases of the blockchain technology for banks, but also identified the main issues impeding its wider adoption in the sector.