TransferWise Announces Apple Pay Support for Money Transfers in the US

The London-based financial technology startup will enable customers in the United States to transfer money via its platform using Apple Pay.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

The London-based financial technology startup will enable customers in the United States to transfer money via its platform using Apple Pay.

B2Broker has launched new solution for brokers working with Meta Trader 5

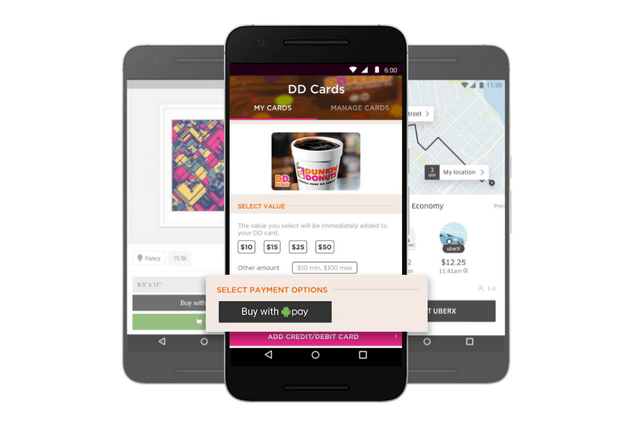

Spain gets Android Pay, which will allow its customers to use their Visa and MasterCard debit or credit card with BBVA to conduct payments with their mobile phones.

The UK-based payments company will use the investments to further expand its operations and allow users to purchase and sell digital currency.

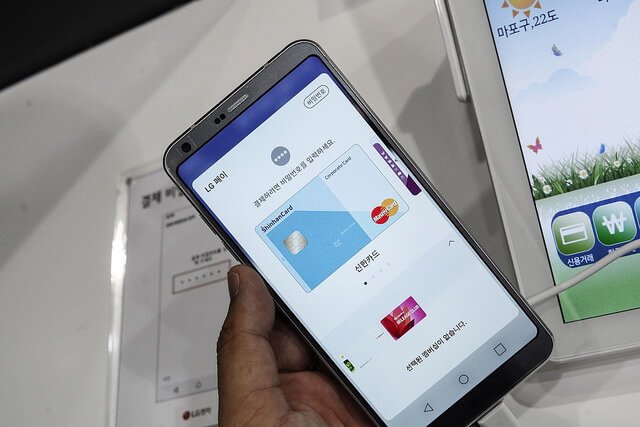

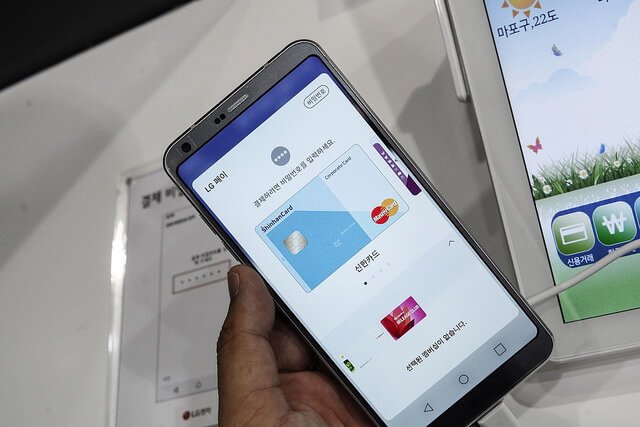

Currently, LG Pay is restricted to the LG G6 and LG G6 Plus in South Korea but hopes to enter the international market soon.

Curve provides one card that can aggregate all of their existing Mastercard and Visa payment cards and lets you retroactively switch the card you use to pay.

Regulatory authorities in Denmark and Singapore have announced a cooperation agreement to boost financial technology innovation in both countries.

The countries have announced a collaboration agreement to support promising fintech businesses and to share information about regulatory changes and economic developments.

Flywire has announced partnership with PayPal regarding its options for businesses, students and patients.

Here are 5 of the catalysts which help fintech apps to grow.

With the latest Amazon novelties fintech experts discuss whether the giant can become a new key player on the market.

The annual FinTech50 list of European most prosperous fintech companies has been published with the UK obviously dominating the rundown.

After several delays, LG successfully launches its mobile payment service in South Korea with plans to expand to other countries.

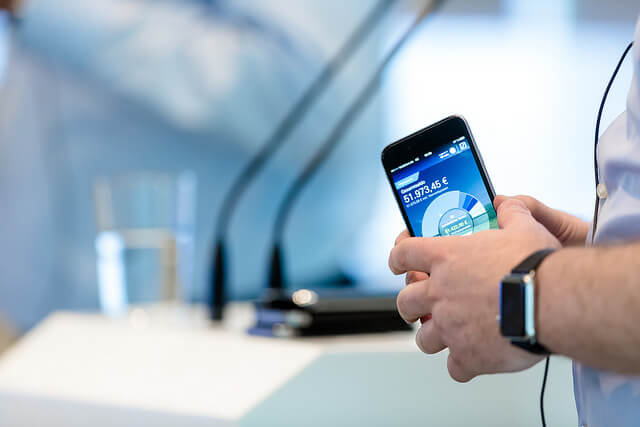

The mobile payment platform will become available in Canada by the end of the month, following the launch of the service in Russia this week.

According to Jennifer Bailey, head of Apple’s payment arm, the users of the app can make limitless mobile payments at the majority of vendors around the country.