Bank of Japan May Apply ‘FinTech’ to Its Operations in Future, Says Governor Haruhiko Kuroda

Bank of Japan conducted its first FinTech Forum focused on the impact of fintech on financial services.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Bank of Japan conducted its first FinTech Forum focused on the impact of fintech on financial services.

Singapore is aiming to become a center for fintech due to the changes of the regulation system.

Google is reportedly developing an update to its Apple Pay application that will show users where the NFC antenna on their mobile phones is located.

Chinese e-commerce giant has unveiled its plans to launch a new service that will let customers to make payments in the virtual world by making hand gestures or nodding their heads.

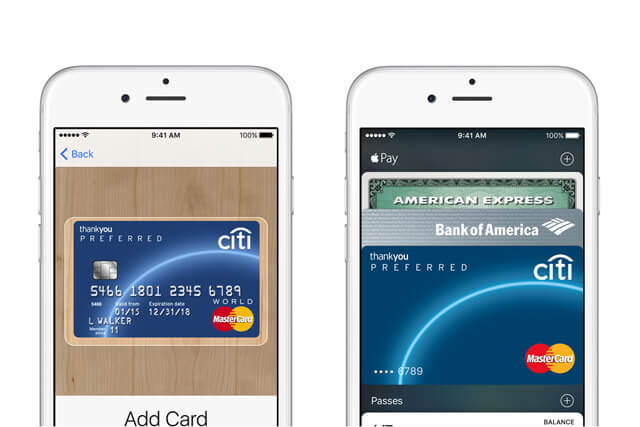

Tim Cook unveiled that the number of monthly active users last month rose more than 450 percent year over year.

The companies have combined its experience to offer precise index representation of FinTech that now includes 49 companies.

Apple Pay’s availability in Switzerland marks the second European launch of the service.

Walmart Pay is a mobile payment option developed by Walmart and available at its stores.

The partnership with BitPay allows Worldcore to add bitcoin as payment option for account top-up.

With the initiative Coinbase intends to ease the process of digital currency exchange.

Apple competes with PayPal to offer the best solution for online shoppers.

Samsung Pay follows its main rivals Apple Pay and Android Pay to leverage the Australian market.

Making attempts to expand payments globally, Apple Pay has run into technical challenges, low consumer take-up and resistance from banks.

Japanese banking group is planning to grow its financial technology business through new acquisitions. Meantime, regulatory authorities in Abu Dhabi are working on establishing fintech ecosystem in the UAE.

The Nasdaq Financial Framework aims at delivering cutting-edge end-to-end solutions to financial infrastructure providers worldwide.