INTC Stock Down 0.45% in Pre-Market, Intel Set to Purchase Israel’s Moovit for $1 Billion

The American multinational corporation Intel is going to acquire Moovit for $1 billion. Meanwhile, Intel (INTC) is slightly down in the pre-market.

The American multinational corporation Intel is going to acquire Moovit for $1 billion. Meanwhile, Intel (INTC) is slightly down in the pre-market.

Warren Buffett’s Berkshire Hathaway refrains from any fresh buys during this market correction saying that the market is just not attractive enough to make new investments.

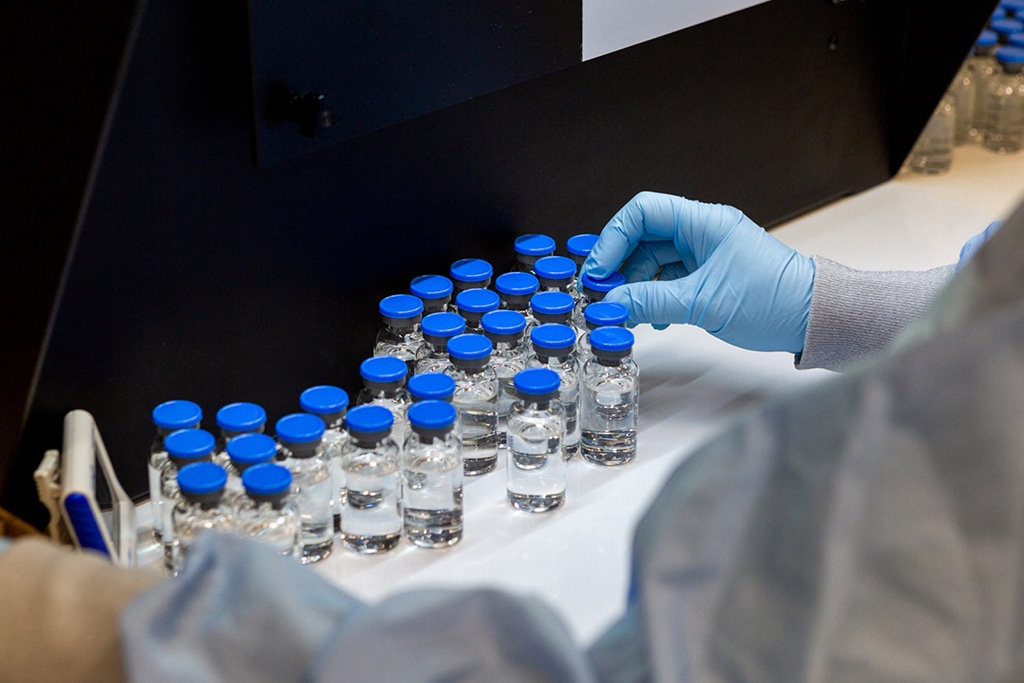

Following the Gilead CEO’s statement about exporting remdesivir to the U.S. hospitals, Gilead Sciences (GILD) stock is up. In the pre-market today, Gilead shares are over 3% up, trading at above $82.

Berkshire Hathaway had a record $137 billion in cash and equivalent instruments on its balance sheet at the end of Q1 2020. Meanwhile, Warren Buffett has decided to sell the airlines stocks.

Tesla (TSLA) stock lost over 10% yesterday. The fall is attributed to a series of controversial tweets from Elon Musk. In one of them, he said that TSLA stock price is too high.

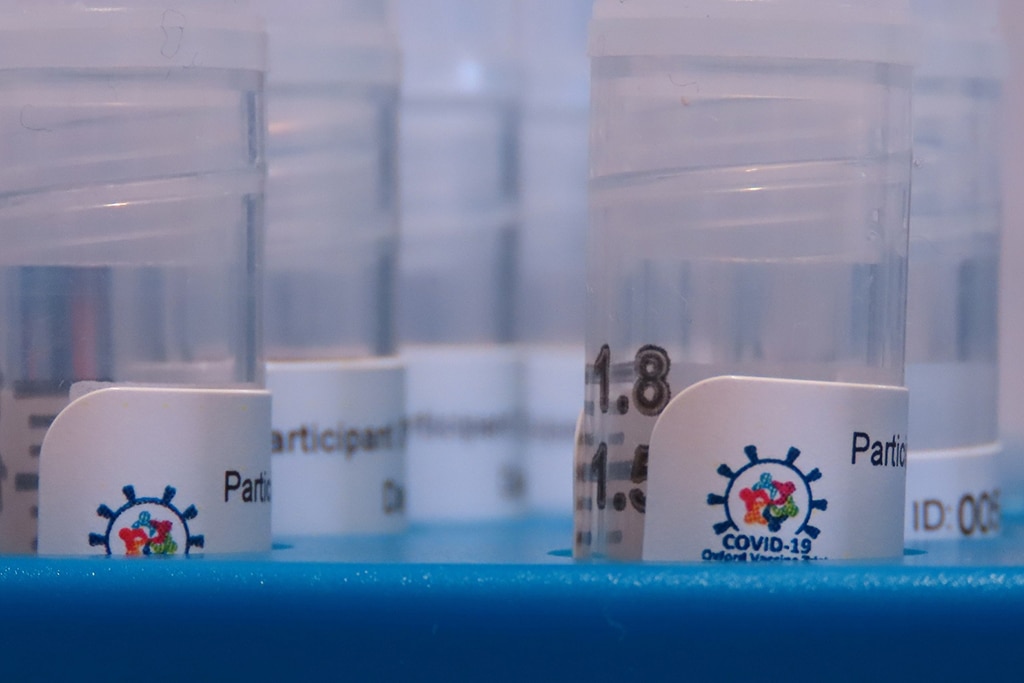

Moderna is moving forward with its coronavirus vaccine. The company announced a deal with Lonza Group AG to manufacture 1 billion coronavirus vaccine doses a year. MRNA stock is up.

Apple reported revenue of $58.3 billion for its fiscal second quarter, falling below its initial Q2 guidance but surpassing Wall Street’s muted expectations. AAPL stock is down in the pre-market.

As it has become known that AstraZeneca and Oxford University are working together on a coronavirus vaccine, the AZN stock price is rising.

50,000 units of Remdesivir are ready for shipment. The drug has passed initial trials and has been proven to be effective in the treatment of COVID-19. Gilead (GILD) stock price is increasing.

Credit card stocks, Visa (V), MasterCard (MA) and American Express (AXP) rose 5.4%, 6.6% and 6.3% respectively on Wednesday, April 29. MasterCard Q1 earnings report beat analysts’ expectations.

The cryptocurrency market has regained over 100% from the March 12 flash crash leaving the stock markets far behind after they gained 36%. The majority of coins are in the green now.

In an unprecedented move, Shell has cut down the interim dividend for its shareholders by 66% from $0.47 last year to now at $0.16. The massive crash in oil demand due to COVID-19 has been responsible for this move as per the oil giant.

Tesla CEO Elon Musk asked the government to give people back their freedom amid the coronavirus pandemic. The company reported Q1 earnings that beat analysts’ expectations. TSLA stock is up.

Microsoft (MSFT) stock price has risen as the software giant released its fiscal Q3 results. Sales increased by 15%, powered by Microsoft cloud business.

On April 29, when Facebook released its Q1 earnings, its shares rose by 6.17% to close at $194.19. In the pre-market today, FB stock has added 9.38% and is making up $212.40 per share at the moment of writing.