Arthur Hayes Predicts Bitcoin Upside amid US Fed Intervention in Japan’s Bond Market

Former BitMEX CEO Arthur Hayes said Bitcoin could break higher if the US Federal Reserve intervenes in Japan’s bond market.

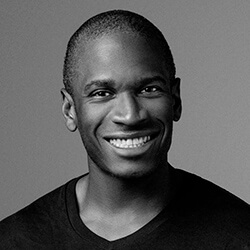

CEO and Founder of BitMEX.

Arthur Hayes is the co-founder and CEO of BitMEX. After graduating with a degree in economics from the Wharton School of Business, Hayes lived in Hong Kong as an equity derivatives trader. He was the market-maker for Deutsche Bank and Citibank’s Exchange Traded Funds (ETF) businesses.

He also has extensive experience trading equity index futures, forwards, and swaps as well as non-deliverable FX forwards. Hayes brings a deep understanding of how to structure and trade financial derivatives.

BitMEX

American

Hong Kong

University of Pennsylvania, Wharton School of Business, BS in Economics and Finance - 2004-2008

University of Pennsylvania, Bachelors of Science in Economics, Finance, - 2004-2008

BitMEX - CEO/Co-Founder

Citigroup Inc - Delta OneTrader - 2011–2013

Deutsche Bank AG - Associate

Former BitMEX CEO Arthur Hayes said Bitcoin could break higher if the US Federal Reserve intervenes in Japan’s bond market.

Arthur Hayes says Bitcoin’s 2025 weakness was due to tightening dollar liquidity, while BTC rebounds above key resistance.

Arthur Hayes has resumed heavy accumulation as on-chain data shows fresh inflows of ENA, ETHFI, and PENDLE into his primary wallet.

Arthur Hayes predicts Bitcoin may dip below $80K before the Fed ends QT on Dec 1. Market liquidity shows early signs of improvement.

Hayes has dumped over $7.42 million in crypto over the weekend, but with his bad Ethereum trading track record, many traders now expect a rally.