Tristan is a technology journalist and editorial leader with 8 years of experience covering science, deep tech, finance, politics, and business. Before joining Coinspeaker, he wrote for Cointelegraph and TNW.

Polygon’s POL token recorded the largest 24-hour crypto price gain at 16.59%, driven by the Open Money Stack launch, a potential $100-125M Coinme acquisition, and unprecedented daily burn rates reaching one million tokens.

Editor Marco T. Lanz

Updated

2 mins read

Editor Marco T. Lanz

Updated

2 mins read

Polygon‘s POL token is in the midst of a price surge propelled by a shift in company strategy, a rumored acquisition, and a record high daily burn rate to start 2026.

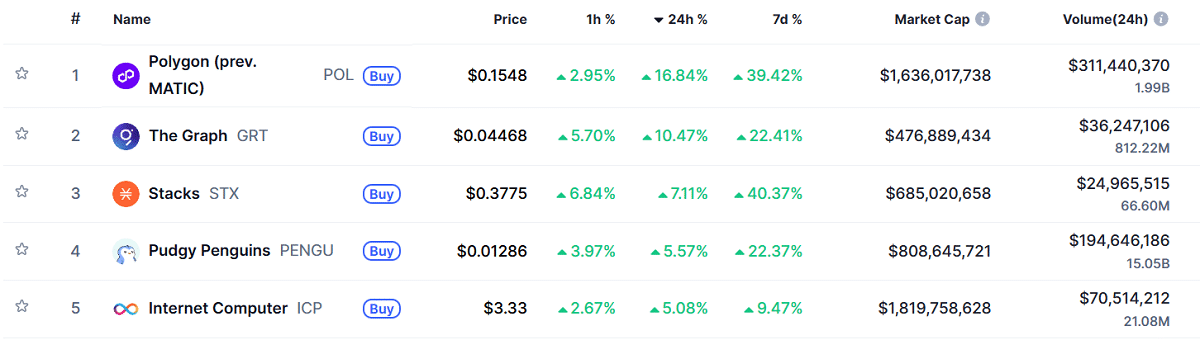

As of Jan. 9 and the time of this article’s publication, POL POL $0.11 24h volatility: 2.3% Market cap: $1.12 B Vol. 24h: $88.53 M is trading at $0.1558. This puts it up 16.59% over the last 24 hours, with an intraday price high of $0.1584. Trading volume for this period reached nearly $312 million, up 167% overnight.

This movement marks the single largest price increase among cryptocurrencies over the past 24 hours.

Polygon marked the largest positive price movement for the 24-hour period beginning on Jan. 8 | Source: CoinMarketCap

The movement has largely been attributed to a major shift in company strategy. As Coinspeaker reported on Jan. 8, Polygon announced “Open Money Stack,” a modular platform designed to provide seamless, cross-chain transactions between fiat and cryptocurrencies in an open, end-to-end framework.

The firm is also rumored to have inked a deal to acquire cryptocurrency ATM operator Coinme. According to unnamed sources who spoke with CoinDesk under the condition of anonymity, a deal in the range of $100 million to $125 million is close to being closed.

Given the firm’s rapidly expanding service portfolio and the breadth of its technology suite, the acquisition of Coinme and its reported 6,000+ ATMs could make Polygon a full stack banking service bridging the traditional finance and digital assets worlds.

Polygon is close to acquiring Coinme, one of the oldest U.S. bitcoin ATM operators, in a deal valued at $100M-$125M, marking the Ethereum scaling network's move into offline crypto access and retail adoption infrastructure.

— Max Avery (@realMaxAvery) January 9, 2026

POL’s overnight rally could set a new resistance target as the token’s upward momentum is shored up by record high burn rates. As the firm’s CEO, Sandeep Nailwal, said in a Jan. 5 post on Twitter, “Polygon chain is having its S curve moment on the fees generated.”

In the time since, about one million POL per day has been burned on fees generated, with around 3.5% of POL’s total supply expected to burn in 2026. According to Nailwal, this makes the token “massively deflationary.”

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Tristan is a technology journalist and editorial leader with 8 years of experience covering science, deep tech, finance, politics, and business. Before joining Coinspeaker, he wrote for Cointelegraph and TNW.