Mercy Mutanya is a Tech enthusiast, Digital Marketer, Writer and IT Business Management Student. She enjoys reading, writing, doing crosswords and binge-watching her favourite TV series.

Earlier this year, Kiyosaki identified three key things that he believes will drive the price of Bitcoin up.

Edited by Julia Sakovich

Updated

2 mins read

Edited by Julia Sakovich

Updated

2 mins read

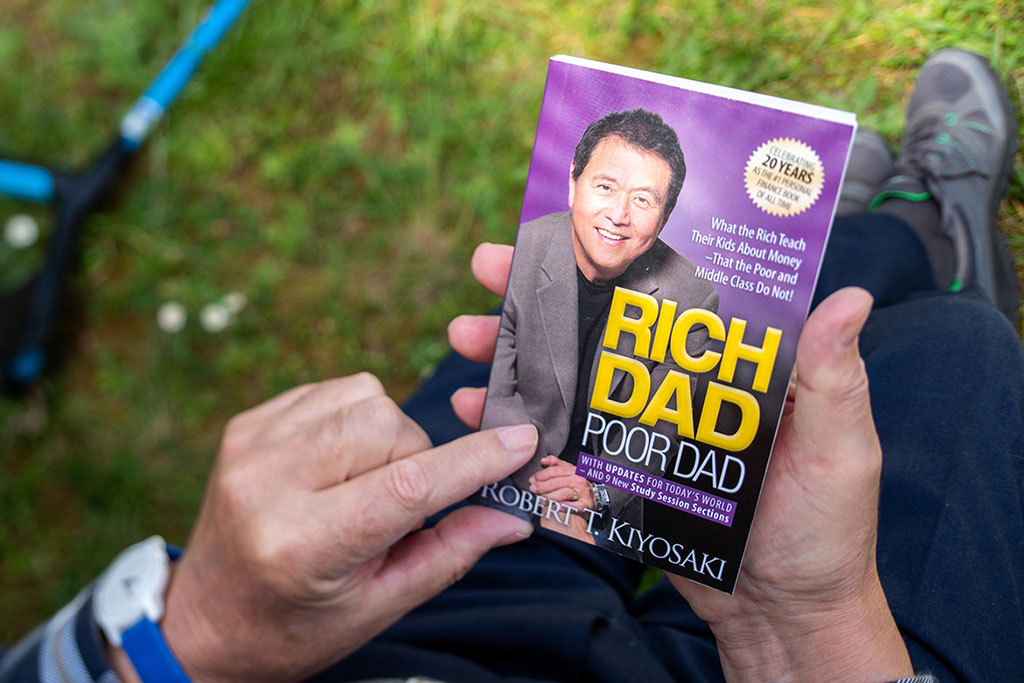

Robert Kiyosaki, the entrepreneur and author of the popular personal finance book “Rich Dad, Poor Dad” has endorsed Bitcoin over traditional assets. In a post on social media platform X, the known Bitcoin champion stated that while conventional assets continue to ‘crash,’ Bitcoin has held steady.

Kiyosaki shared a ‘lesson’ from his book, condemning the conventional model of earning money from regular jobs. He stated that the value of money earned this way was designed to be stolen through taxes and inflation. He instead touted cash flow assets such as rental properties, oil, and food production as a better way to earn ‘tax-free money.’

RICH DAD’s Lesson #1 “The rich don’t work for $.” WHY? Because our Wealth is designed to be stolen from our fake money via taxes and inflation and the stock market. Instead the Rich work for assets that puts tax free money in their pocket…cash flow assets such as rental…

— Robert Kiyosaki (@theRealKiyosaki) November 2, 2023

The businessman has, in the past, criticized the United States government for continuing to print more money and warned of potential hyperinflation. In the X post, Kiyosaki calls the currency “fake” and warns against investing in “stocks, bonds, mutual funds and ETFs, which are crashing.” He stated that in addition to earning ‘real tax-free money,’ the financially successful save ‘real assets’ like gold, silver, and Bitcoin.

Earlier this year, Kiyosaki identified three key things that he believes will drive the price of Bitcoin up. The first was the US banking crisis which resulted from several major banks such as Silvergate, Signature Bank, Silicon Valley Bank and others crashing. The second was the BRICS-proposed gold-backed cryptocurrency for internal trade settlements aimed to reduce dependency on the US dollar. Conversations as to the feasibility of such a currency are still ongoing. The third factor he mentioned was the rapid increase in the US national debt. The country’s debt reached $31.4 trillion this year, prompting President Joe Biden to sign a bill suspending the debt ceiling.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Mercy Mutanya is a Tech enthusiast, Digital Marketer, Writer and IT Business Management Student. She enjoys reading, writing, doing crosswords and binge-watching her favourite TV series.