Hut 8 Bolsters Bitcoin Portfolio with $100 Million Purchase

Hut 8 plans to leverage its Bitcoin reserves to fund large-scale growth initiatives in power and digital infrastructure.

Hut 8 plans to leverage its Bitcoin reserves to fund large-scale growth initiatives in power and digital infrastructure.

Bitcoin miner Hut 8 confirmed a $500 million raise to purchase BTC and up to $250 million share repurchase.

Following Donald Trump’s decisive election, crypto mining stocks like Marathon Digital, Riot Blockchain, and Hut 8 Corp experienced pre-market rallies.

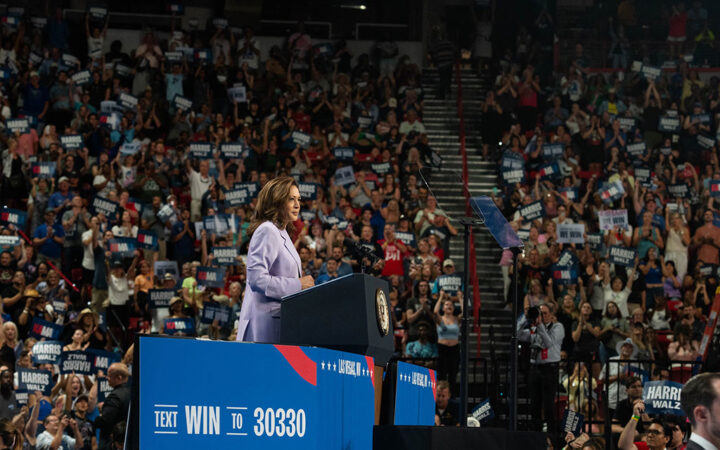

Earlier on September 11, publicly traded crypto and Bitcoin mining firms saw their share price drop in reaction to the first Presidential debate between Kamala Harris and Donald Trump.

Analysts says Bitcoin data centers are perfect for retrofitting due to their high power density racks, cooling infrastructure, and general data center operating capabilities.

The agreement comes at a time when Bitcoin miners’ revenue has dropped significantly since the halving in April.

The decline in Bitcoin followed the movement of a substantial amount of BTC by Mt. Gox, the once-dominant crypto exchange.

The upcoming Bitcoin halving 2024 scheduled for a later date this month is said to have injected substantial investments into the market, supporting overall sentiment

This surge in direct demand from financial institutions on the miners has created a spike in the volume of shortage of Bitcoin on centralized exchanges.

By acquiring all of Celsius mining equipment and infrastructure, Ionic Digital believes it can quickly reach its goal of total mining power of 12.7 exahash per second (EH/s) later this year.

The deal with Hut 8 comes after Celsius recently obtained approval from the bankruptcy court to transition into a Bitcoin mining entity that creditors will solely operate.

The new company will have a greater mining capacity than Hut 8. It will also have a more diverse revenue stream than its constituents.

Hut 8 Mining reported a revenue of about $19.2 million in Q2, a significant decline from $43.8 million recorded in the same period last year, mainly caused by increased mining difficulty.

Canadian crypto miner Hut 8 and its US rival US Bitcoin are working on a mutually beneficial merger to float a new company.

According to Federal Reserve chairman Jerome Powell, the rate hikes were necessary to ease inflation.