Crypto Exchange Gemini Sets Hub in Malta to Comply with Europe’s MiCA

Gemini has announced the creation of a European hub in Malta to align with the EU’s Markets in Crypto Assets (MiCA) regulations.

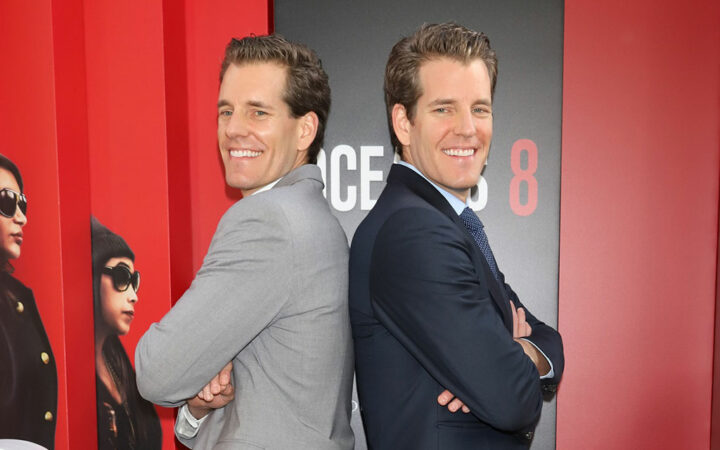

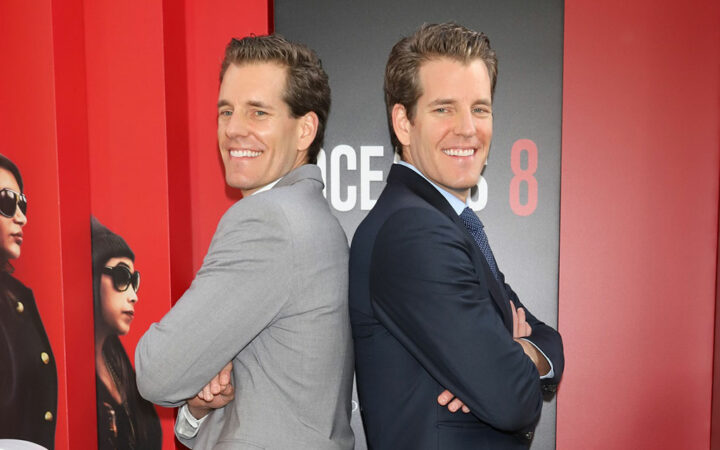

The Winklevoss brothers intend to list their Winklevoss Bitcoin Trust on the NASDAQ stock exchange.

Gemini has announced the creation of a European hub in Malta to align with the EU’s Markets in Crypto Assets (MiCA) regulations.

The support from Winklevoss comes at a time when the regulatory environment of the United States is rapidly unfolding.

Cameron Winklevoss urged the US vice president to take swift and concrete action to address the damage done to the crypto sector over the past four years.

Tyler Winklevoss lashed out at SEC chair Gary Gensler and FDIC Chair Martin Gruenberg while referring to both of them as “lapdogs and attack dogs” who leveraged the power of their agencies to push Warren’s anti-crypto policies.

The PAC also received financial donations from industry giants last year, including Coinbase and Ripple.

The approved ETFs are expected to attract significant inflows. Estimates suggest that Valkyrie could see $200-400 million, with the overall market experiencing $4-5 billion in inflows within the first few weeks.

Gemini said that the recent report from New York Post is quite misleading and “pure fantasy”. The exchange added that all the funds belonged to its Earn users.

Gemini began its venture into the Indian market earlier this year after it announced the opening of its second-largest office in Gurgaon.

The Gemini founders filed for the first Bitcoin ETF with the US SEC ten years ago, which was rejected for almost the same reason the recent BlackRock and Fidelity products were dismissed.

Gemini is looking to expand its business offerings across the UAE as regulators begin to accept applications for VASP licensing.

Gemini also plans to expand its workforce after the EU adopted the new Markets in Crypto-Assets Regulations (MiCA), which were formally approved on May 16.

The company has promised its customers that it will be expanding its derivatives offering with additional perpetual contracts, dated futures, and options in the coming weeks.

The anonymous sources revealed that the loan came after Gemini failed to raise external financial support.

Gemini crypto exchange reassured its customers that reputable banks, including Fidelity, hold all GUSD reserves.

American multinational financial services and banking giant, JPMorgan Chase is reportedly on track to cut its business ties with Gemini Exchange.