Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!

The Gemini founders filed for the first Bitcoin ETF with the US SEC ten years ago, which was rejected for almost the same reason the recent BlackRock and Fidelity products were dismissed.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

The need for a regulated Bitcoin product, including an Exchange Traded Fund (ETF), is undoubtedly mounting on the United States regulators as institutional investors, led by BlackRock Inc (NYSE: BLK) with nearly $10 trillion in Assets Under Management (AUM), pushes to enter the crypto industry. With the $1 trillion crypto market estimated to overtake that of precious metals in the coming years, amid ballooning global inflation, the demand for well-structured digital assets like Bitcoin and Ethereum can not be ignored.

As a result, the political divide between the Democrats and Republicans has increased when it comes to ways to regulate the nascent industry. According to the Biden administration, perhaps a view shared by most Democrats in Congress, most digital assets are unregulated securities, and investors should prepare for the digital dollar through FedNow soon.

On the other hand, some politicians including presidential aspirant Robert F Kennedy Jr, Bitcoin, and other crypto assets are integral parts of the financial freedom that needs to be protected. As a result, experts forecast a great rift in next year’s US presidential election on matters pertaining to crypto assets.

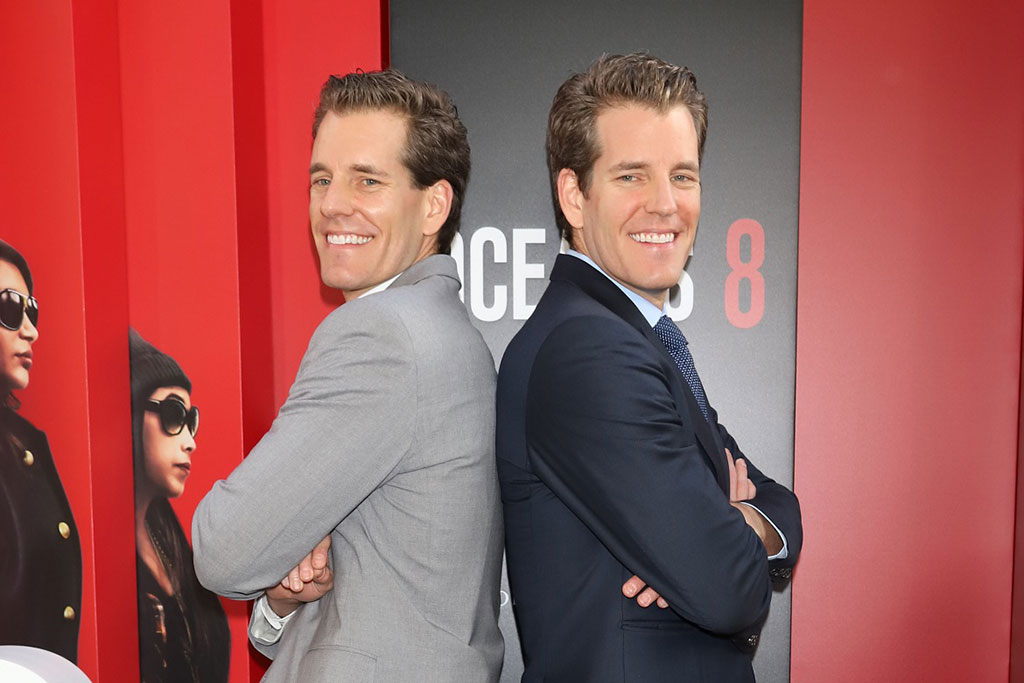

According to Cameron Winklevoss, one of the Gemini exchanges co-founders, the SEC has pushed American crypto investors to risky products and firms like FTX for failing to approve safer avenues to access the nascent crypto market. Notably, Gemini filed for a Bitcoin ETF ten years ago but the SEC rejected the filing.

Today marks 10 years since @tyler and I filed for the first spot Bitcoin ETF. The @SECGov‘s refusal to approve these products for a decade has been a complete and utter disaster for US investors and demonstrates how the SEC is a failed regulator. Here’s why:

-“protected”… pic.twitter.com/xmK1xo1iX8

— Cameron Winklevoss (@cameron) July 2, 2023

According to the SEC, the Bitcoin market is heavily controlled by wash trading and there are no mechanisms to avoid mass fraud. However, Cameron noted that the SEC needs to cease overstepping its statutory powers in regulating the crypto industry.

“Maybe the SEC will reflect on its dismal record and instead of overstepping its statutory power and trying to act like the gatekeeper of economic life, it will focus on fulfilling its mandate of investor protection,” he noted.

Notably, the crypto investor highlighted that some investors have been forced to enter the digital asset industry through regulated and risky products like Grayscale Bitcoin Trust (GBTC), which he referred to as toxic. Worth noting that Gemini and Digital Currency Group (DCG)- backed Genesis Trading are under court supervision after failing to meet a reasonable deal on defaulted loans.

Meanwhile, the SEC has dismissed the recent Bitcoin ETF frenzy for lacking clarity and asked the respective firms to review their filings. The Bitcoin ETF frenzy significantly helped BTC price rebound from trading below $25k to as high as $30.8k in the past few weeks.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!