March 5th, 2026

The addition of settlements to the meeting agenda raised speculation on the social media platform that the SEC was finally going to end its two-year-long court battle with Ripple.

The US SEC approved the Grayscale Ethereum Mini Trust and ProShares Ethereum ETF on Wednesday with trading expected to commence next week.

This settlement is coming after two years of litigation and extensive negotiations.

While the potential for a breakout exists, long-term factors like the ongoing SEC lawsuit against Ripple Labs, the company behind XRP, still cloud the horizon.

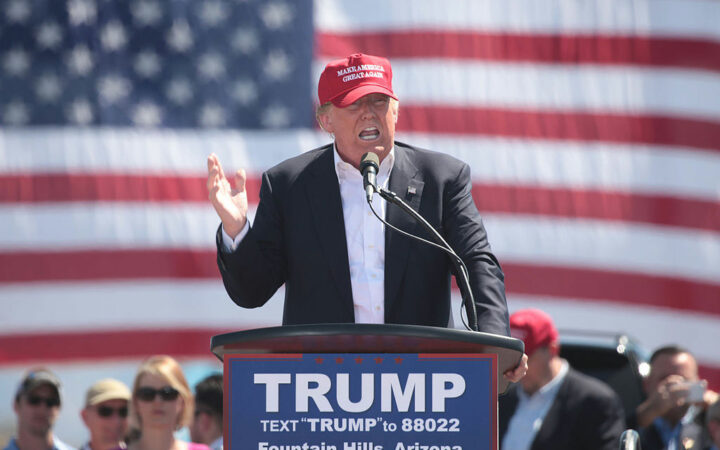

Trump’s pivot toward crypto comes as he positions himself for another run at the White House. In May, his campaign began accepting donations in cryptocurrencies.

Such moves are often seen as a sign that these whales intend to hold their XRP for the long term, which can potentially support higher prices.

The complaint argued that Tether and Bitfinex took part in a manipulating scheme to artificially increase cryptocurrency prices, including Bitcoin.

This deadline for claims is a key part of Terraform Labs’ strategy to handle its financial and legal issues.

The supply of Ethereum (ETH) on crypto exchanges is gradually declining as the staked Ether increases, thus escalating the supply crisis.

Vance has been actively gunning for pro-crypto policies and had voted for the repeal of the controversial SAB 121 accounting rule for crypto. He also criticized SEC chair Gary Gensler for politicizing the securities business.

Bitcoin saw a resurgence following an assassination attempt on former US President Donald Trump during a campaign event in Pennsylvania.

Analysts agree that the launch of ETH spot ETFs could act as a major catalyst for Ethereum price in the coming months.

CME Group announced that the new XRP and Internet Computer reference rates are designed to provide the US dollar price of each digital asset.

The SEC’s new approach could widen the number of companies in the US offering crypto services, giving Americans enough options to select which companies they would prefer to manage or keep their crypto investments

As Binance moves into its eighth year, it plans to continue leading the digital asset sector. The exchange holds licenses and registrations across 18 jurisdictions, more than any other centralized crypto exchange.