March 5th, 2026

Similar to GBTC, the Grayscale Ethereum Trust (ETHE) could also see massive outflows in the beginning since its currently trading at 26% discount to the NAV.

The JAM Implementer prize is a 10 million DOT reward pool meant to encourage the creation of implementations in various programming languages to strengthen the ecosystem’s foundation.

James Murphy, founder and chairman of Murphy & McGonigle, said he wouldn’t settle any crypto case with the current SEC before seeing how the election turns out.

The surge in Layer 2 adoption can be traced back to the recent green light given to spot Ethereum ETFs by the US SEC.

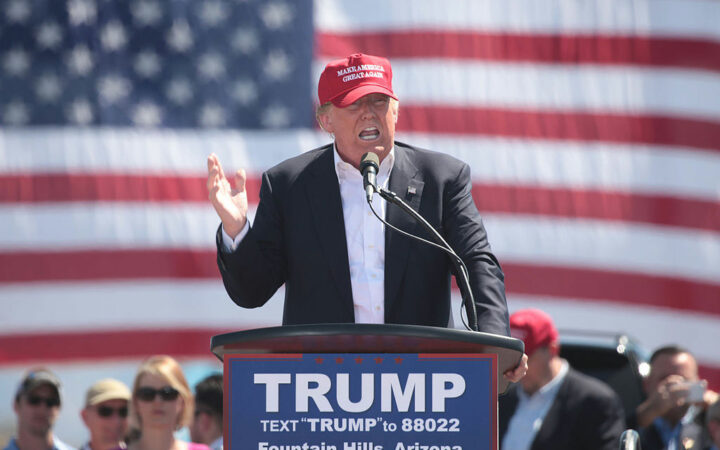

After Trump’s recent comments and overwhelming promise of supporting the crypto industry, some crypto market analysts says that the former President has a hit of retracing on his commitments.

Standard chartered executive stated that similar to Ethereum, other altcoins previously under the SEC scrutiny, such as the XRP case, could also be absolved of the ‘security’ status.

Xangle, a Seoul-based crypto data provider, argues that the Korean regulations stop efforts to restore the Korean stock market and address the “Korea Discount”, in which Korean stocks trade at lower valuations than their global peers.

Crypto influencer Balina says he’s prepared to fight the charges to the US Supreme Court.

Garlinghouse revealed in the post that the artwork had been hanging on his wall for a while, and due to the market’s momentum, he felt like sharing it.

ETF analyst James Seyffart noted that while the 19b-4 filings have been approved, the funds still need to pass another scrutiny stage for the S-1 documents to be reviewed.

Soon after the 19b-4 approval by the US SEC, VanEck Investments swung into action by releasing a 37-second advertisement swaying viewers to “Enter the ether”.

A total of $13.43 billion has flowed into spot BTC ETFs since the approval of the digital assets in January, but the current capital flowing into the investment products remains significantly low compared to their peaks in March.

Sigel stated that the first-come-first-serve approach by the SEC would help the issuers plan their product launches in a much better way.

Despite the SEC’s engagement with issuers, industry experts warn that the process isn’t finished yet. “Basically, it’s just starting,” said a high-ranking member at an ETF issuer, referring to the S-1 discussions.

Despite being first in the market, Hong Kong’s Ethereum ETFs fail to gain enough traction with daily trading volumes dropping to their lowest.