Yana Khlebnikova joined CoinSpeaker as an editor in January 2025, after previous stints at Techopedia, crypto.news, Cointelegraph, and CoinMarketCap, where she honed her expertise in cryptocurrency journalism.

By investing in Bitcoin, GameStop doubles down on its outsider identity. Discover how this decision resonates with crypto values and what it could mean for corporate treasury trends.

Edited by Victoria Ronina

Updated

3 mins read

Edited by Victoria Ronina

Updated

3 mins read

GameStop, the old-school video game retailer turned meme stock phenomenon, is making waves once again—this time by diving headfirst into Bitcoin.

On May 28, the company disclosed it had acquired 4,710 BTC, worth roughly $505 million at the time of the announcement. This bold move reignited excitement within the crypto community, reaffirming GameStop’s cult status among decentralized finance advocates.

The crypto world’s fascination with GameStop isn’t new—it traces back to the 2021 short squeeze, where a band of Reddit retail investors turned the struggling retailer into a symbol of resistance against Wall Street elites. That same anti-establishment ethos lies at the heart of Bitcoin, making GameStop and crypto natural allies.

Now, GameStop has solidified that relationship by officially revising its investment policy to treat Bitcoin as a “treasury reserve asset”. The company’s board unanimously approved the change in March, paving the way for this first major crypto purchase.

According to CEO Ryan Cohen, the company sees Bitcoin and gold as a means of hedging against inflation.

💥BREAKING:

RYAN COHEN EXPLAINS WHY GAMESTOP DECIDED TO BUY $500M IN BITCOIN pic.twitter.com/oUggQG9Ypw

— Crypto Rover (@rovercrc) May 28, 2025

GameStop’s rise was fueled by retail traders banding together to outmaneuver institutional short sellers. That underdog spirit mirrors Bitcoin’s roots as a decentralized alternative to centralized banking. To crypto enthusiasts, GameStop isn’t just a retailer—it’s a symbol of decentralized power.

$GME “What other companies should we be paying attention to right now?”

“GameStop.”

Chat, it’s time.

BUCKLE UP! 🌊🌊🌊 pic.twitter.com/90kpc4DBw8

— Alex Thompson (@sierrastrades) May 28, 2025

Many companies flirt with crypto adoption, but few make hard moves like this. By using $505 million of its treasury to acquire Bitcoin, GameStop signals a level of conviction that resonates with a community often skeptical of corporate virtue signaling.

Unlike some public companies that cautiously toe the line, GameStop isn’t putting a ceiling on its BTC exposure. In its SEC filings, it noted there’s no maximum limit on how much Bitcoin it may accumulate, and it may sell at will. That kind of flexibility is seen as savvy and strategic in the eyes of crypto investors.

GameStop has faced ongoing challenges in the retail sector, including plans to close a significant number of stores in 2025. Diversifying into Bitcoin is now viewed as a forward-looking treasury strategy, particularly amid concerns about dollar devaluation and inflation.

The overlap between gamers and crypto users is significant. Both communities are digitally native, skeptical of traditional power structures, and comfortable navigating decentralized systems. GameStop’s move feels less like a pivot and more like a return to its base.

With a market cap of $14.3 billion and $1.48 billion in fresh capital from convertible notes, GameStop is signaling that it’s ready to be more than just a retail relic by jumping on the Bitcoin trend in the US. However, there’s always a ‘but.’

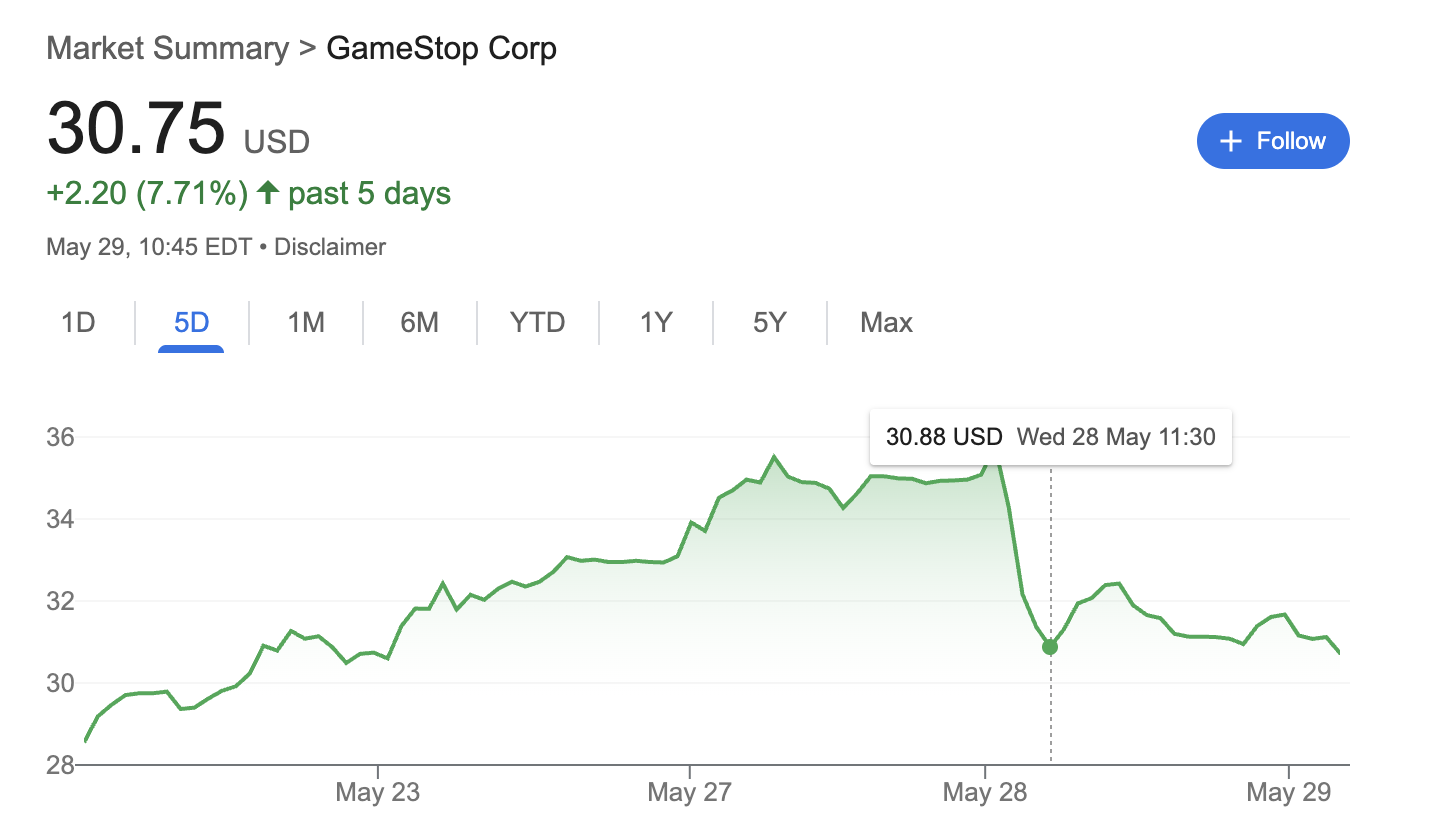

Immediately after the purchase, the company’s shares plummeted from $35 to $30, where they have remained.

Gamestop Shares | Source: Google Finance

Some note that Gamestop is actually the only company whose shares plummeted after Bitcoin purchase. Is it another market trick? Well, only time will tell.

GameStop is the only public company where, after buying bitcoin, the price didn't skyrocket on the same day; instead, it dropped. Clear manipulation. $GME

— Luiz ₿arto (@isweluizz) May 28, 2025

One thing is clear: by purchasing Bitcoin, GameStop has just secured a spot in X trends for another solid week or so.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Yana Khlebnikova joined CoinSpeaker as an editor in January 2025, after previous stints at Techopedia, crypto.news, Cointelegraph, and CoinMarketCap, where she honed her expertise in cryptocurrency journalism.