While private trading is more restrictive and volumes are more constrained than public markets, the Nasdaq private market serves as a crucial part of determining a reference price for investors ahead of a direct listing. Coinbase, one of the largest cryptocurrency exchanges in the US, has announced plans to go public but it will eschew the traditional initial public offering process, opting instead for a direct listing.

This move signals the first large-scale direct listing on the Nasdaq and falls in line with Coinbase’s non-traditional trajectory, given that the company has backed the similarly non-establishment cryptocurrency phenomenon over the years.

Officially, the company filed its S-1 with the Securities and Exchange Commission (SEC) on February 25, 2021, a strategy that both Slack and Spotify have used to sell shares directly to the public without an intermediary.

Coinbase’s Date of Listing

As of now, Coinbase has not released an official date for its listing on the New York Stock Exchange, but the company has already gained a lot of attention.

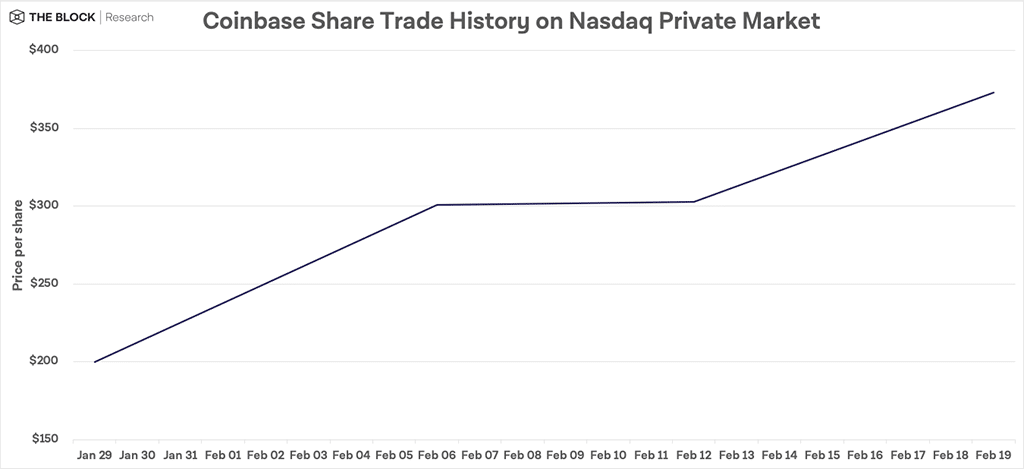

In the lead-up to its announcement, shares traded on the Nasdaq Private Markets at $373, yielding a company valuation of over $100 billion. If share prices remain at or above these extraordinary levels, Coinbase’s valuation upon going public could be the biggest by a U.S technology company since Facebook went public in 2012.

Photo: TheBlockCrypto

Experts predict that the company’s listing could take place sometime this month, however, existing shareholders still have the opportunity to sell their shares before the big event via the Nasdaq Private Market. As Coinbase opted for a direct listing as opposed to an IPO, retail investors will need to wait for when shares can be publicly bought and sold in order to purchase stocks. This direct listing is the exchange’s way of ensuring there’s a level playing field when it comes to the buying and selling of shares – a knowing nod to the perceived decentralized impartiality of the cryptocurrency ecosystem.

Although initial public offerings are typically reserved for institutional investors that can buy huge volumes of shares in one fell swoop, companies like E*TRADE or Freedom24 can offer participation to retail investors when the time arrives – albeit at a financial threshold. This means that theoretically, Coinbase could have made their IPO more widely available if they had wished.

There are more traditional organizations like Fidelity that also offer public participation but at a significantly higher threshold. When Coinbase goes public, it will list its shares on the Nasdaq under the stock ticker “COIN.”

According to Bloomberg reports, private trading of Coinbase Global Inc. shares indicated a $13bn increase compared to February 2021 figures when shares were trading for around $303 each.

Democratizing Access

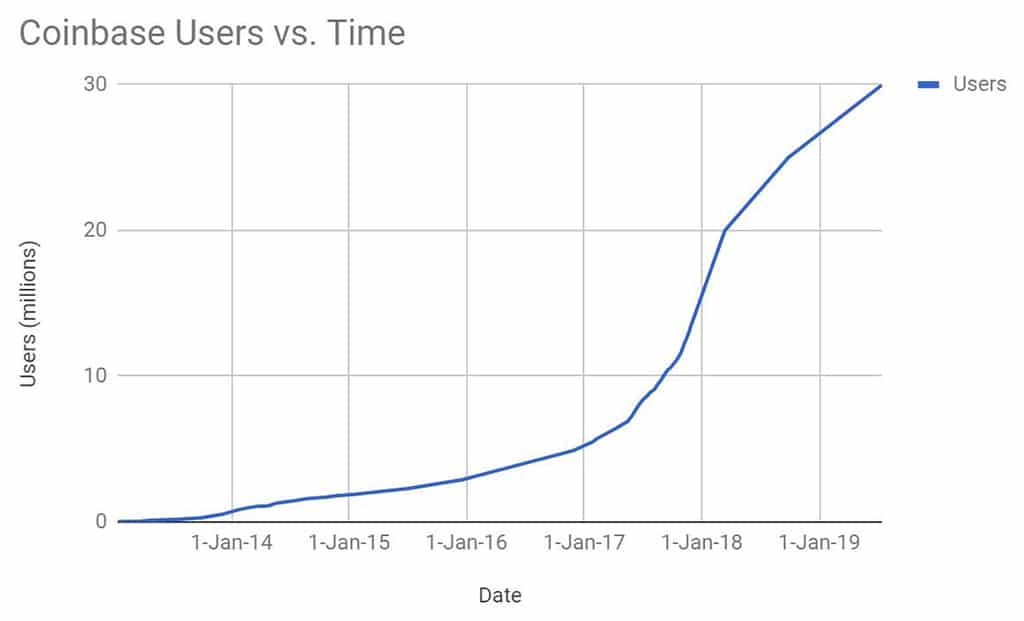

For cryptocurrency enthusiasts, Coinbase operates a straightforward online exchange that allows retail buyers and sellers to meet in the middle and find a price. For more advanced users, they offer a robust trading platform with a full set of features and charts.

What sets Coinbase apart from its competitors is its efficiency and focus on keeping users’ personal data secure. By making compliance a high priority, investing heavily in cybersecurity, and building novel key storage mechanisms, Coinbase furthers its goals of democratizing access to the cryptocurrency economy and creating an open financial system to the world.

Photo: Cointelegraph

Correlation between Cryptocurrency and Stocks

Cryptocurrency and stock markets have a strong potential of blending. Many of the challenges in the financial inclusion area can be compensated for through the strengths of blockchain, while global economic processes will bring stability to cryptocurrency, decrease volatility and strengthen the value of assets from the investors’ point of view. The financial markets can also diversify cryptocurrency portfolios for investors and traders.

As cryptocurrency and stocks increasingly converge, investors enjoy new opportunities within the emerging age of democratized finance. Naturally, this brings more money into the industry and encourages infrastructure development. As digital assets continue to blend with conventional trading tools, we see a concomitant increase in transparency and accountability.

Overall, the merging of the two worlds improves the financial ecosystem for the better.

A Turning Point for Cryptocurrency

Coinbase’s imminent arrival on the New York Stock Exchange has far-reaching implications for the cryptocurrency landscape, and for finance more generally.

On a fundamental level, it signals the company’s success. Being the first major direct listing on the Nasdaq with a valuation of over $100bn legitimizes Coinbase, considering that it has been a significant player in a once subculture industry.

Second, the listing authenticates the business of Bitcoin, as well as the alternative cryptocurrencies that Coinbase buys, sells, and trades on its platform.

The stigma surrounding cryptocurrencies is steadily diminishing. While the cryptocurrency market has continued to gain traction over the years, many-voiced early reluctance in trusting its underlying technology and structure.

Unlike fiat, cryptocurrencies are not backed by any institutions or legislation, making them somewhat volatile and risky. Since the decentralized network is also pseudonymous, money laundering and other illegal trading activities have fueled a trust gap.

However, Coinbase’s listing represents an evolution in the sector. As Bitcoin continues to gain backing from institutional investors, banks, and governments – Coinbase’s direct listing marks a huge step in enabling a cultural shift away from negative cryptocurrency connotations that have long plagued the industry.

By listing on an exchange as prominent as Nasdaq, Coinbase’s stock value will be viewed as higher quality and could rise higher. Further to this, liquidity for listed companies tends to be lower.

The listing requirements for Nasdaq are notoriously stringent. Companies must have aggregate pre-tax earnings of $11 million in the last three years and a minimum cash flow of at least $27.5 million for the past three fiscal years. This includes a rigorous disclosure process.

Once Coinbase becomes a regulated, listed agency, it will have to comply in a different manner than other unlisted, crypto exchanges.

What’s more, institutional investors also see Coinbase’s arrival on Wall Street as a way to get exposure to cryptocurrencies. In the event that an individual displays skepticism about buying these assets directly, the Coinbase stock can serve as a safer alternative to participate in the market.

From the very beginning, Coinbase’s founders stated that their key strategy was to work with regulators to make cryptocurrencies mainstream and while the listing will garner a lot of attention, it may also serve as a big-time validator for Bitcoin and other popular cryptocurrencies. You could liken it to the Netscape offering which captivated the world in the mid-1990s by boosting the visibility of the internet.

The listing will no doubt provide Coinbase with a new-found sense of legitimacy and set the tone for future cryptocurrency brokers to go public. What this amounts to is a turning point for those in the cryptocurrency space who have been patiently awaiting such a monumental development.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Dmytro Spilka is a CEO at Solvid and founder of Pridicto, a web analytics startup that uses AI and Machine Learning to forecast web traffic, monitor vital metrics and set visual traffic aims. His work has been featured in various publications, including Tech Radar, Entrepreneur, Huff Post, The Next Web and ReadWrite.